[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin worth dipped to $28,750 on Monday, August 7, and most merchants thought that was it and that the worth had lastly damaged the assist at $29k for the final time, able to spiral down. Nonetheless, the worth out of the blue shot up once more after sinking to this one-week low stage.

Initially, it appeared like it could cease at $29,250, as this stage stopped its development on early Tuesday, however because the day progressed, the worth unexpectedly broke the resistance, surging up.

Its subsequent huge impediment was $29,500, which additionally gave Bitcoin some hassle within the second half of the day. Nonetheless, after a short rejection, the coin broke by means of, stunning merchants for the second time in 24 hours.

The most important shock got here when BTC returned to $30k for the primary time in over two weeks. The coin additionally managed to breach this resistance, reaching its highest level at $30,144 within the ultimate hours of the day. Nonetheless, the opposition didn’t actually break, and Bitcoin’s worth was rejected right down to $29.7k, besides, it has seen a every day enhance of over 2.30%.

As we speak, Bitcoin sits at $29,812, and it seems it’s beginning one other climb, though this one appears slower, steadier, and extra real.

What Occurs Subsequent?

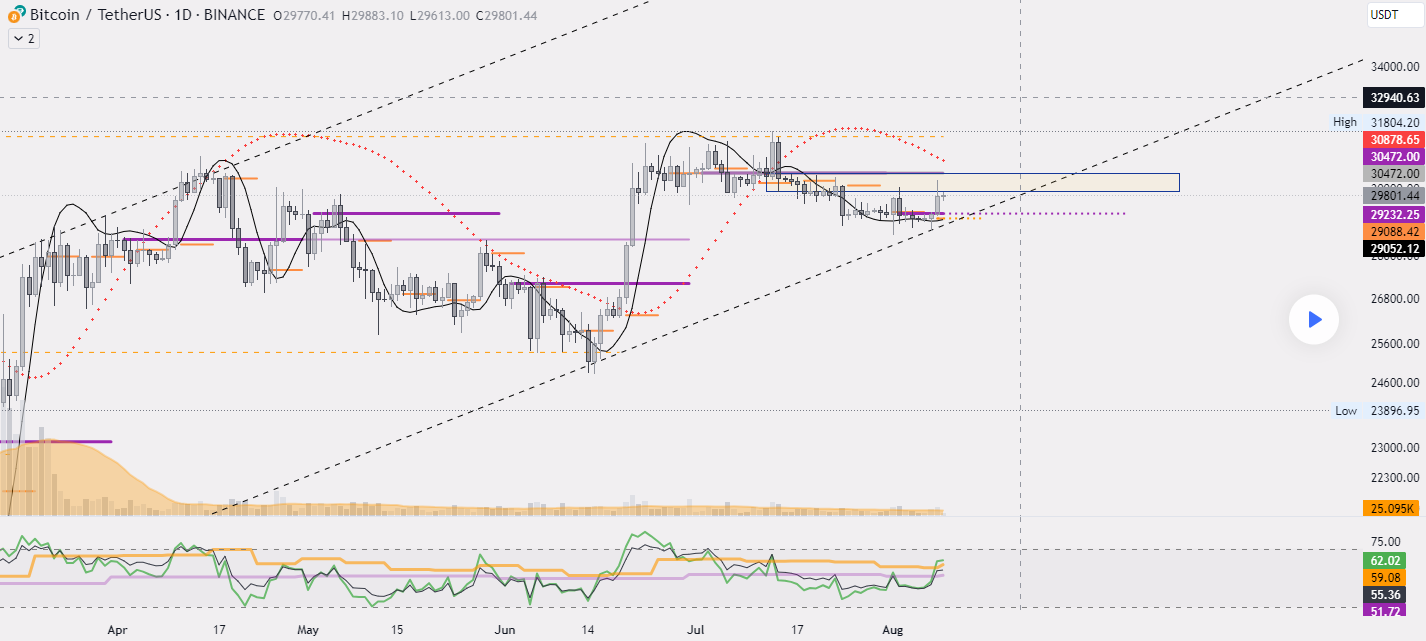

Many analysts imagine that the BTC worth is attempting to make use of its assist stage inside the fork construction to start out a brand new bullish rally — 9 months forward of the halving. Greater than that, the market sentiment appears optimistic, with some anticipating the coin to return to the $31k vary within the subsequent few days, assuming that the helps don’t break within the meantime.

