[ad_1]

Cardano is at the moment dealing with a stark distinction between its promising growth trajectory and the numerous losses incurred by ADA holders.

Latest worth evaluation has revealed that the losses are nearing an astonishing 90%, sending waves of concern by the cryptocurrency neighborhood. The once-active addresses have dwindled, additional accentuating the unease surrounding ADA’s worth pattern.

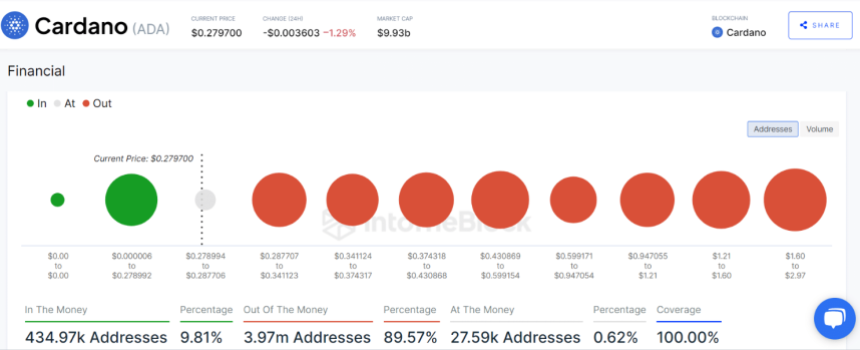

In an accompanying chart within the evaluation that lays naked the present scenario, it turns into evident that almost 4 million ADA addresses discover themselves within the unlucky place of holding the cryptocurrency at a loss. This staggering determine represents roughly 89.7% of all ADA holders on the time of this report.

This unsettling statistic raises pertinent questions concerning the causes behind this mass erosion of worth, shedding gentle on potential market dynamics and investor sentiment.

Supply: IntoTheBlock

Cardano Distinctive Funding Strategy

Cardano has persistently been a pioneer in revolutionizing the blockchain panorama, persistently introducing groundbreaking developments. One such innovation is their novel strategy to funding decentralized purposes (dApps) – a departure from the normal reliance on enterprise capital or preliminary coin choices.

Cardano’s introduction of undercollateralized loans introduces a recent paradigm that would reshape the best way blockchain tasks are financed and sustained, providing a glimpse into the way forward for decentralized funding fashions.

ADA’s Fluctuating Worth

Regardless of the developments, ADA’s current worth efficiency has sparked issues. With a present worth of $0.274 in line with CoinGecko, the cryptocurrency has skilled a decline of 1.2% within the final 24 hours alone. A extra extended seven-day hunch paints a bleaker image, with a decline of practically 8%.

ADA worth motion right this moment. Supply: Coingecko

Navigating ADA’s Future

As Cardano’s growth trajectory continues to impress with its forward-looking improvements, the prevailing challenges in ADA’s worth pattern and holder losses shouldn’t be underestimated.

The decline in energetic addresses additional compounds the prevailing worries, probably signaling shifts in consumer engagement and curiosity.

ADA hits a market cap of $9.6 billion right this moment. Chart: TradingView.com

Whereas the undercollateralized mortgage strategy holds promise for the ecosystem’s future, addressing the issues surrounding ADA’s worth and holder losses stays a urgent process.

Cardano’s journey as a trailblazer within the blockchain realm is accompanied by a fancy story of contrasting fortunes. The outstanding improvements it introduces stand as a testomony to its dedication to reshaping the business.

Nevertheless, the substantial losses incurred by ADA holders and the wavering worth pattern underscore the significance of addressing market dynamics, sentiment, and consumer engagement to make sure the longevity and stability of Cardano’s ecosystem.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. If you make investments, your capital is topic to threat).

Featured picture from TimeOut

[ad_2]

Source link