[ad_1]

Fast Take

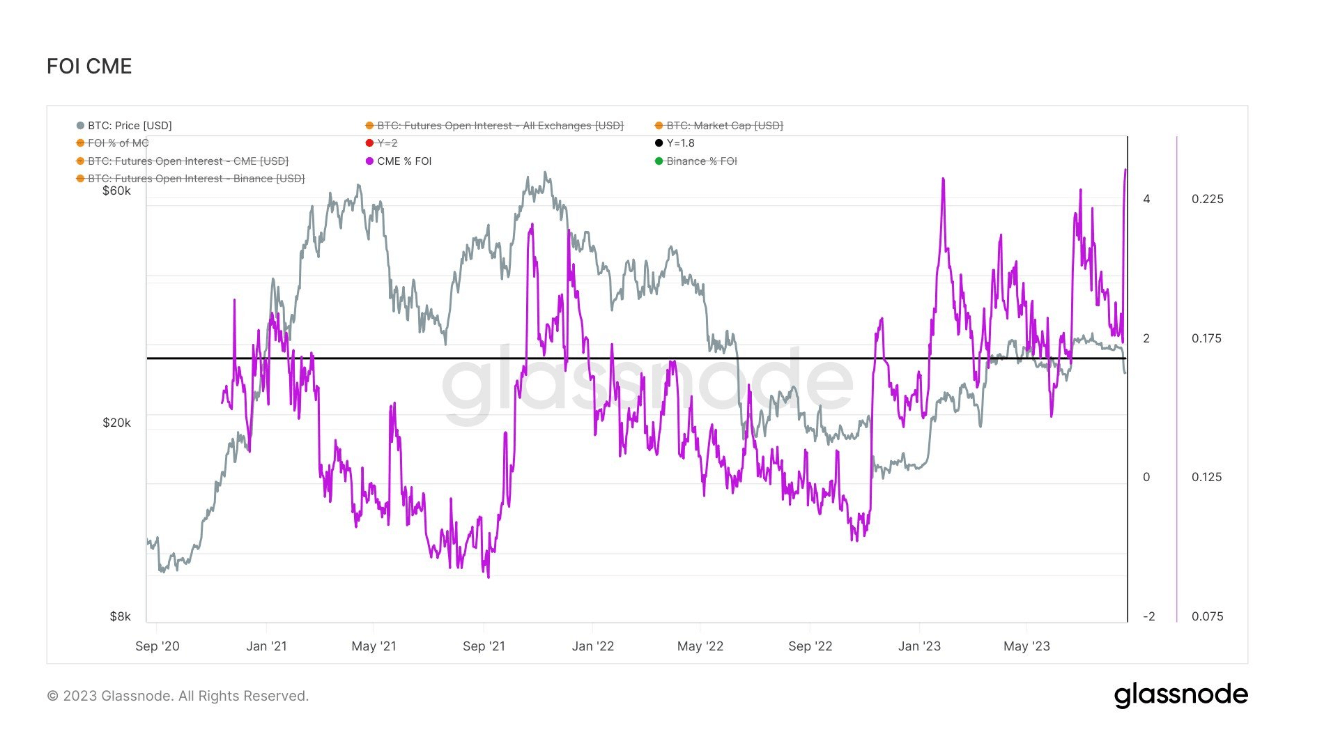

The futures market has all the time been a major barometer of investor sentiment and hypothesis within the cryptocurrency area. Current information evaluation suggests noteworthy developments in Bitcoin futures, significantly on the Chicago Mercantile Alternate (CME).

Open curiosity, the mixture of excellent futures contracts but to be settled, has seen the CME’s share in Bitcoin futures spike to an unprecedented 23% (equal to 85K BTC). That is the very best proportion ever recorded for the trade, indicating a attainable shift in institutional choice or technique.

