[ad_1]

Fast Take

Bitcoin’s Open Curiosity Reaches a 4-Month Excessive

Open curiosity in Bitcoin has escalated to a four-month peak as roughly 418,000 Bitcoin are held in open curiosity contracts, marking a big upturn in investor engagement.

CME Emerges as a Key Participant

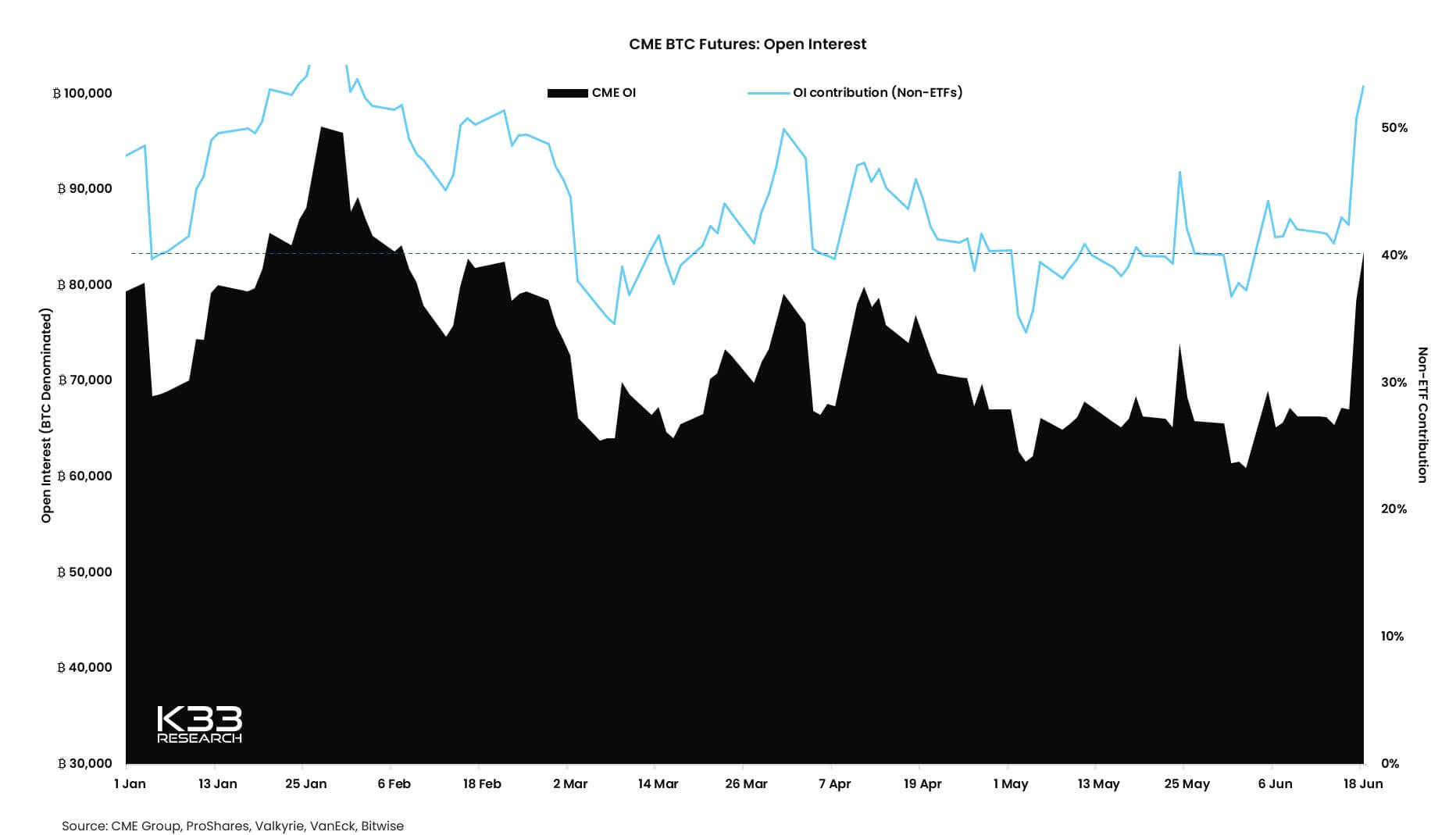

An vital catalyst behind this progress seems to be the Chicago Mercantile Trade (CME). At the moment, CME holds 83,560 futures in open curiosity contracts. This degree of engagement is an all-time excessive since January and signifies a big return of investor curiosity in Bitcoin futures.

Analyst Insights on the Present Market Scenario

Vetle Lunde, a analysis analyst at K33, helps this viewpoint, highlighting that regardless of the current progress on an annualized foundation, trailing returns stay comfortably above 10%.

