[ad_1]

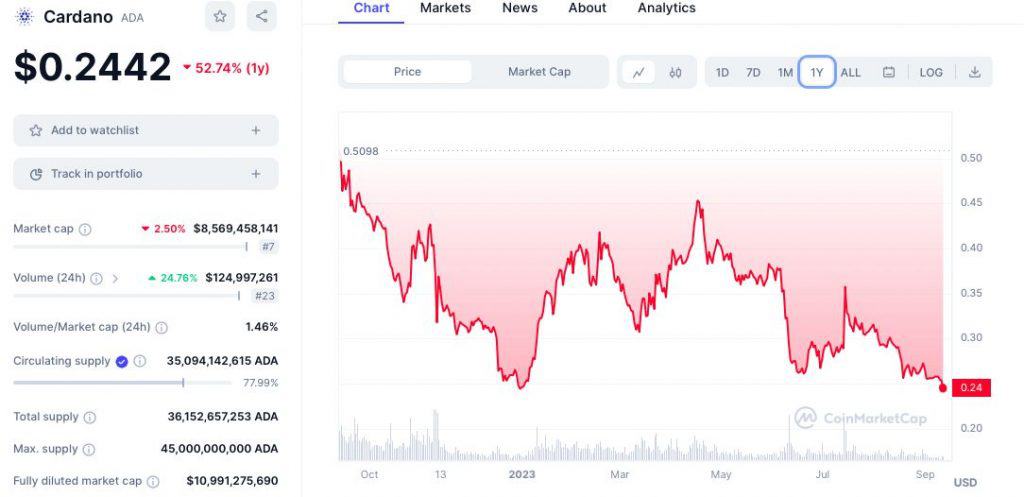

Cardano’s ADA cryptocurrency has dipped to its lowest worth in a yr, with present buying and selling at $0.244, marking a 52.5% yearly decline. ADA reached its minimal worth prior to now 24 hours, touching $0.2413.

The low worth comes as crypto costs plummet and DeFi exercise on the blockchain community sees a notable drop.

One of many key elements contributing to ADA’s battle is its classification as a safety by the U.S. Securities and Alternate Fee (SEC) within the context of its investigations into Coinbase and Binance.

Regardless of vehement denials from Cardano’s founder, Charles Hoskinson, and Enter-Output World (IOG), the father or mother firm of the Cardano blockchain, this regulatory cloud has forged a shadow on ADA, resulting in a greater than 15% decline in its worth because the classification.

Coinciding with ADA’s worth decline is a fall in DeFi exercise on the Cardano community. Knowledge shared by Crypto Slate reveals that Cardano’s transaction quantity hit a yearly low on September 9, plummeting to only $821,390. It is a important drop from the community’s transaction volumes exceeding $10 million seen in late Might and early June.

Whereas Cardano’s DeFi TVL stays comparatively excessive, though it has seen a slight lower to 587 million tokens from a peak of 621 million, the general decline in DeFi exercise and ADA’s worth woes underscore the challenges dealing with the community within the present crypto market.

Bitcoin and Altcoins Are Down

The crypto market is now within the crimson. Bitcoin had a quiet weekend with minimal worth modifications. It’s at present buying and selling at $25,666, down 0.37% in 24 hours. Total, Bitcoin has declined by 0.88% for the week and 12.7% for the month.

Ethereum (ETH) additionally struggled over the weekend, remaining flat on Saturday and dropping by greater than 1.1% on Sunday. At present buying and selling at $1,595, Ether has seen a 1.73% decline in 24 hours. On a weekly foundation, Ether’s efficiency has lagged behind Bitcoin, with its spot worth lowering by 2.24%.

Solana (SOL), at present valued at $17.77, has additionally lagged behind the market, posting a 3.08% decline within the final 24 hours and an 8.7% weekly drop. The once-popular altcoin is dealing with a downturn, with particular person buyers and the DeFi ecosystem on the platform feeling the impression of declining liquidity and buying and selling volumes. The primary driver behind this worth decline is FTX’s plan to liquidate $3.4 billion price of cryptocurrencies, together with SOL, held in reserves.

The worldwide cryptocurrency market capitalization at present stands at $1.02 trillion, barely down from $1.045 trillion recorded every week in the past, indicating ongoing cautious sentiment within the crypto markets.

Learn extra:

[ad_2]

Source link