[ad_1]

The destiny of Binance USD (BUSD), the stablecoin launched by Binance, hangs within the stability as its market capitalization has skilled a big decline of over 80% in 2023.

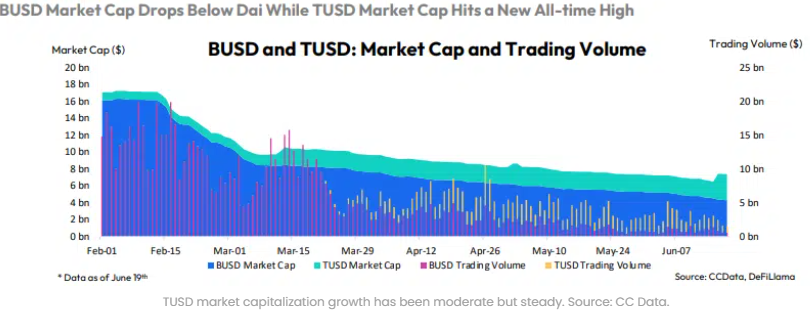

From November 2022 to June of the present yr, BUSD’s market capitalization has plummeted from USD23 billion to USD4 billion. Notably, the capitalization suffered an 18% loss in Might alone, as reported by CCData, an evaluation firm.

TrueUSD (TUSD) Features Traction As BUSD Market Cap Declines

Because the market capitalization of BUSD continues to say no and attain a vital degree, representing lower than 5% of the general stablecoin market capitalization, Binance has begun actively selling the adoption of TrueUSD (TUSD).

Whereas TUSD’s market capitalization nonetheless falls barely under that of BUSD, presently standing at over USD3.1 billion, it has surpassed BUSD when it comes to buying and selling volumes. In line with information supplied by CCData, the buying and selling volumes of TUSD have tripled, indicating a rising curiosity and utilization of the stablecoin.

Associated Studying: Masks Basis Strikes 2.5 Million Tokens To Exchanges, Large Dip Incoming?

TrueUSD (TUSD), launched in 2017 by TrustToken, has emerged because the fifth-largest stablecoin available in the market, trailing carefully behind BUSD. Functioning as an Ethereum-based ERC-20 token, TUSD secures its worth with greenback reserves deposited in a number of US-based banking entities. The corporate behind TUSD ensures a 1:1 convertibility with the US foreign money, instilling confidence in its stability and reliability amongst customers.

As BUSD’s market capitalization experiences a big decline, the rising reputation and buying and selling volumes of TUSD function a testomony to the rising demand for an alternate stablecoin possibility. Additionally, Binance’s shift in direction of selling TUSD suggests a strategic response to the altering panorama of stablecoin utilization and market dynamics.

The steep decline in BUSD’s market capitalization might be attributed to its impending discontinuation. In February 2023, NewsBTC reported that Paxos would stop issuing the BUSD stablecoin because of an ongoing lawsuit filed by the USA Securities and Trade Fee (SEC).

As per Paxos’ official assertion, BUSD will probably be redeemable till February 24, 2024, marking the potential date for its exit from the market.

Traders Transfer To USDT As It Nears Its All-Time Excessive Capitalization

Because the market capitalization of Tether (USDT) continues to rise steadily, approaching its all-time excessive, traders are taking discover and making strategic strikes. In line with information from CoinMarketCap, USDT’s present market capitalization stands at $82.9 billion (USD), near its earlier peak of $83.2 billion, reached in Might 2022. This upward trajectory has prompted traders to diversify their portfolios and discover various stablecoin choices.

Associated Studying: Bitcoin Simply Gained Over 18% In Seven Days: What’s Occurred When This Has Occurred In The Previous?

Additionally, Traders are drawn to USDT because of its stability and pegging to the US greenback, providing a dependable retailer of worth amidst market fluctuations. With its widespread acceptance and liquidity, USDT has turn into a most popular selection for merchants, offering a handy and safe technique of preserving their capital throughout risky market circumstances.

At press time, USDT was buying and selling at $0.9780 per coin with a 24-hour value improve of 1.38%.

Featured picture from iStock, charts from Tradingview and CCData

[ad_2]

Source link