[ad_1]

On-chain knowledge exhibits that Bitcoin whales have simply had their most energetic hour in round three months because the asset has damaged previous $30,000.

Bitcoin Whale Transaction Depend Has Noticed A Spike Not too long ago

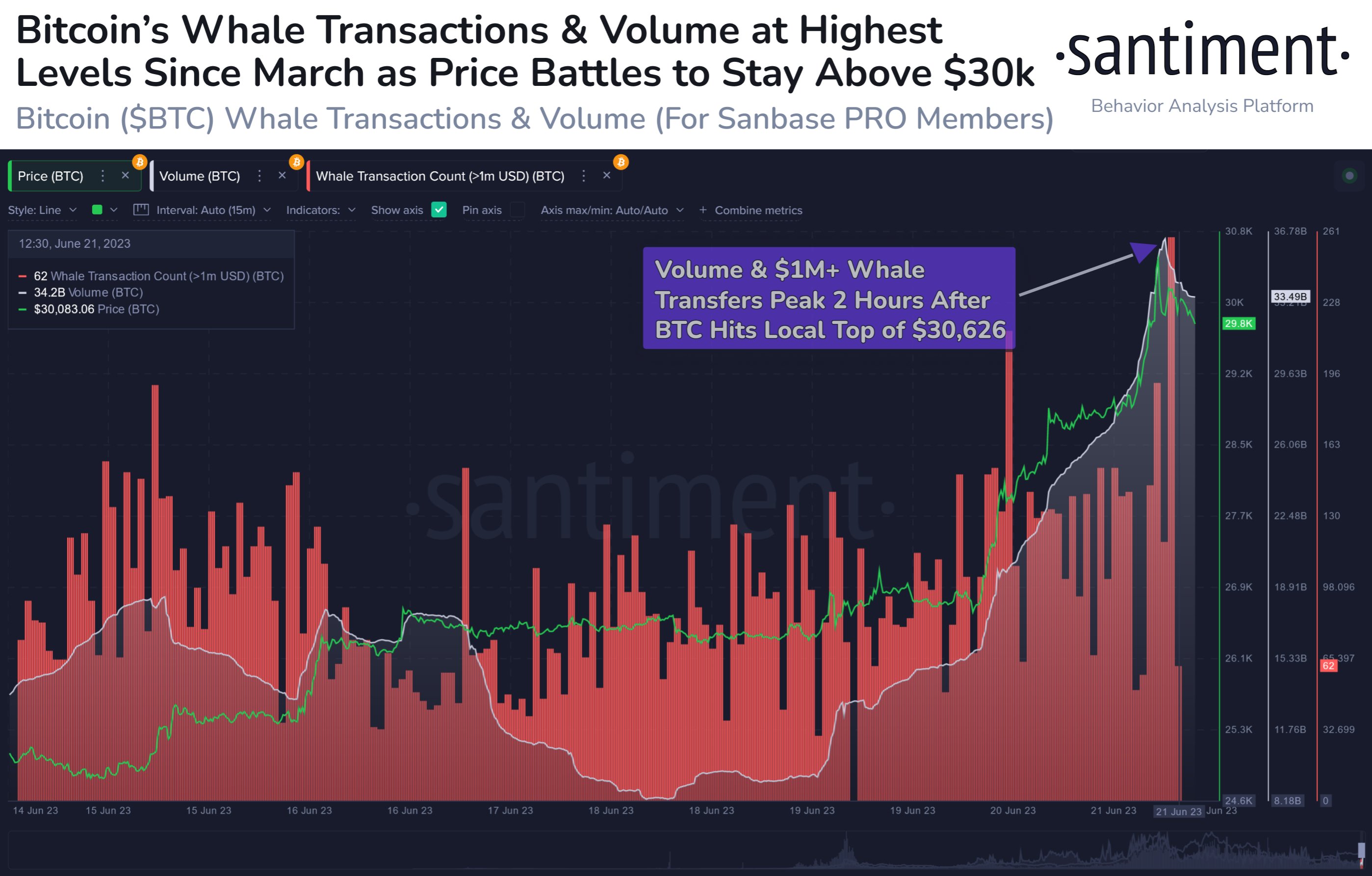

In keeping with knowledge from the on-chain analytics agency Santiment, 259 whale transactions occurred two hours after the native high that the cryptocurrency has noticed through the previous day up to now.

The related indicator right here is the “whale transaction rely,” which measures the full variety of Bitcoin transactions going down on the blockchain that’s value a minimum of $1 million in worth.

As usually, solely the whales are able to shifting such giant quantities with a single switch, these transactions can present us a touch in regards to the diploma of exercise that the whales are displaying proper now

When the worth of the whale transaction rely is excessive, it implies that there are a excessive quantity of huge transactions going down on the community at the moment. Naturally, such a pattern would indicate the whales are extremely energetic in the mean time.

For the reason that quantities concerned in these transfers are so excessive, a lot of them going down directly may cause noticeable fluctuations within the asset’s worth. Thus, when the whale transaction rely is elevated, the cryptocurrency could develop into extra possible to point out excessive volatility.

Now, here’s a chart that exhibits the pattern within the Bitcoin whale transaction rely over the previous week:

Appears to be like like the worth of the metric has been fairly excessive in current days | Supply: Santiment on Twitter

As displayed within the above graph, the Bitcoin whale transaction rely has registered an enormous spike through the previous day. This extraordinary surge within the indicator occurred round two hours after the asset hit its native high and lasted for round an hour.

On this hour, whales made 259 transactions, which is probably the most quantity in over three months. As for the implication of this spike on the value of the asset, as talked about earlier than, excessive values of the indicator can result in extra volatility for the cryptocurrency.

Such volatility can go both method, nonetheless, because the metric merely counts the pure variety of whale transactions taking place on the blockchain; it accommodates no details about whether or not the transfers have been made for getting or promoting functions.

Nonetheless, extra context just like the prevailing worth pattern can maybe assist us guess higher about what these whales meant to attain with these giant transactions.

Because the spike within the indicator got here simply after the BTC high, it’s potential that the whales had been seeking to promote earlier than the asset noticed an extra decline. The worth continued to go downhill following these transfers, hinting that a minimum of some promoting did happen.

This drawdown has up to now been short-lived, nonetheless, as Bitcoin has already recovered again above the $30,000 degree. This is usually a signal that though some promoting could have taken place, it was nonetheless at ranges low sufficient that the market was capable of take in it simply fantastic.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,100, up 21% within the final week.

BTC has surged over the last couple of days | Supply: BTCUSD on TradingView

Featured picture from Todd Cravens on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link