[ad_1]

The token of the layer-2 answer Arbitrum, ARB, is likely one of the best-performing cryptocurrencies throughout the high 100 by market cap over the previous seven days. With a achieve of 8.5% regardless of the heavy drawdown within the broader crypto market, the Arbitrum token data the fifth highest value achieve over the past week.

Arbitrum Token Exhibits Relative Energy

Trying on the ARB / BTC chart (2-hour) reveals that the Arbitrum token is likely one of the few altcoins that has lately proven power towards Bitcoin. If BTC sees an increase in the direction of $30,000, it’s typically advisable to search for the altcoins that present relative power in the meanwhile and ARB is unquestionably considered one of them.

Within the 2-hour chart, ARB/BTC is writing increased highs and better lows since Monday, Could 8. At present, ARB/BTC wants to interrupt above the 0.00004477 stage to proceed the pattern. If that is profitable, stronger resistance at 0.00004620 will be anticipated. However, a profitable breach could be an especially bullish sign.

The 4-hour chart of ARB/USD reveals that the value was as soon as once more rejected on the 23.8% Fibonacci stage at $1.22. This resistance is essential for ARB in the meanwhile. To be able to preserve the uptrend, the value stage should be cleared, in any other case a renewed fall in the direction of $1.05 might be on the playing cards.

If a breakout succeeds, the zone between $1.30 and the 38.2% Fibonacci at $1.33 would come into focus. Sturdy resistance will also be anticipated at $1.42, the place the 50% Fibonacci retracement stage is positioned.

Famend Crypto Merchants Are Bullish On ARB

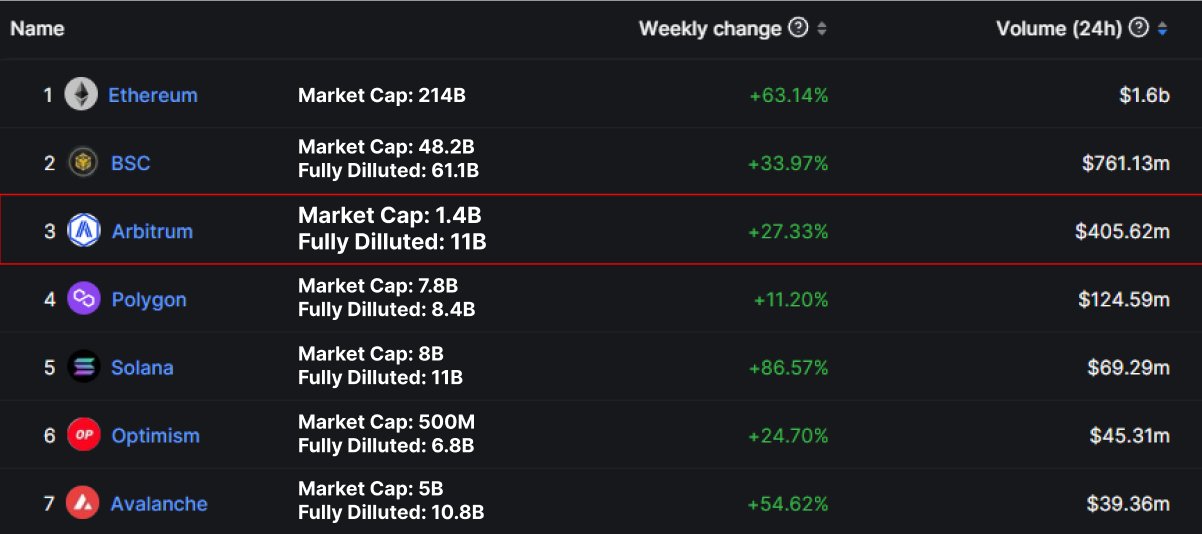

One of many analysts who’s bullish on ARB is well-liked crypto dealer @DaanCrypto. The analyst factors to the excessive on-chain transaction quantity on Arbitrum, the place the layer-2 ranks solely behind Ethereum and BSC.

Furthermore, it’s attention-grabbing to notice that the totally diluted market caps of ARB, MATIC, SOL, OP and AVAX are comparatively shut to one another, based on the analyst, whereas the circulating provide is kind of completely different. Based on Daan, ARB remains to be undervalued or much less overvalued in comparison with the opposite protocols, reminiscent of Optimism (OP).

One motive, along with ARB’s robust fundamentals, are the scheduled token unlocks: “That is essential to notice if you’re investing for the long term. OP for instance will likely be getting some larger unlocks all year long whereas ARB received’t get any till March 2024”, says Daan, who concluded, “the unlocking schedule & adoption was a motive for me to open this pair commerce between ARB & OP.”

$ARB / $OP Pair Commerce going robust.

Properly on it is option to my goal of $ARB being 2x the Absolutely Diluted Valuation of $OP. https://t.co/uJSKilhc0u pic.twitter.com/z635BpCztr

— Daan Crypto Trades (@DaanCrypto) Could 15, 2023

Andrew Kang, co-founder of Mechanism Capital, additionally shares this view. In mid-April, the infamous altcoin whale wrote that “Arbitrum is the quickest rising blue chip chain not but valued at blue chip standing and can rerate to be high of the alt L1/L2 stack.”

His reasoning: With regards to dApps with actual worth and innovation, Arbitrum dApps are on the forefront. “Whereas these bullish circumstances maintain this yr, FDV [Fully Diluted Value] is a meme. Particularly contemplating there aren’t any main unlocks till subsequent yr,” added Kang.

Featured picture from soliditydeveloper.com, chart from TradingView.com

[ad_2]

Source link