[ad_1]

Fast Take

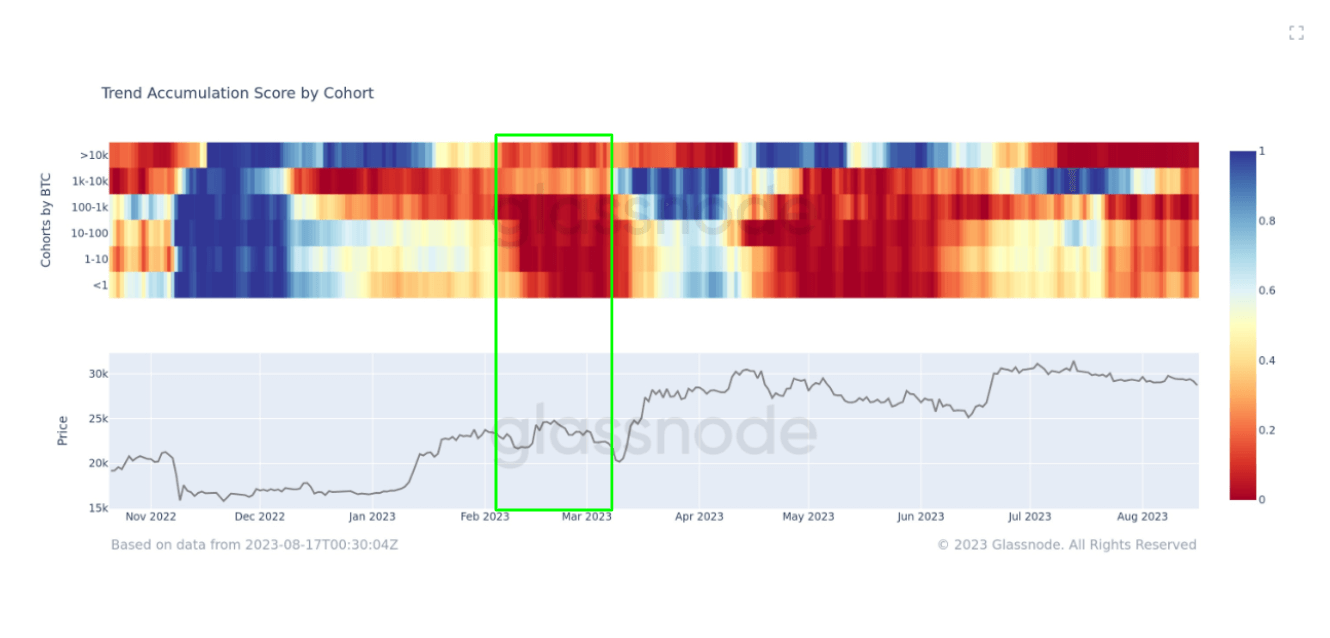

A putting parallel is noticed within the worth habits of Bitcoin throughout the banking collapse in March 2023 and the present market circumstances. Earlier than the banking downfall, Bitcoin’s worth remained comparatively dormant, oscillating within the slender band of $23,000 to $25,000. The collapse of SVB triggered a fall, pushing Bitcoin under the $20,000 threshold.

Quick ahead to at this time, and the same situation seems to be unfolding. Regardless of slipping under $29,000, Bitcoin’s worth nonetheless manifests a flat development underpinned by traditionally low volatility. In opposition to the backdrop of this placidity, treasury yields are experiencing a surge. Whereas it’s a tad early to foretell a exact final result, these components recommend a brewing change in Bitcoin’s worth path.

This juxtaposition underlines the interconnectedness of crypto property with conventional banking eventualities and broader market dynamics. It’s a testomony to the truth that whereas Bitcoin operates on decentralized rules, its worth actions usually are not totally proof against systemic monetary occasions.

The put up Bitcoin’s flat development amid surging treasury yields indicators potential worth upheaval appeared first on CryptoSlate.

[ad_2]

Source link