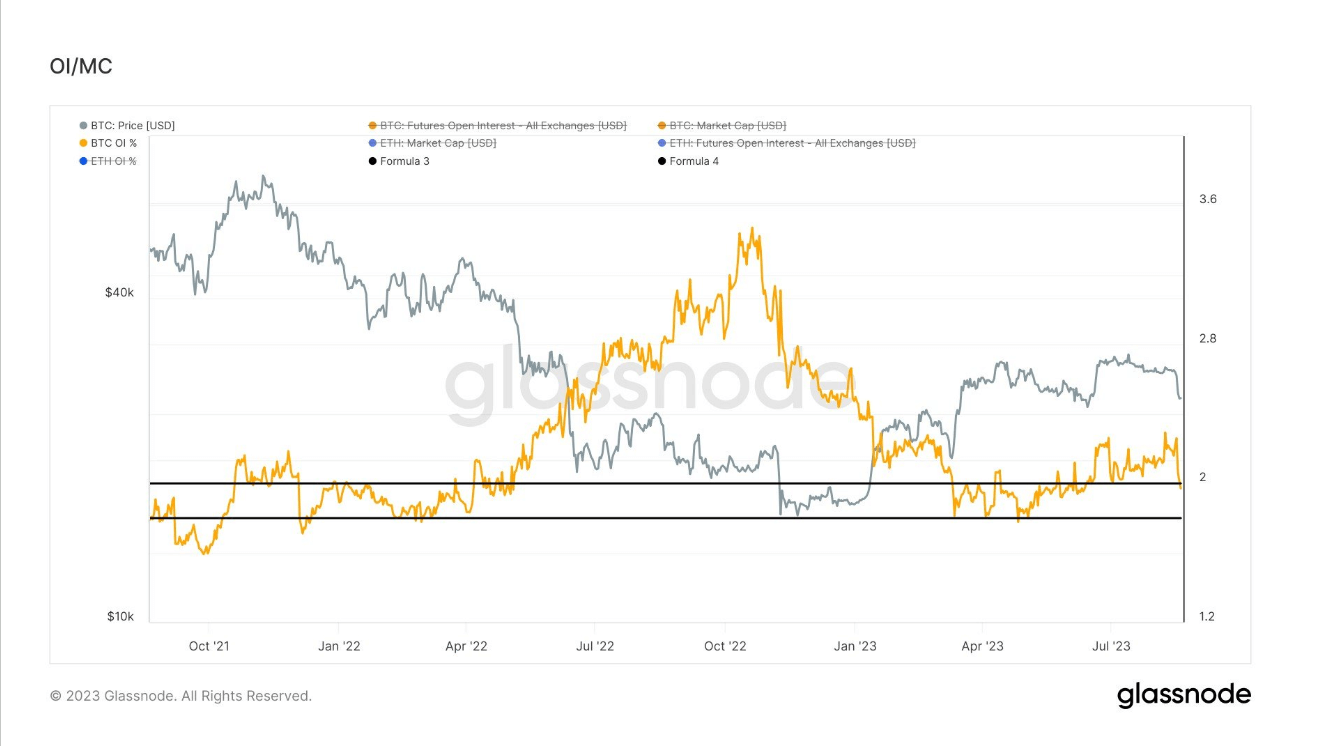

Contrarily, open curiosity as a proportion of the Bitcoin market capitalization has dipped beneath the two% threshold. It is a important respite, contemplating this metric has persistently been above 2% since Could/June.

This lowered ratio displays a more healthy, much less leveraged market, lowering the chance of large-scale liquidations that might destabilize the market. This shift suggests a extra sustainable engagement of traders with Bitcoin futures, probably pointing to a maturing market.

Regardless of the surge in CME’s market share, the general discount in open curiosity relative to market cap is a constructive signal, indicating that the Bitcoin futures market could be shifting in the direction of extra balanced and fewer risk-prone operations.

The publish CME Bitcoin futures spike to unprecedented 23% amid total market de-leveraging appeared first on CryptoSlate.

[ad_2]

Source link