[ad_1]

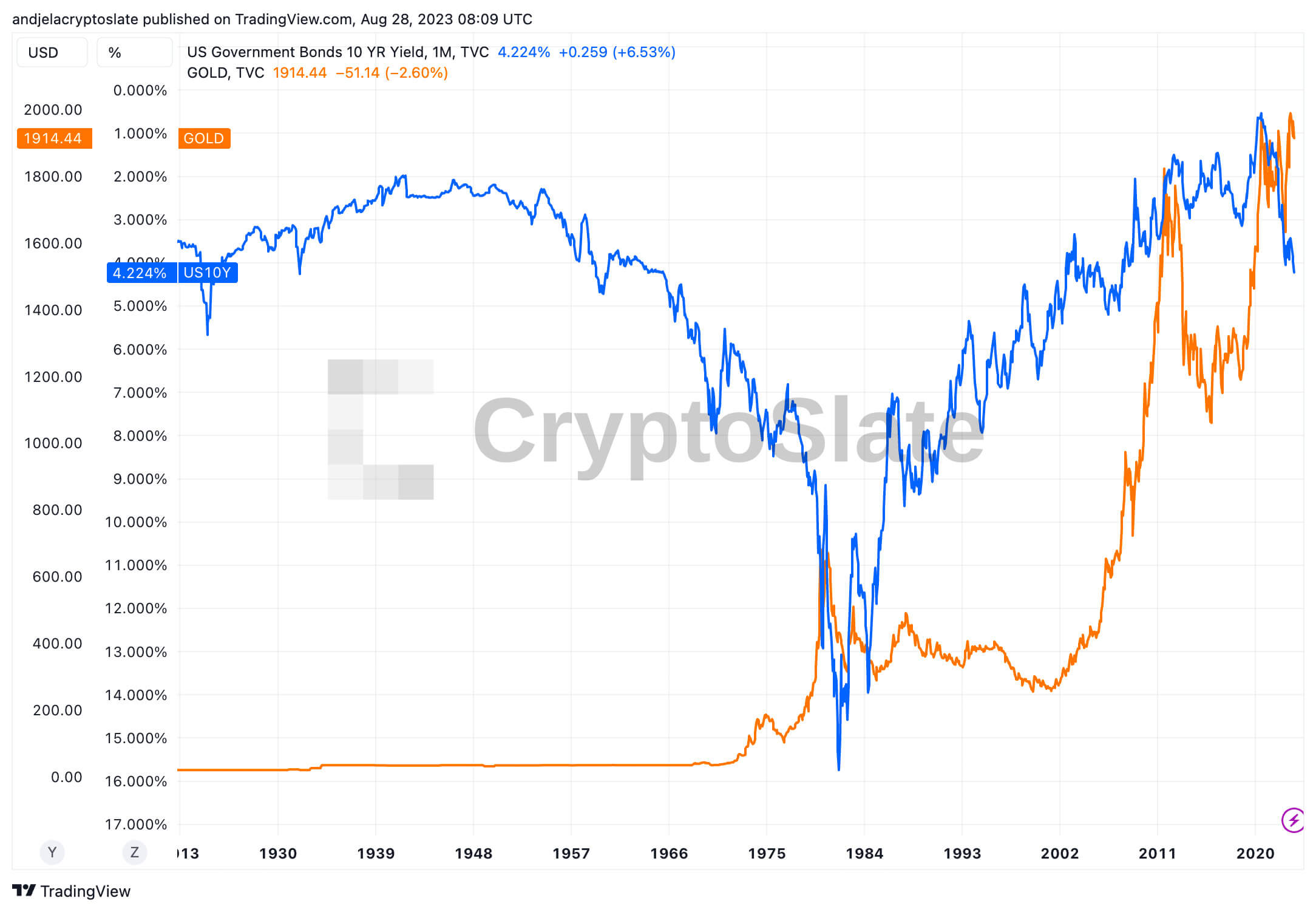

Traditionally, the 10-year Treasury yield has been a dependable barometer of broader financial sentiment. Nevertheless, latest knowledge suggests a weakening correlation between this yield and one other key asset: gold. This divergence, not seen in a long time, has profound implications for traders and the broader market.

The ten-year Treasury yield represents the return on funding for U.S. authorities bonds with a 10-year maturity. It’s an important metric for a number of causes.

Firstly, it’s a mirrored image of investor confidence. When the yield rises, it signifies optimism concerning the U.S. economic system’s prospects. Conversely, a falling yield can sign financial pessimism. Secondly, as a result of the U.S. authorities backs these bonds, they’re seen as nearly risk-free, making their yields a benchmark for different rates of interest, together with these for mortgages and company bonds.

Then again, gold is taken into account a retailer of worth. Its worth typically strikes inversely to the 10-year Treasury yield. Traders flock to gold as a secure haven when yields are low, indicating financial uncertainty. Conversely, when yields rise, signaling financial optimism, gold typically turns into much less engaging than income-generating belongings.

