[ad_1]

Cardano’s native token, ADA, has been considerably affected by the latest downturn within the cryptocurrency market, experiencing a notable decline in value. Regardless of a latest surge of over 6% within the final 24 hours, the bearish sentiment continues to exert its affect.

Over the previous week, Cardano has encountered a lack of roughly 26% in worth, ensuing within the breaking of essential help ranges which have now reworked into resistance ranges.

From a technical outlook, Cardano signifies a prevailing bearish pattern, with each demand and accumulation ranges remaining comparatively low. It turns into essential for the coin to beat the overhead resistance with the intention to mitigate the rising power of bearish forces and facilitate a possible restoration.

Presently, the coin is oversold, prompting the emergence of patrons aiming to surpass the resistance limitations. Moreover, the decline in Bitcoin’s worth in latest days, because it revisited the $26,000 degree, has had a unfavourable influence on numerous altcoins, together with Cardano. Consequently, the market capitalization of Cardano has declined, indicating diminished shopping for power out there.

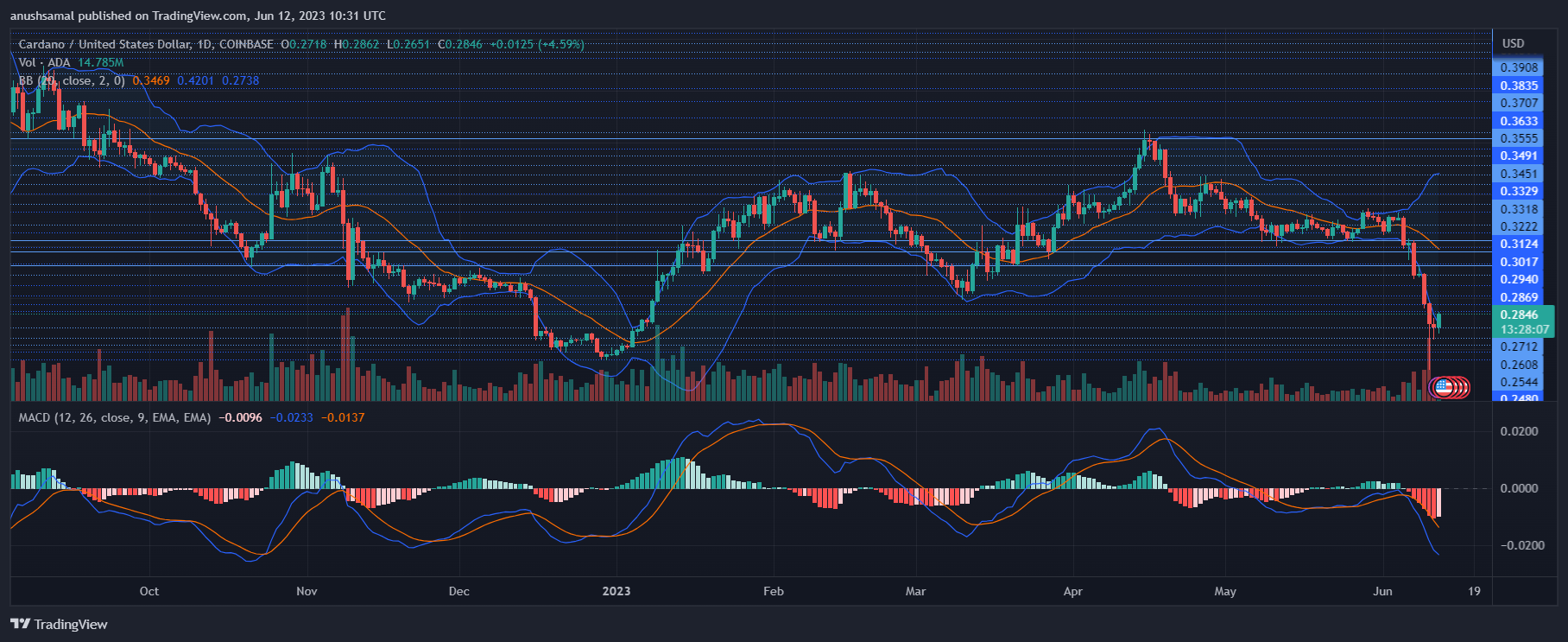

Cardano Value Evaluation: One-Day Chart

ADA was buying and selling at $0.28, on the time of writing. Following its rejection on the $0.34 degree, the bears have taken management of the worth trajectory. Presently, ADA has revisited a multi-month low value degree. This signified a bearish pattern and the essential resistance degree for the altcoin is noticed at $0.30.

Ought to ADA face rejection at this degree, there’s a chance of the worth descending additional under its present degree. Within the occasion of additional depreciation, the coin might discover help initially at $0.25 and probably even decrease.

The buying and selling quantity for Cardano within the final session was comparatively low, suggesting that sellers at present maintain a bonus out there.

Technical Evaluation

Following the rejection at $0.34, Cardano (ADA) has struggled to regain optimistic momentum and appeal to demand. The Relative Energy Index (RSI) has dipped under the half-line and even additional under the 30-mark, indicating that the coin is considerably undervalued and oversold.

Moreover, the worth of ADA has dropped under the 20-Easy Shifting Common (SMA) line, suggesting that promoting stress is at present driving the worth momentum.

So as to revive demand out there, ADA wants to beat the resistance degree of $0.30. Breaching this important barrier might probably ignite a restoration and appeal to patrons again into the market.

Because of the low demand for ADA, promote indicators have emerged, suggesting a possible continuation of the downtrend. The Shifting Common Convergence Divergence (MACD), which signifies value momentum and potential reversals, has fashioned crimson sign bars, aligning with promote indicators for ADA.

Moreover, the Bollinger Bands, which mirror value volatility and fluctuations, have considerably diverged. This means that there could also be elevated value volatility and fluctuation within the upcoming buying and selling classes.

Featured Picture From UnSplash, Charts From TradingView.com

[ad_2]

Source link