[ad_1]

On June 20, The O’Keefe Media Group uploaded a video that includes BlackRock recruiter Serge Varlay discussing the world’s largest asset supervisor’s work mode.

The footage was taken throughout a number of conferences of Varlay and OMG Information’ undercover journalist. The recruiter didn’t know or suspect that he was being recorded and shared necessary info with the journalist.

Varlay says, “BlackRock manages $20 trillion. It’s incomprehensible numbers,” and tells the reporter, “On daily basis, I determine how sometime’s life goes to be formed.” He additionally discusses the facility of BlackRock on politicians:

“It’s not by who the president is. It’s who’s controlling the pockets of the president.”

“Who’s that?” asks the reporter.

“Hedge funds, BlackRock, the banks. These guys run the world,” replies Serge, “Marketing campaign financing. You should purchase your candidates. All these monetary establishments, they purchase politicians.” Varlay additionally factors out that “senators are low cost” and will be “purchased” for $10,000.

Greater than that, Serge tells the reporter how the US authorities depends on BlackRock for its financial simulation and computational energy.

Varlay says that “Ukraine is nice for enterprise,” hoping that his date—the undercover reporter, “is aware of that.” “We don’t need the battle to finish as a rustic. The longer this goes on, the weaker Russia is. Russia blows up Ukraine’s grain silos. The worth of wheat is gonna go mad up. So what are you gonna do when you’re a buying and selling agency? The second that information hits, inside a millisecond, you’re going to pump trades into whomever the wheat suppliers are. Into their shares.” Serge goes on to elucidate that dangerous information is nice for information channels’ enterprise too.

Furthermore, the BlackRock recruiter has shared some buying and selling suggestions with the reporter: “If you wish to make investments good, there’s a tracker that tracks all politicians and the place they’ve their shares. If we predict the inventory value goes to tank, we’re gonna promote in order that we bought excessive, it tanks, and we purchase it again.”

After O’Keefe Media Group’s video and press launch with feedback had been revealed, Serge Varlay deleted his LinkedIn profile image. BlackRock declined the writer’s request for remark.

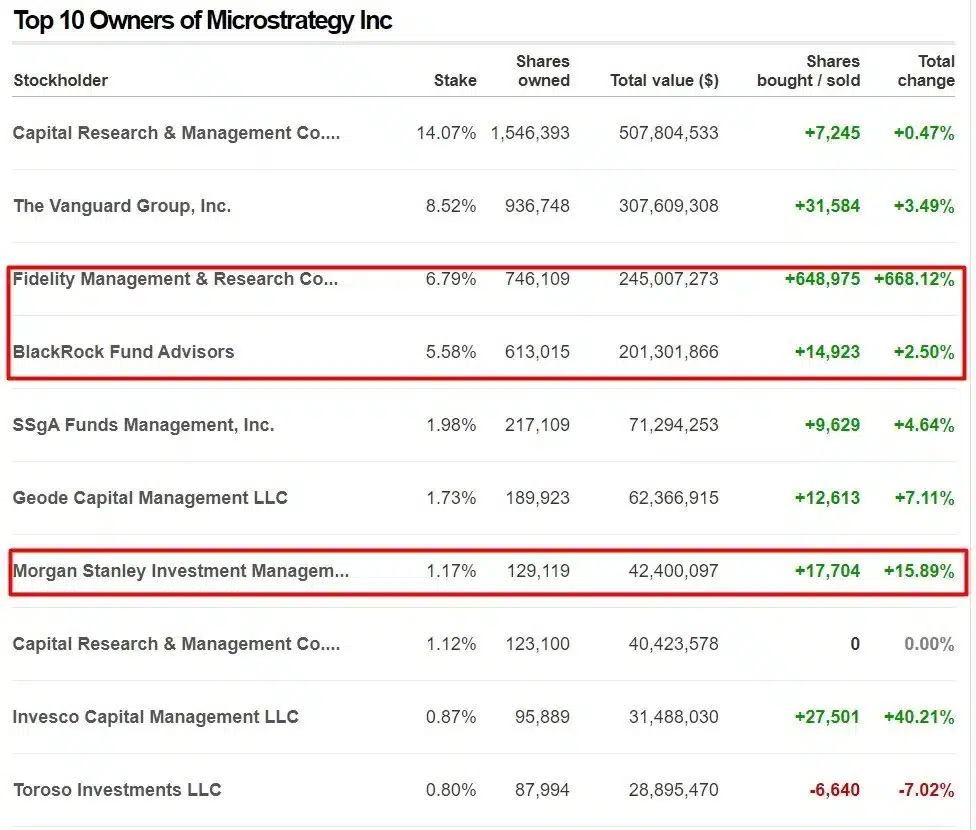

It’s value noting that BlackRock is an organization that has lately began buying Bitcoin at low ranges. Together with different highly effective banks, reminiscent of Constancy Administration, Financial institution of America, and Morgan Stanley, the asset supervisor acquired shares of MicroStrategy, the biggest holder of Bitcoin.

