[ad_1]

On this article, let’s take a deep-dive on CoinGecko’s 2023 Q1 Crypto/NFT Business report to grasp how the area bounces again from the bear market blues of yesteryear! The beginning of 2023 marked a recent begin for the crypto market. It rebounds from its end-of-2022 hunch and sees a 48.9% enhance in market cap from $831.8B to $1.238T by March 31, 2023. This resurgence helped recuperate losses ensuing from the collapse of FTX and Luna.

It additionally propelled Bitcoin and Ethereum costs to roughly $28,000 and $1,800, respectively. Let’s study extra concerning the new path wherein the crypto area is headed.

NFT Bear Market No Extra! 2023 Appears to be like Promising For Crypto & NFTs

CoinGecko’s all-encompassing 2023 Q1 Crypto Business Report offers an outline of the crypto market panorama, an evaluation of Bitcoin and Ethereum, an in-depth have a look at DeFi and NFT ecosystems, and a evaluation of the efficiency of each centralized and decentralized exchanges. Bitcoin (BTC) of all cryptos, skilled a formidable achieve of almost 72% in Q1 2023. Throughout the identical interval, the crypto market carried out strongly with a complete market cap of $1.2 trillion.

This displays a 48.9% achieve in comparison with the tip of 2022. Common every day buying and selling quantity additionally elevated by 30% in comparison with the earlier quarter. Throughout Q1 2023, the highest 15 stablecoins skilled a 4.5% lower in market cap ($6.2 billion). That is primarily because of the shutdown of BUSD by Paxos and the temporary USDC depegging occasion. Tether (USDT) continued to steer the stablecoin market with a 20.5% enhance in market cap ($13.6 billion).

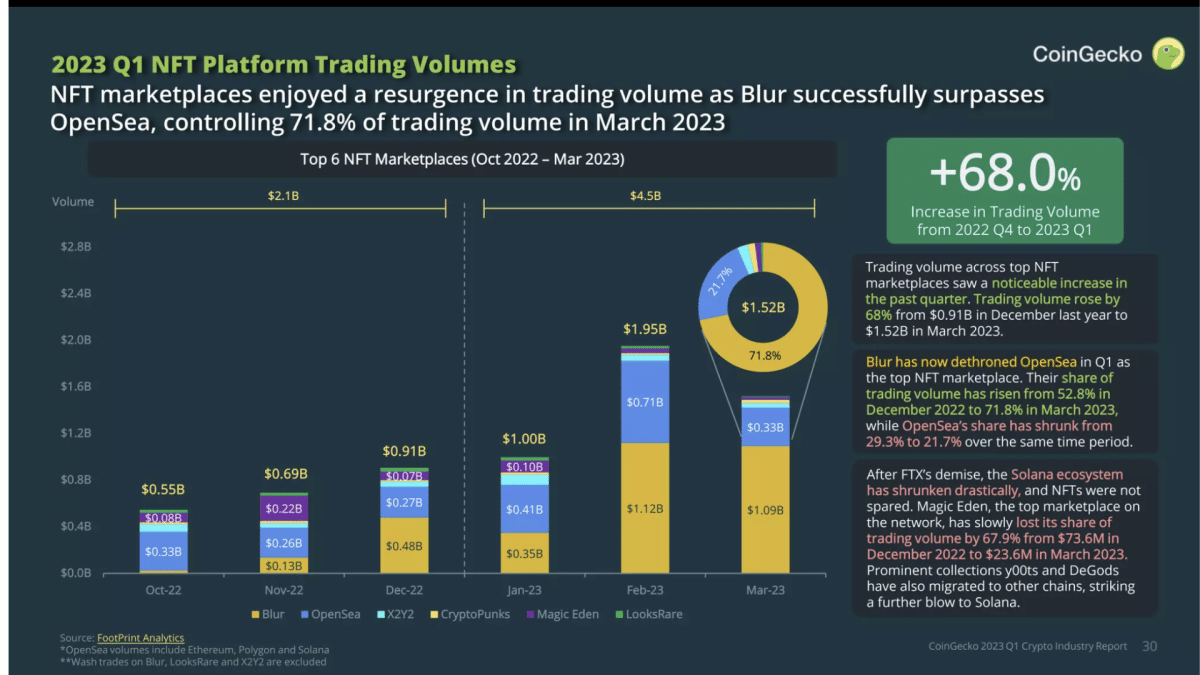

NFT buying and selling quantity elevated by 68% from $2.1 billion in 2022 This fall to $4.5 billion in 2023 Q1, with most of it coming from the brand new platform Blur. Blur grew its market share from 52.8% in December 2022 to 71.8% in March 2023, whereas OpenSea’s share shrunk from 29.3% to 21.7%. Solana’s ecosystem noticed a decline, with Magic Eden’s buying and selling quantity dropping 67.9% from December 2022 to March 2023, and y00ts and DeGods migrating to different chains.

DeFi & Spot Buying and selling Progress

In 2023 Q1, spot buying and selling quantity on the highest 10 crypto exchanges elevated by 18.1% from the earlier quarter, totaling $2.8 trillion. Month-to-month buying and selling quantity has been rising since December 2022, however has but to succeed in the degrees seen in H1 2022. DEXs grew sooner than CEXs on account of regulatory crackdowns, however CEXs nonetheless accounted for over 90% of buying and selling quantity.

Liquid staking governance tokens led the cost within the DeFi sector, driving a 65.2% enhance in market cap throughout 2023 Q1, representing a $29.6 billion enhance. Particularly, the affirmation of Ethereum’s Shapella improve noticed liquid staking governance tokens surge by 210.9%. This pushed it to grow to be the third largest class in DeFi. Alternatively, DEX governance tokens grew by 44.3% in Q1 however noticed a -5% drop in market share since January.

The complete 44-page detailed CoinGecko trade evaluation slider is discovered right here, for extra particulars on varied sectors and micro-movements throughout the crypto/NFT industries.

All funding/monetary opinions expressed by NFTevening.com aren’t suggestions.

This text is academic materials.

As all the time, make your individual analysis prior to creating any type of funding.

[ad_2]

Source link