[ad_1]

Fast Take

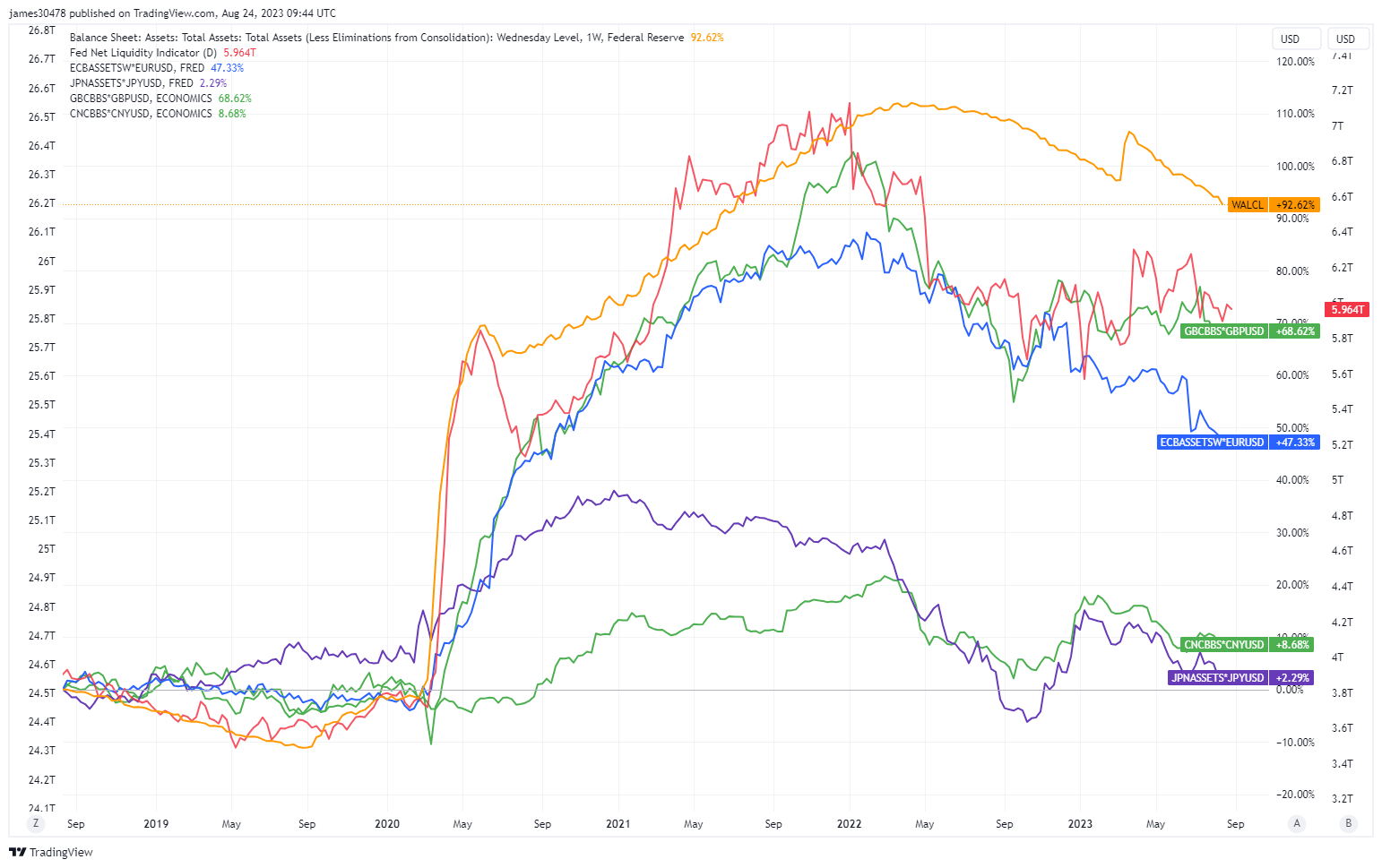

International central banks are decidedly rolling again on their respective steadiness sheets, indicating an aggressive stride in quantitative tightening for 2023.

The Financial institution of England’s (BOE) steadiness sheet downsized by 3%, whereas the Federal Reserve reported a 4% discount. Notably, the Folks’s Financial institution of China charts a 5% decline in its steadiness sheet.

The European Central Financial institution (ECB) and the Financial institution of Japan are main the pack with a decline of 8.5% and 9%, respectively.

Analyst Holger Zschaepitz highlighted that the ECB’s steadiness sheet has hit its lowest level since March 2021. Zschaepitz goes on additional to say the full belongings of those banks are important fractions of their corresponding GDPs.

The ECB’s belongings account for 53% of the EU’s GDP, with the Federal Reserve and BOE representing 30% and 33% of the US and UK GDPs, respectively. The Financial institution of Japan stands out, with its belongings equating to 126% of Japan’s GDP.

This development is indicative of the central banks’ persistent efforts to alleviate the inflationary pressures and stabilize their economies following the pandemic-induced monetary upheaval.

The put up Central banks globally roll again steadiness sheets – quantitative tightening tempo heightened appeared first on CryptoSlate.

[ad_2]

Source link