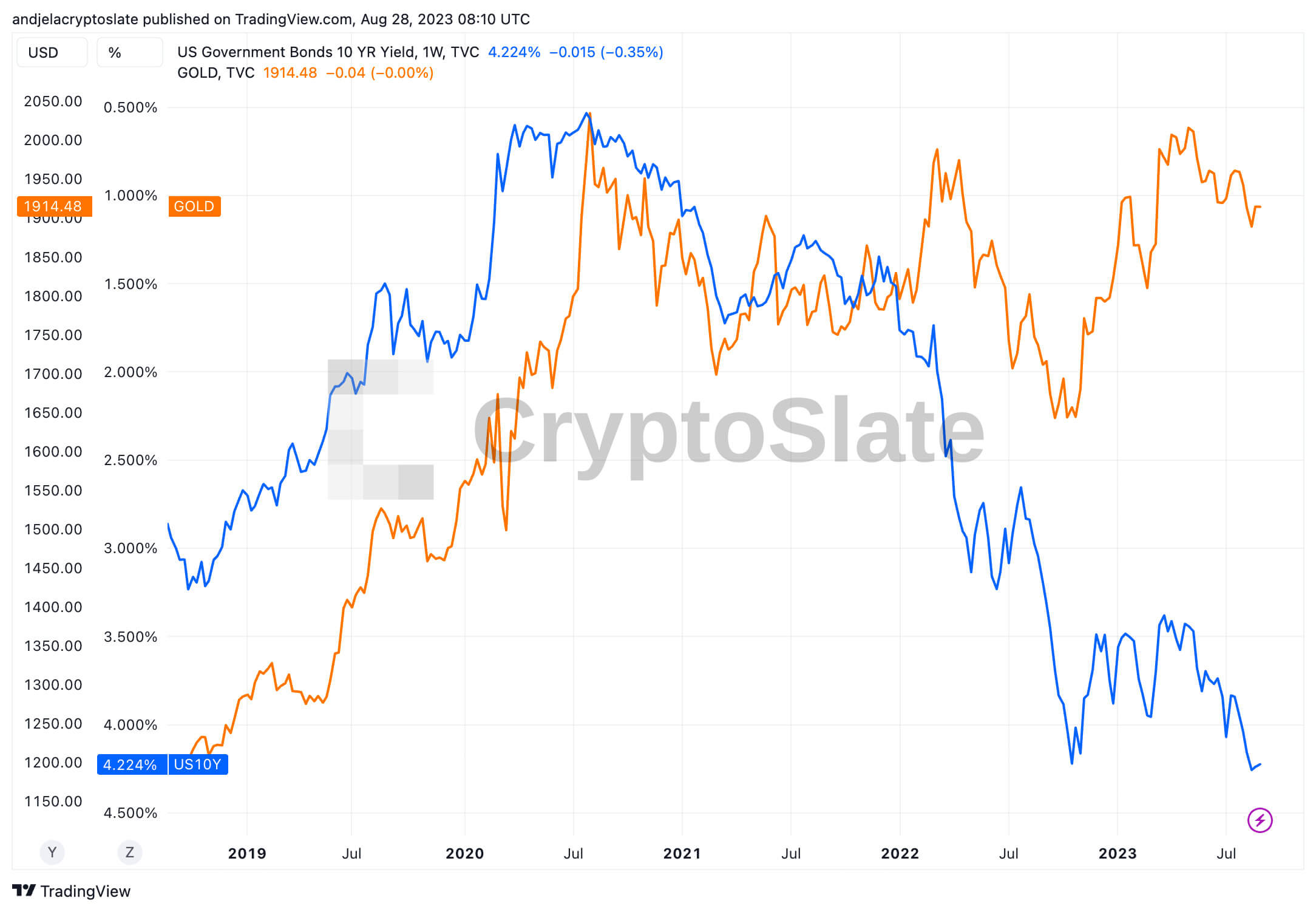

Current market developments and international occasions have disrupted this traditionally inverse relationship.

In July 2020, the 10-year Treasury yield plummeted to 0.5%, its all-time low. Since then, it has climbed considerably, standing at 4.22% on Aug. 28. Such an increase sometimes suggests rising financial confidence, which might often be accompanied by a dip in gold costs. But, gold has defied expectations. After peaking at $1,974 in July 2020, it soared to an all-time excessive of $1,991 by Apr. 3, 2023, and stays robust at $1,914 as of Aug. 28, 2023.

This divergence is critical, and its causes may very well be multi-faceted, involving numerous international occasions and market developments influencing investor conduct. Whereas the rising yield signifies optimism about U.S. financial progress or potential inflation, the resilient gold costs trace at different international elements sustaining its demand and point out a possible instability of U.S. Treasurys. Elements resembling geopolitical tensions, financial insurance policies, fluctuations within the worth of the U.S. greenback, or ongoing issues about inflation may all contribute to this pattern, making gold a extra engaging hedge for traders.

This divergence presents challenges and alternatives for the market, creating a brand new paradigm for traders. They need to navigate an atmosphere the place conventional correlations, very important for guiding funding methods, are much less sure. This shift may demand new methods, resembling diversifying portfolios or focusing extra on particular person asset dynamics.

The put up Breaking traditions: Why gold costs defy 10-year Treasury yield actions appeared first on CryptoSlate.

[ad_2]

Source link