[ad_1]

A newbie’s (and a degen’s) information to navigating tax season

It’s no secret that tax reporting is a difficult downside for crypto traders. The pace of the house, excessive technical complexity and lack of steerage usually leaves many struggling to calculate their obligations (or avoiding them completely!) come new yr. As a CC and Synthetix staker, I’ve but to seek out any “tax calculation” providers that accurately categorize transactions with Synthetix or any of its companion protocols.

Usually, the providers simply report all transactions as merely “revenue” or “loss,” when the true tax reporting must be extra particular to the precise providers of the protocol. I’ve just lately been grappling with this problem myself, so I assumed it will be useful to undergo the train of actually making an attempt to know what tax reporting as a Synthetix staker ought to appear like, and hopefully save others in the neighborhood the trouble as nicely. This text will principally strategy reporting from a US Tax perspective, however it’s seemingly the method must be related for different nations. Furthermore, with the staged touchdown of Synthetix V3 aligning with the publication of this text – some points of this content material might change.

NOTE: I’m a Core Contributor at Synthetix, not a tax advisor nor a consultant of any tax company or accountant. The contents of this information are supplied within the hopes that it will likely be helpful, nonetheless there isn’t a declare of accuracy or applicability. You assume full duty to your personal tax reporting and due to this fact it’s suggested that you just do your individual analysis. This isn’t tax recommendation.

A evaluation

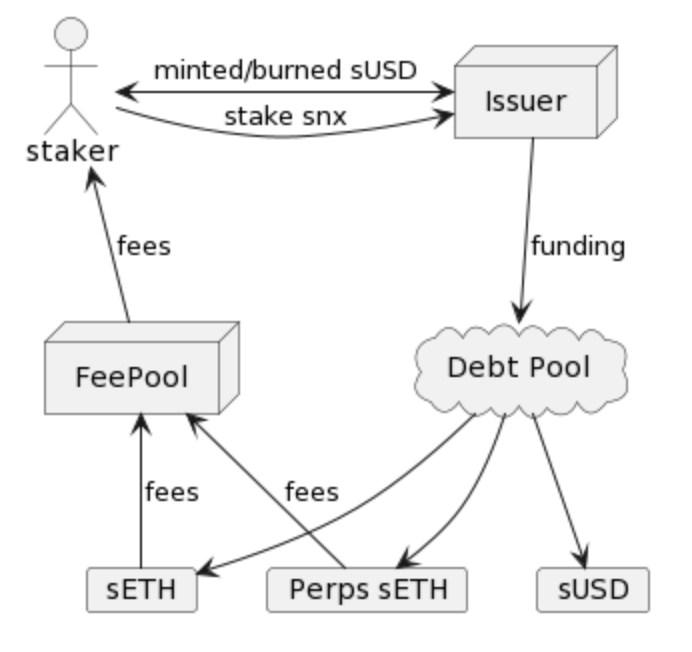

So what does an acceptable tax report for a Synthetix staker appear like? To know that, it’s helpful to evaluation what is definitely occurring when a person stakes with Synthetix.

A staker begins by locking an quantity of SNX by interacting with the net UI. As a part of this course of, the staker receives sUSD in return. The sUSD will be spent elsewhere, however it should be paid again sooner or later to unlock your SNX collateral. Some stakers might select to commerce on the merchandise Synthetix liquidity helps to energy (ex. Spot markets, perpetual futures, Lyra, and many others.), others might select to easily maintain it of their account. Different daring of us will promote it for ETH or USDC and maybe purchase actual world merchandise with it! Curiously, the way in which that the sUSD is used isn’t essential, as I’ll clarify later. Subsequent, each week, the person can be required to keep up their collaterization-ratio by minting/burning sUSD to make sure that their collateral is wholesome, sufficiently utilized, and on the goal collateralization ratio to obtain rewards. In return, the person receives rewards, each within the type of SNX from protocol inflation and sUSD buying and selling charges collected from customers.

Lastly, a staker’s place ends after they finally repay their sUSD debt, thereby burning all of the sUSD that they minted (the precise quantity required to burn relies on how the Synthetix debt pool carried out on the time) and unlocking the SNX that they initially deposited. Alternatively, the account might be liquidated if it fails to keep up its c-ratio, and on this case, the person has a portion or all of its debt repaid in return for its collateral to be collected. Though there are extra methods a staker can work together with Synthetix, this text focuses on exploring the tax reporting that could be completed for a staker, as per the aforementioned course of.

