[ad_1]

Bankrupt lender Celsius’s plan to liquidate its altcoins for Bitcoin (BTC) and Ethereum (ETH) might exert extra strain on the crypto market, in line with a July 10 report from blockchain analytical agency Kaiko.

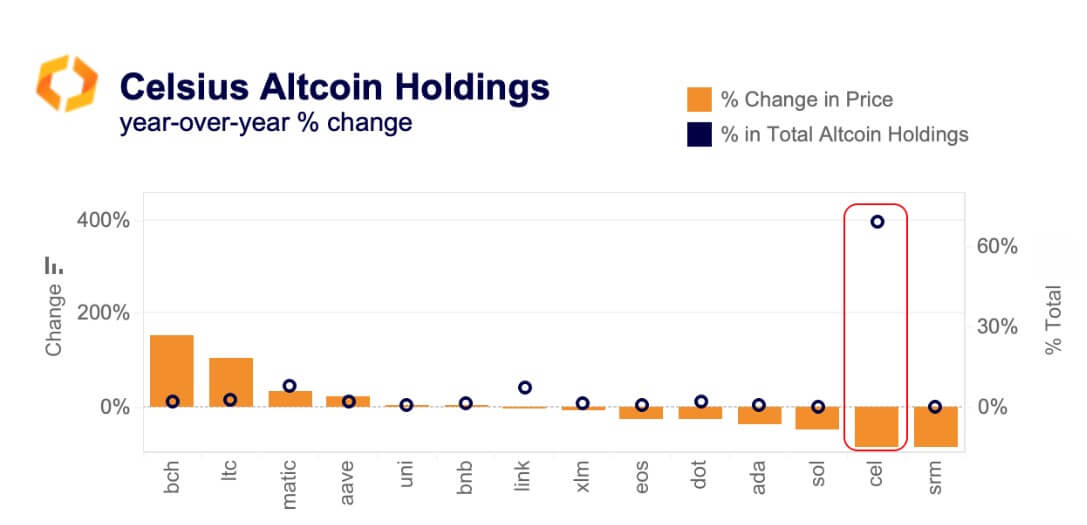

Kaiko famous that the majority altcoins held by Celsius had recorded important drops, starting from 6% to as excessive as 84%, of their liquidity over the previous yr.

“The aggregated market depth for Celsius’ altcoin holdings has declined by 40% since 2022, totalling round $90mn in early July.”

Per the chart beneath, solely Litecoin (LTC), Bitcoin Money (BCH), Polygon (MATIC), and Aave (AAVE) noticed pronounced modifications of their liquidity conditions over the previous yr, whereas others principally declined.

BCH and LTC, specifically, noticed a surge of their liquidity state of affairs after EDX, a crypto trade backed by conventional monetary establishments, enabled help in June.

The crypto firm additional famous that Celsius’s complete altcoin holding exceeded $90 million, “which implies it will likely be troublesome for the corporate to liquidate with out incurring excessive worth slippage.” It added:

“Greater than 60% of altcoin market depth is targeting Binance and different off-shore exchanges whereas 30% is on U.S. exchanges.”

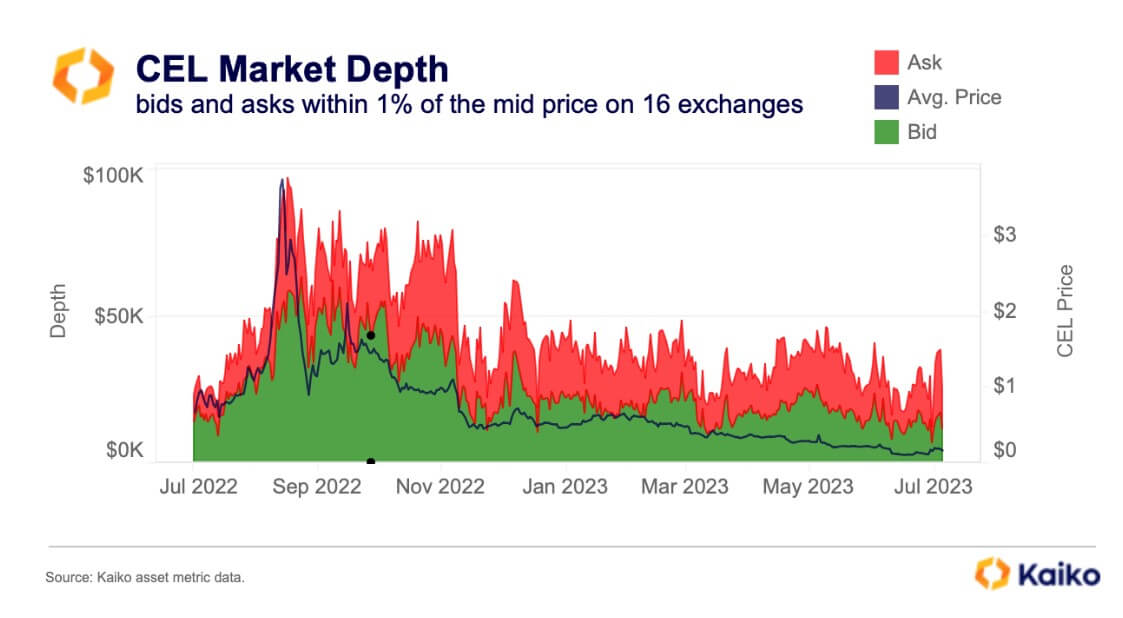

CEL token liquidity is nearly non-existent

In line with Kaiko, Celsius faces an issue as there’s nearly no liquidity for its most important altcoin holding, CEL.

CEL is Celsius’s native token, accounting for almost 65% of the bankrupt agency’s complete altcoin holdings.

“There’s nearly no liquidity for CEL as measured by market depth, which has collapsed to simply $30k, concentrated totally on OKX and Bybit.”

Since Celsius filed for chapter, the lender’s native token has seen waned curiosity, with its worth dropping to beneath $1 after peaking at over $8 in 2021, in line with CryptoSlate’s information.

The submit Celsius’s bankruptcy-induced liquidation plans might strain total crypto market: Kaiko appeared first on CryptoSlate.

[ad_2]

Source link