[ad_1]

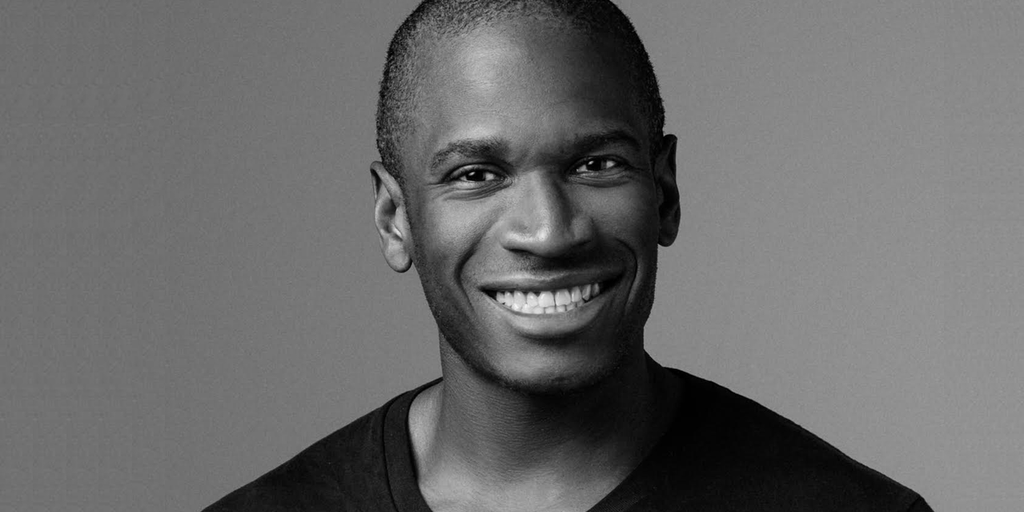

BitMEX co-founder Arthur Hayes believes the Federal Reserve will lose its quest to beat inflation, finally benefiting “threat belongings of finite provide,” reminiscent of Bitcoin.

In a weblog submit revealed on Wednesday, the essayist argued that the Fed is sucking cash from one space of the economic system whereas injecting cash into one other.

So long as the Fed’s technique to fight inflation stays “quixotic,” belongings like Bitcoin will probably rise in the long term.

“Bitcoin has a finite provide, and due to this fact because the denominator of fiat bathroom paper grows, so will Bitcoin’s worth in fiat foreign money phrases,” Hayes wrote. Other than large tech and crypto, the ex-CEO believes nothing will yield a greater return for buyers apart from parking their cash at Fed and incomes almost 6% yield.

He went on to clarify why the Fed’s techniques have been flawed.

Particularly, by regularly elevating its Reverse Repo Program (RRP) and Curiosity on Reserve Balances (IORB), the central financial institution is pressured to pay out billions extra per thirty days to depositors, which counteracts the Fed’s impact on the cash provide from quantitative tightening (QT; promoting bonds on the open market).

“If the Fed believes that to kill inflation it should each increase rates of interest and cut back the scale of its steadiness sheet, then it’s chopping its nostril to spite its face,” wrote Hayes.

The central financial institution’s method differs from Paul Volcker – a former central financial institution chairman credited with crushing inflation within the Eighties by hawkish financial coverage. As Hayes defined, whereas the Fed within the Eighties might have adjusted its coverage fee, it didn’t micromanage RRP and IORB charges to match it.

“The one variable that modified from the Fed’s perspective was the scale of its steadiness sheet,” stated Hayes.

At current, the Fed is draining $80 billion per thirty days from the market by QT, whereas injecting $22.53 billion into banks. Although this nonetheless seems “restrictive,” Hayes estimated that the rising curiosity expense on U.S. authorities debt is placing one other $80 billion per thirty days again into the economic system. “I estimate that ~$23 billion in liquidity is internet injected each month,” he stated.

Finally, Hayes stated he expects the Fed to reverse course on QT because the U.S. Treasury turns into replete with different consumers of its debt, and grows determined to keep away from a cataclysmic default. That stated, the market doesn’t appear to acknowledge this as imminent, and thus hasn’t moved its capital into Bitcoin – but.

“We gotta go all the way down to go up,” concluded Hayes. “I’m not going to struggle the market, however simply sit tight and settle for my stimmies.”

Keep on high of crypto information, get day by day updates in your inbox.

[ad_2]

Source link