Categorizing Synthetix Transactions

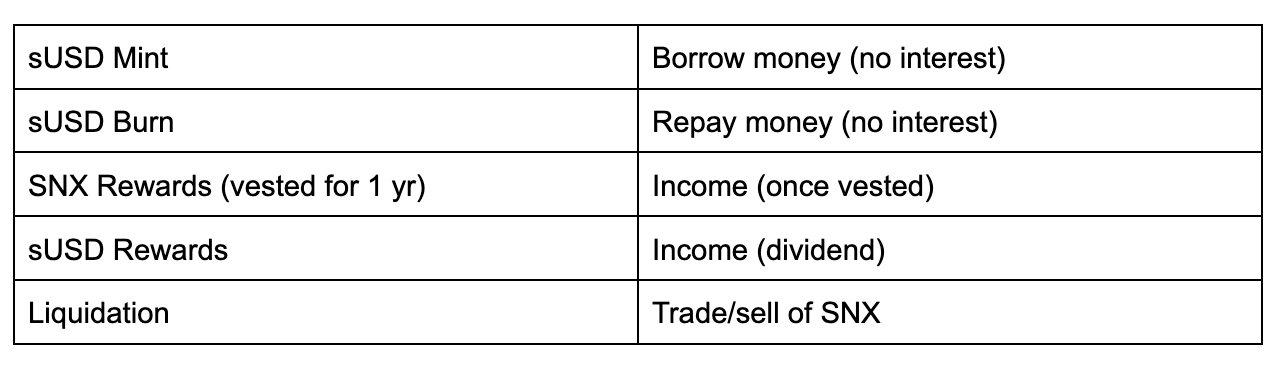

One of many first duties of tax preparation is categorizing the transactions that should be reported, and with these categorizations, a tax legal responsibility will be decided for every transaction. There are lots of transaction sorts mentioned above, and if we categorize them, we will assemble right into a desk:

Minting sUSD with locked SNX is successfully taking out a mortgage, because the sUSD must be returned sooner or later. Which means that no taxes are technically incurred by merely minting or burning sUSD, because it’s not likely (in and of itself) a revenue and a loss. There are some complexities in the case of this because of the fluctuation of the debt pool, however we’ll get to that shortly 🙂. SNX rewards are revenue as a result of they’re compensation for you locking collateral and minting sUSD to the pool. sUSD rewards play an identical function. In case your account will get liquidated, nonetheless, you might have primarily divested all of the SNX which you misplaced because of the liquidation, and due to this fact, you have to report your capital good points (or losses) of the SNX. You additionally must pay taxes on nonetheless a lot sUSD you didn’t must repay.

On this article I’ve but to acknowledge the fluctuation of the debt pool. Whereas the fluctuation tends to be comparatively insignificant in comparison with most tax liabilities, it’s nonetheless required to find out how a lot taxes are due because of the debt pool fluctuation. Furthermore, the debt pool tends to slowly improve, so there’s truly incentive to report debt pool duty for debt as a loss to make sure that your taxes are full. When combining this with sUSD rewards, there’s truly a very easy formulation which will be utilized to calculate your revenue as a result of debt pool fluctuation in a given yr:

totalSnxIncome = startDebt − endDebt + sUSDminted − sUSDburned

Word that, within the equation above, startingDebt is both the quantity of debt you had at Jan 1st of that yr, or, if you happen to began staking throughout the tax yr in query, 0. And endDebt is the quantity of debt you had on Dec thirty first, or if you happen to exited your place throughout the tax yr in query, 0. The startDebt – endDebt a part of the equation successfully covers any quantity of debt “left over” from both a previous yr, or remaining on the finish of the yr, and sUSDMinted – sUSDBurned is basically the obligations that you’ve paid/have excellent. For those who full this calculation yearly, and add it as a part of your revenue tax for any given yr, you find yourself along with your tax legal responsibility/loss as a result of debt pool fluctuation for that yr. You possibly can additionally do related calculations for a quarterly/month-to-month foundation, as your tax necessities permit. In 2022, a staker who was staking on the debt pool from the start of the yr to the top of the yr would have incurred a major internet loss, so it’s undoubtedly worthwhile to do that calculation to be sure to are getting the deduction you deserve from losses, as a result of fluctuation of the debt pool!

Accumulating Information

So, you now know that you’ve a specific amount of revenue to report to your sUSD and SNX earnings considering the debt pool fluctuations. However the query nonetheless stays, how would one collect this knowledge? Many lively stakers have a whole lot of transactions per yr from merely collaborating within the SNX staking course of – claiming, minting and burning each week, and many others. If the automated tax calculation softwares don’t compute it accurately, then the place is the perfect place to get the info? Through the years, I’ve discovered Zerion to be a superb useful resource for this. For those who go to their web site and plug in your pockets tackle (you don’t must “join” your pockets, simply paste it within the search bar), after which change to the “historical past” tab, you will note an outline of all your account transactions for all networks. You possibly can then click on “Export CSV” on the highest proper to get this enriched and formatted multiyear overview of your account transactions with knowledge extracted for transfers/trades/revenue/and many others. Whereas it additionally offers its personal tax calculation providers, it’s not essential to make use of them if you happen to merely export a CSV and apply your individual changes as wanted.

As a way to simplify the issue of computing these values for myself, I developed a small script which pulls knowledge immediately from on-chain and assembles knowledge within the equation shared above. The script will be discovered on a Github Gist. You’ll seemingly nonetheless must do some handbook calculations, however this script can assist you get 90% of the way in which.

Conclusion

If in case you have made it this far, then hopefully it is best to have some concepts and instruments that will help you handle your taxes for Synthetix. Regardless of the daunting process, with the fitting instruments and some hours of bookkeeping, it’s attainable to achieve a whole image of your revenue, bills and capital good points with the protocol. Doing the additional effort to calculate your possible losses on the debt pool will permit for larger financial savings, whereas additionally rising the completeness of your report on the similar time. That is sometimes sufficient to report your taxes and transfer on to subsequent yr to do all of it once more (wohoo!). Your accountant will thanks, and maybe your pockets too.

I wish to thank fellow Core Contributors Bex and Matt for serving to to evaluation and supply enhancements for this text.

[ad_2]

Source link