[ad_1]

Blur has a stranglehold on the NFT lending trade. Because the controversial NFT alternate started providing lending providers to NFT collectors final month, it has managed to manage 82% of lending quantity. What’s going on with Blur’s NFT lending program?

What is occurring with Blur’s NFT lending program?

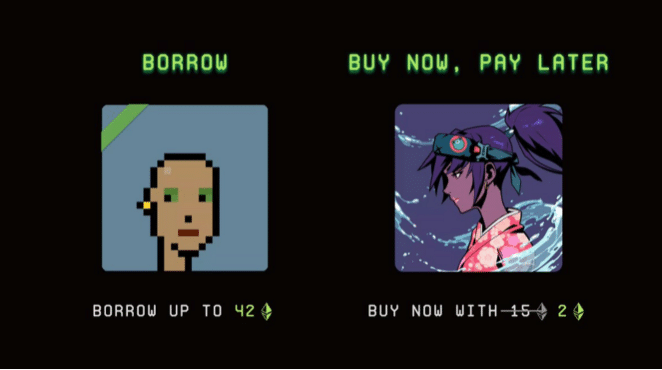

Blur made an enormous announcement final month. It will pivot into providing collateralized loans for blue-chip NFT holders. Moreover, consumers might additionally buy NFTs by paying a downpayment upfront and financing the remainder of their buy. This program is known as Mix, and since its launch, has proved terribly common.

During the last 22 days, Blur has managed $308m in mortgage quantity. This determine accounts for an 82% share of the full lending quantity of $375m in Could. Mix has change into so profitable, actually, that this quantity at present represents 46.2% of the alternate’s operations.

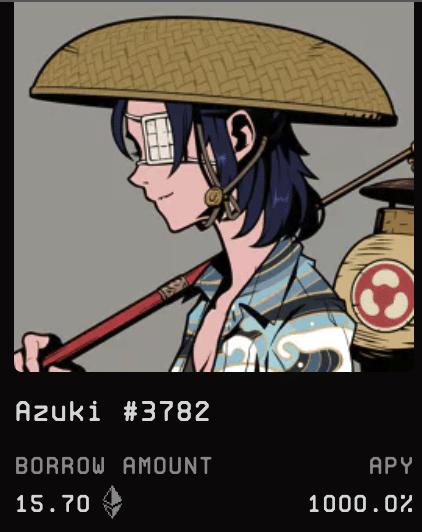

Mix customers are primarily concentrating on the Azuki assortment. Identified for its wonderful artwork and rich collectors, Azuki offers a comparatively steady flooring for mortgage operators to work with. To this point, Azuki has seen $127m in mortgage quantity. The platform additionally helps loans for different high NFT collections together with CryptoPunks, Milady Makers, DeGods, Bored Ape Yacht Membership, and Mutant Ape Yacht Membership.

Thus far, excessive net-worth collectors have dominated lending volumes. This isn’t stunning provided that Blur is rewarding Mix customers with their latest airdrop. Because of this, whales are farming this airdrop by pouring cash into the Mix platform. The extra loans they provide and take out, the extra lending factors they obtain and the larger airdrop these people will finally obtain.

Has Mix impacted the NFT market?

Like Blur’s earlier airdrop campaigns, Mix has had a ripple impact on the remainder of the NFT market. Initially, costs nudged upwards as Mix unlocked liquidity that was beforehand locked up in NFTs. Some holders posted their costly objects as collateral to purchase different NFTs, hoping they’d be capable of execute worthwhile trades earlier than needing to pay generally exorbitant borrowing prices. Moreover, some consumers took benefit of Mix’s low money-down financing choices to purchase NFTs for a fraction of their prices.

Regardless of its success, some members of the NFT neighborhood have been important of Mix. Jonathan Gabler, the co-founder of different NFT lending protocol NFTFi, said that “Unchanged, the present incentive design will doubtless result in dangerous outcomes for debtors comparable to mass defaults or liquidations of high-risk loans, flush NFTs into the arms of level farmers, and in consequence, might result in a lot increased market volatility. Current peer-to-peer protocols are typically extra borrower-friendly and result in more healthy mortgage markets.”

No matter any controversy, Blur has continued to claim itself as a disruptive participant within the NFT market. The alternate’s Mix program is one other instance of its willingness to innovate to satisfy buyer calls for. Furthermore, it additionally demonstrates Blur’s understanding of its buyer base– give NFT consumers a method to purchase extra NFTs and they’ll soar on the alternative.

All funding/monetary opinions expressed by NFTevening.com will not be suggestions.

This text is instructional materials.

As at all times, make your personal analysis prior to creating any form of funding.

[ad_2]

Source link