[ad_1]

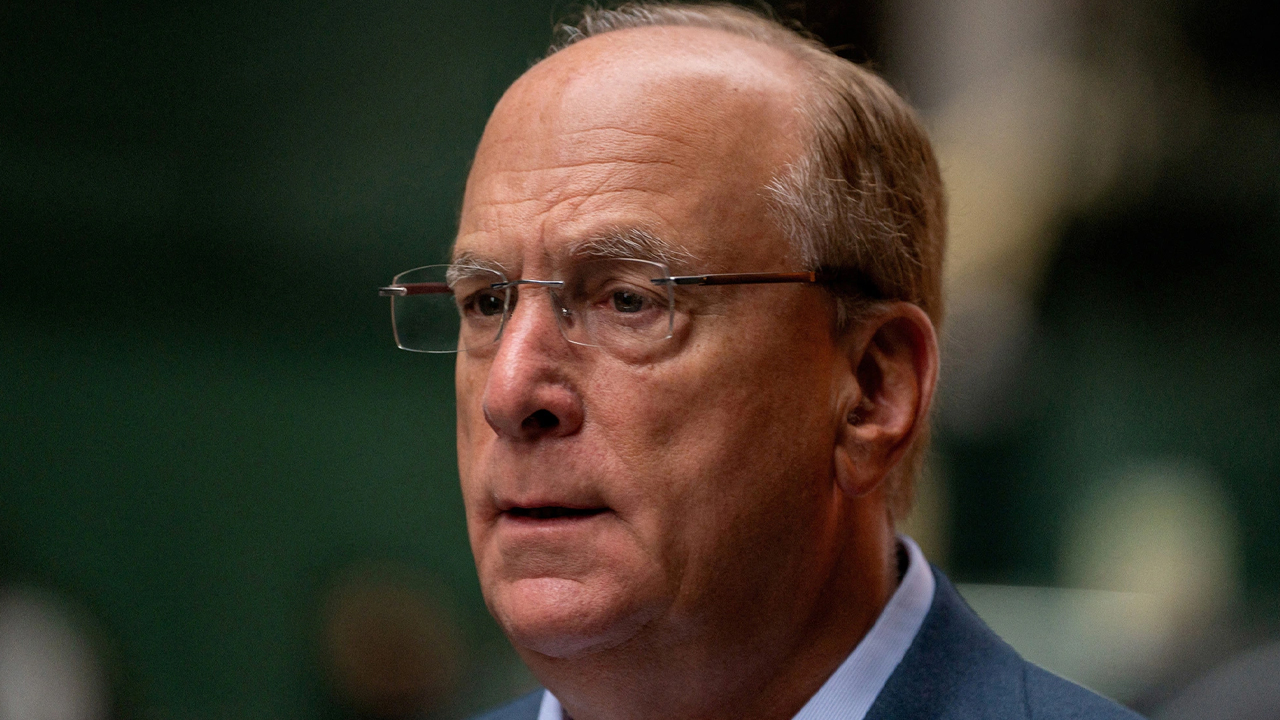

Blackrock’s CEO, Larry Fink, said in an interview on Friday that he doesn’t anticipate a “massive recession” in the USA. Nevertheless, he believes that “inflation goes to be stickier for longer.” In distinction to the U.S. central financial institution’s 2% objective, Fink predicts that “we’re going to have a 4ish flooring in inflation.”

Blackrock Shoppers Cut back Danger in Portfolios as Inflation Considerations Persist

Larry Fink, chairman and CEO of Blackrock (NYSE: BLK), the asset supervisor with greater than $9 trillion in property below administration (AUM), predicts that inflation within the U.S. will persist for a substantial period of time. Fink was interviewed on Friday by the hosts of CNBC’s “Squawk on the Road” and said that he doesn’t anticipate a serious financial downturn within the nation.

“I’m not anticipating a giant recession within the [United States],” Fink informed the printed hosts. He additionally emphasised that the numerous fiscal stimulus injected into the nation must be “offset.”

Whereas acknowledging that some sectors of the financial system are “weakening,” Fink said that “different sectors, due to these super fiscal stimuli, are going to offset a few of that.” The Blackrock government additionally mentioned inflation, emphasizing that he believes it “goes to be stickier for longer. In different phrases, I believe we’re going to have a 4ish flooring in inflation.”

Concerning a attainable recession in 2023, he said that he’s “undecided we’re going to have a recession” and steered it would happen in 2024. Fink additionally expressed bewilderment on the response to the autumn of Silvergate Financial institution, Silicon Valley Financial institution, and Signature Financial institution.

Fink mentioned:

This isn’t a systemic downside, this isn’t an issue that’s going to have influence. As we noticed at the moment we had our massive banks having nice quarters … performing very well. So I believe that is simply an instance of, , when the ocean or the tide goes out, some persons are going to be left there.

In mid-March, Fink shared his views on the banking business following the collapse of three banks and asserted that “we’re prone to see stricter capital requirements for banks.” Fink’s newest analysis, shared with CNBC hosts on Friday, coincides with current remarks made by Blackrock’s chief funding officer of worldwide fastened revenue, Rick Rieder.

Rieder anticipates that the U.S. Federal Reserve will enhance the benchmark fee to six% this yr and keep it at that stage for an prolonged interval to alleviate inflationary pressures. Throughout his interview, Fink additionally knowledgeable CNBC that Blackrock’s purchasers are lowering danger of their portfolios.

“We’re seeing increasingly purchasers who need to lower danger whereas sustaining a extra holistic and resilient portfolio by establishing a stronger basis of bonds and equities,” Fink defined.

Additional, the Blackrock CEO touted the corporate’s success over the previous 5 years, boasting of “rising by $1.8 trillion in internet inflows.” Regardless of “all this pessimism,” he emphasised that Blackrock grew “extra on this first quarter than the primary quarter of ’22.”

What do you assume Larry Fink’s predictions imply for the way forward for the U.S. financial system? Do you agree or disagree with the Blackrock CEO’s evaluation of the inflationary atmosphere and the chance of no recession in 2023? Share your ideas within the feedback beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, companies, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, immediately or not directly, for any injury or loss induced or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or companies talked about on this article.

[ad_2]

Source link