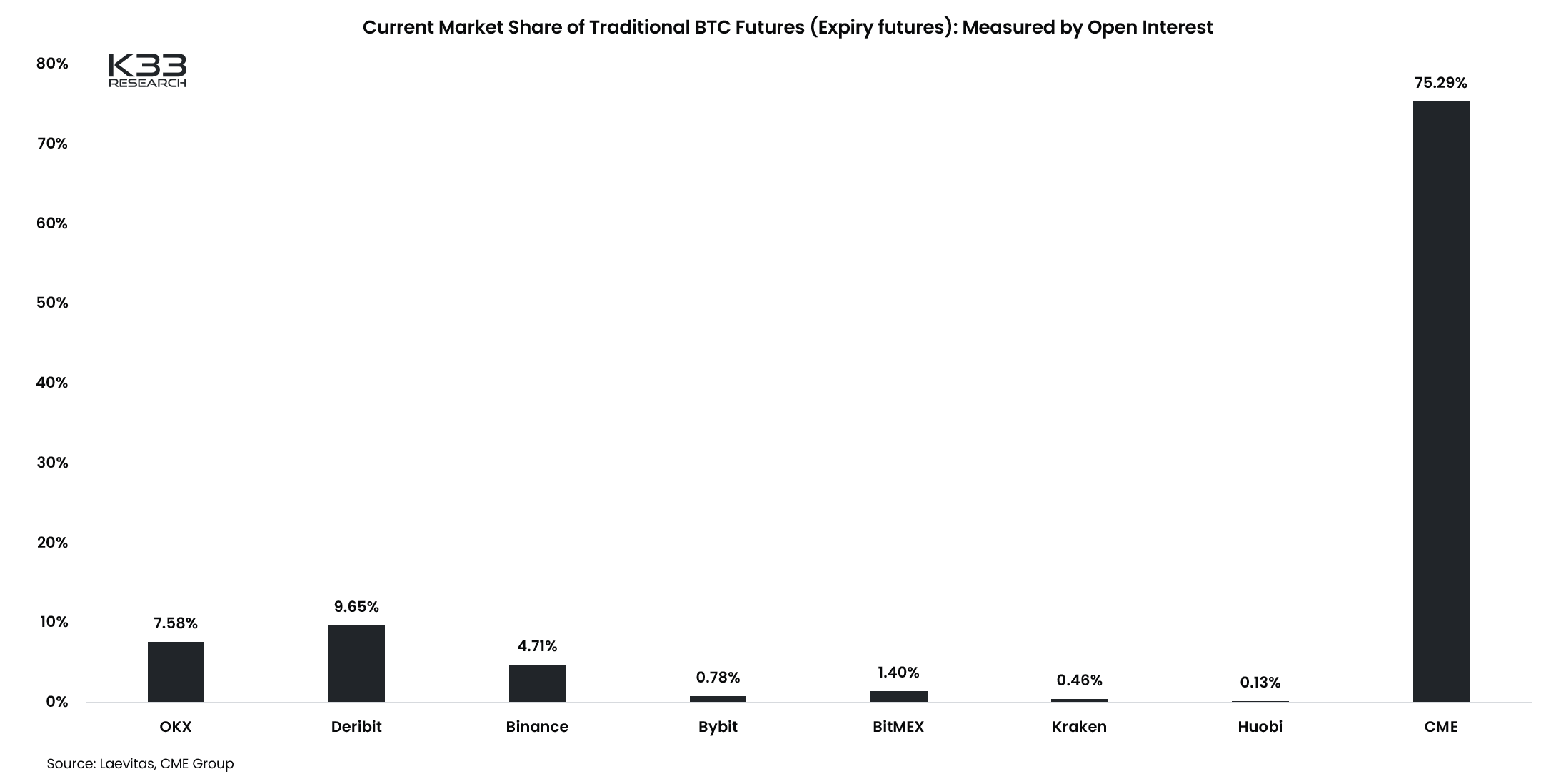

Increasing additional on this matter, Lunde identified that amongst all derivatives exchanges, CME skilled essentially the most vital each day progress in Bitcoin’s open curiosity. When it comes to general open curiosity, Binance stays the biggest alternate, adopted by Bybit after which CME.

Nevertheless, when contemplating expiring futures, the panorama is sort of completely different. CME dominates with a market share of 75%, rendering offshore futures comparatively insignificant.

Implications for the Market

On condition that CME is without doubt one of the world’s largest derivatives exchanges and is primarily utilized by institutional traders, this surge of exercise signifies a noteworthy entry of enormous gamers into the Bitcoin market.

The implications of this might be vital, suggesting a potential stabilization and elevated acceptance of Bitcoin amongst conventional monetary establishments.

The put up CME sees Bitcoin open curiosity develop by over 5k appeared first on CryptoSlate.

[ad_2]

Source link