[ad_1]

On-chain information exhibits the Bitcoin whales have been shopping for the dip, as their addresses have surged again in direction of pre-crash ranges once more.

Bitcoin Whales Have Absolutely Recovered To Their Pre-Crash Quantity

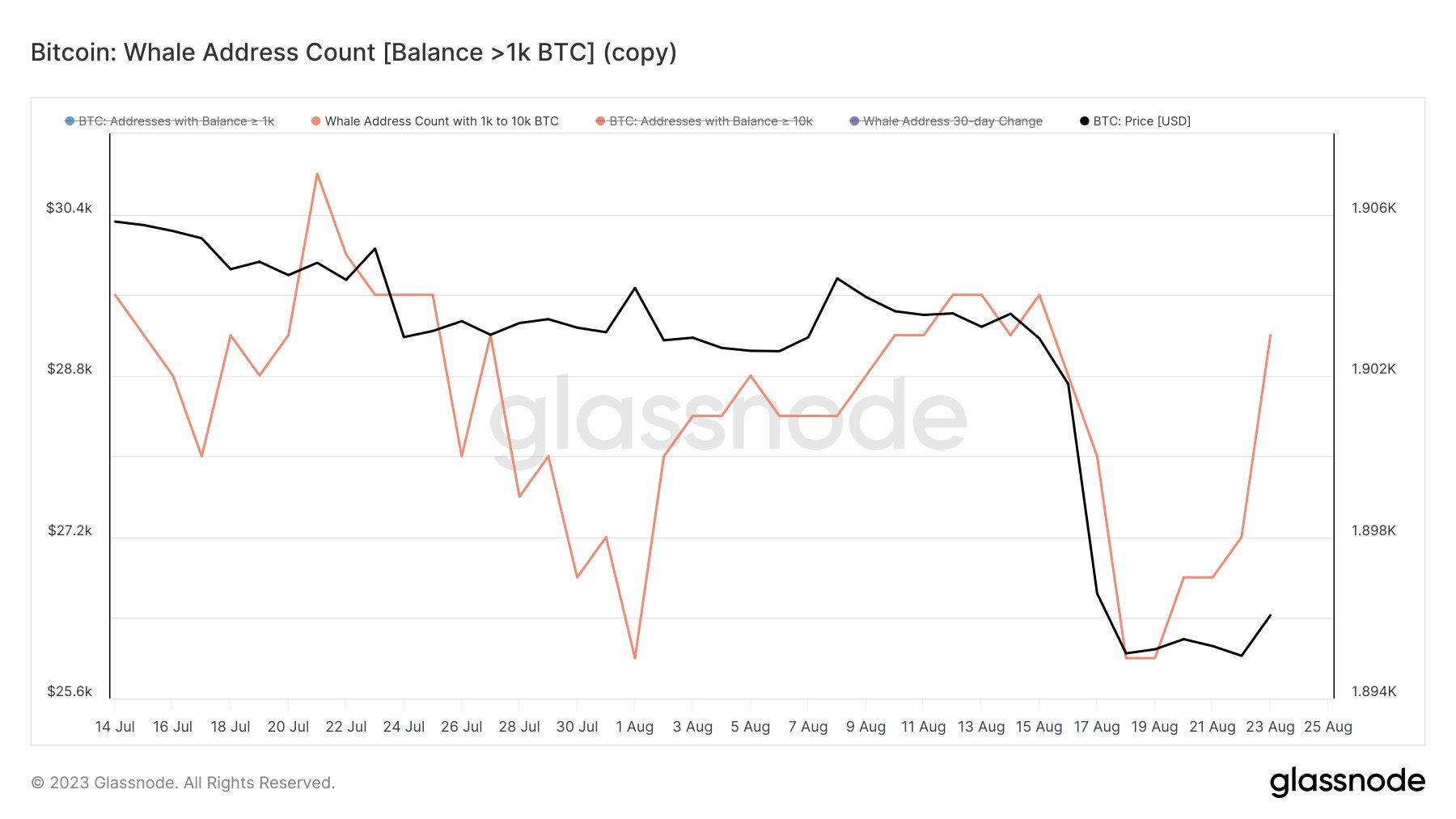

As identified by an analyst in a publish on X, the whales seem to have been accumulating lately. The related indicator right here is the “whale handle depend,” which measures the entire variety of Bitcoin addresses that maintain at the least 1,000 BTC and at most 10,000 BTC.

On the present change charge, this vary converts to roughly $26 million on the decrease sure and $260 million on the higher sure. These are clearly very important quantities and the one traders giant sufficient to be house owners of those addresses can be the whale entities.

The whales naturally carry some affect available in the market, as a result of the truth that they maintain a notable a part of the entire circulating provide of the asset. Thus, their actions may be value maintaining a tally of, as they will affect the worth of the asset.

One other model of the indicator tracks the addresses with balances upwards of 10,000 BTC (that’s, this vary’s higher sure), however at these ranges, the wallets turn into extra more likely to belong to central entities like exchanges, so the development of their addresses might not maintain the identical significance as what that of the traditional whales would.

Now, here’s a chart that exhibits the development within the Bitcoin whale handle depend over the previous month or so:

Appears to be like like the worth of the metric has spiked in current days | Supply: @ali_charts on X

As displayed within the above graph, the whale handle depend noticed a big drop across the time of the asset’s crash just a few days again, the place the worth plummeted from the $29,000 degree to under the $26,000 mark.

This decline within the variety of addresses of those humongous traders would suggest that some members of this cohort participated in distribution throughout the crash.

These whales who participated within the selloff didn’t essentially filter out their total holdings and exit the market, although, as distribution simply sufficient to convey their handle balances under the 1,000 BTC mark would nonetheless result in a drawdown within the indicator.

Initially, following the crash, the variety of these giant Bitcoin holders remained flat, implying that there wasn’t any important accumulation or distribution happening.

Up to now few days, nonetheless, the BTC whale handle depend has registered a pointy spike, suggesting that extra whale-sized addresses have popped up on the community. With this uplift, the indicator has returned again to about the identical values because it was earlier than the worth crash had occurred.

The whales collaborating in shopping for on the present value lows is of course a constructive signal for the cryptocurrency, because it may present a extra strong basis for a rebound within the asset’s worth.

BTC Worth

On the time of writing, Bitcoin is buying and selling close to $26,021, down 1% within the final seven days.

BTC seems to have been transferring sideways across the $26,000 degree lately | Supply: BTCUSD on TradingView

Featured picture from Todd Cravens on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link