This means that Bitcoin will first strive to make sure the helps are holding regular earlier than it tries to enterprise additional up. Nonetheless, if the helps break, the worth will drop to $28,460 after which $26,500.

As for shifting ahead, the coin will first have to interrupt a resistance at $29.9k, adopted by the one at $30.5k. Assuming it manages to take action, it will probably head again as much as $31k.

Bitcoin Surges as Market Grows Extra Optimistic About Spot ETFs

Bitcoin’s new worth surge got here unexpectedly and with out warning, but it surely seems to have been attributable to the joy relating to Bitcoin spot ETFs. The SEC has but to determine, however many appear satisfied that this time shall be when the regulator lastly approves a number of ETF purposes.

#BTC has rebounded straight into ~$30,000

Final week & even in late April, $BTC was capable of do the identical however ended as an upside wick

Which is why a Weekly Shut above ~$29250 is so vital to indicate that vendor strain on this ~$29900-$30100 is getting weaker#Crypto #Bitcoin https://t.co/t26zlUBJLX pic.twitter.com/99Uer547JZ

— Rekt Capital (@rektcapital) August 8, 2023

Additionally it is price noting that Eric Balchunas, senior ETF analyst for Bloomberg, introduced yesterday that some contacts from inside BlackRock and Invesco see the approval of a spot Bitcoin ETF as a matter of “when,” not “if.” As for when it may be accepted, the favored opinion appears to be in 4 to 6 months. Not less than, that is what Galaxy Digital’s CEO, Mike Novogratz, stated through the earnings name yesterday.

Based on “contacts” from inside BlackRock and Invesco spot Bitcoin ETF approval a matter of “when, not if” probably in “4 to 6 months” — Galaxy CEO Mike Novogratz on earnings name this morning pic.twitter.com/TIhHC7xnHI

— Eric Balchunas (@EricBalchunas) August 8, 2023

Banking Professional Says Euro is Riskier than BTC

One other constructive information for Bitcoin got here from Bob Lyddon of Lyddon Consulting, a prime banking knowledgeable and main economist. Lyddon warned that the EU is on the point of an financial catastrophe, because it lacks the reserves to assist the EUR. He believes that the one motive why the euro continues to be standing is the truth that it’s being sustained as a result of the credit standing businesses haven’t but downgraded Germany.

Whereas he appears to view shopping for Bitcoin as playing, he brazenly stated that even “playing on Bitcoin” is safer than holding EUR now.

XRP20 Presale Booms Elevate $1.4 Million in Mere Days

Regardless of Bitcoin’s uncertainty, which appears able to going up or down with equal chance, crypto customers are nonetheless keen to take an opportunity with sure tasks.

One of the vital fashionable ones proper now could be XRP20, a token primarily based on XRP that just lately launched a presale on Ethereum’s community. The challenge’s purpose is to reignite the eagerness of the XRP military with a brand new ERC-20 token that may convey staking to the XRP followers.

It goals to permit them to catch the same alternative as those that purchased XRP at $0.0028 lengthy earlier than it reached its present ranges. At present, XRP20 is being bought for $0.000092 per token, and its presale will stay open till it involves a tender cap of $1.85 million. Nonetheless, the time is brief, because the challenge has already raised $1.47 million since August 9. Anybody all in favour of buying it will probably accomplish that by way of ETH, USED, and even BNB.

Associated:

Wall Avenue Memes – Subsequent Huge Crypto

Early Entry Presale Dwell Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Group Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link