[ad_1]

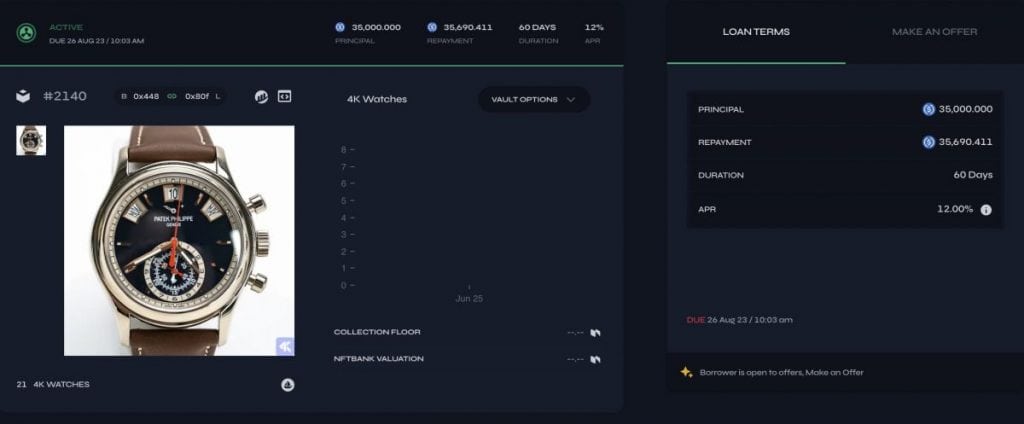

On June 25, an nameless particular person gave a stranger a $35,000 mortgage. The latter used a Patek Philip watch as collateral. The chronograph, reportedly a 5960/01G-001 mannequin, prices between $54,000 and $79,000 in 2023.

Notably, the lender doesn’t know the borrower’s identify or handle and has by no means met them. Nevertheless, because of the proof-of-ownership enabled by NFT-backed Actual World Property, this was not a deal.

To checklist a watch as collateral, the borrower despatched it to an escrow firm, which then despatched the borrower a non-fungible token representing the possession of the merchandise. Following this, the borrower listed the token on Arcade, a p2p mortgage protocol for NFTs. The person then accepted the perfect mortgage supply. After this, the non-fungible token was transferred to an escrow pockets, the place it’ll keep till the borrower repays the sum or till the lending interval ends.

The borrower took $35,000 for 2 months at an annual share charge of 12%. So, by August 26, they’re obliged to repay $35,690,411. The people will obtain the Patek Philip watch again as soon as the corresponding non-fungible token is burned. In case the borrower defaults, the lender can declare the merchandise.

This use case exhibits the probabilities enabled by the proof-of-ownership of Actual World Property (RWAs) backed by NFTs. Although the market could be very younger, in 2023, RWA is changing into a sizzling matter. The tokenization of Actual World Property is an modern strategy to bridge DeFi (Decentralized Finance) and TradFi (Conventional Finance). As of in the present day, we’ve got seen watches or actual property represented on-chain by non-fungible tokens – nonetheless, the market has the potential to develop within the nearest future.

There are a number of decentralized exchanges that assist the buying and selling of tokenized Actual World Property. Amongst these is Pearl, a Polygon-based trade with deep liquidity for tokenized RWAs and premium digital belongings.

Learn extra:

[ad_2]

Source link