In accordance with Coindesk, BlackRock began working with the cryptocurrency change Coinbase final yr as a way to make crypto obtainable to institutional buyers. That is to say that whereas the US Securities and Change Fee was actively going after cryptocurrency exchanges, the biggest government-affiliated banks, and funds had been accumulating crypto.

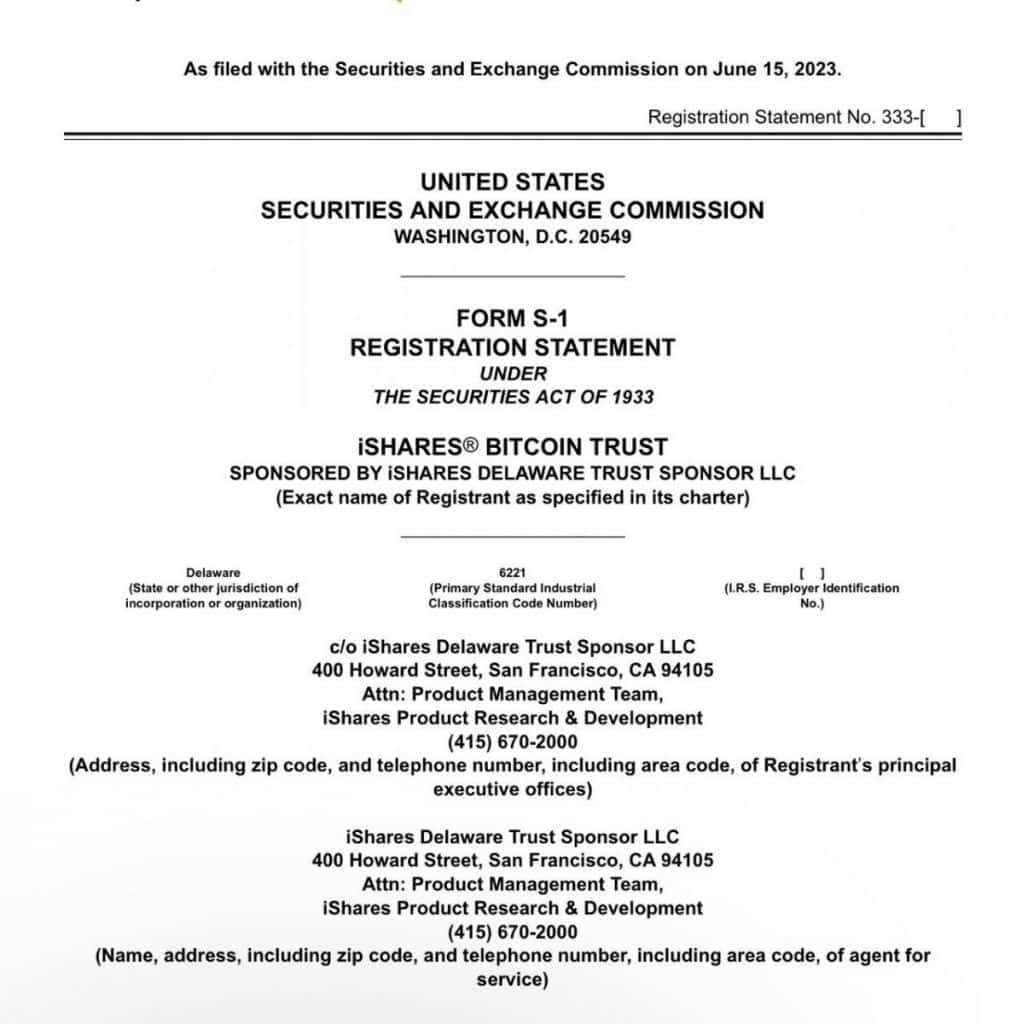

On June 15, BlackRock formally filed for a spot in Bitcoin ETF.

Following this, on June 20, EDX Markets went reside. The platform is a brand new digital asset market designed to satisfy the wants of each crypto-native companies and the world’s largest monetary establishments. EDXM goals to supply protected, quick, and environment friendly buying and selling of digital property, in addition to leverage “greatest practices from conventional monetary markets on a purpose-built crypto platform.”

A number of giant cryptocurrency exchanges, together with Binance and Coinbase, have lately confronted issues with the US Securities and Change Fee. Nevertheless, because of what Serge Varlay has shared on BlackRock and its management of politicians, we are able to now think about why the US authorities was after Binance and Coinbase.

Learn associated posts:

[ad_2]

Source link