[ad_1]

On-chain knowledge from Glassnode reveals the Bitcoin whales have lately damaged a sample that was beforehand held via the halving cycles.

Bitcoin Whale Development Had Beforehand Been Diminishing With Every Cycle

In accordance with knowledge from the on-chain analytics agency Glassnode, the present cycle is displaying an attention-grabbing deviation from the rule adopted throughout the previous couple of cycles.

Right here, the cycles or the “epochs” for the cryptocurrency have been outlined utilizing the halving occasions. “Halvings” are periodic blockchain occasions that completely lower in half the block rewards that the miners obtain for fixing blocks.

These occasions happen each time 210,000 blocks have been mined on the community, or roughly each 4 years. The explanation they’re typically chosen as the beginning and finish factors for BTC cycles is that they carry profound impression on the economics of the market because the manufacturing price of the asset is lower in half following them. This enhance within the shortage of the asset is a story so robust that bull runs have all the time adopted the halving occasions.

The subsequent halving is meant to happen someday within the first half of subsequent 12 months. At present, miners obtain 6.25 BTC for each block that they mine, so following this subsequent occasion, they may solely obtain 3.125 BTC of their rewards.

Now, there have been many patterns which have held all through the Bitcoin cycles, however one such development appears to be like to be breaking down with the newest epoch, because the under chart highlights.

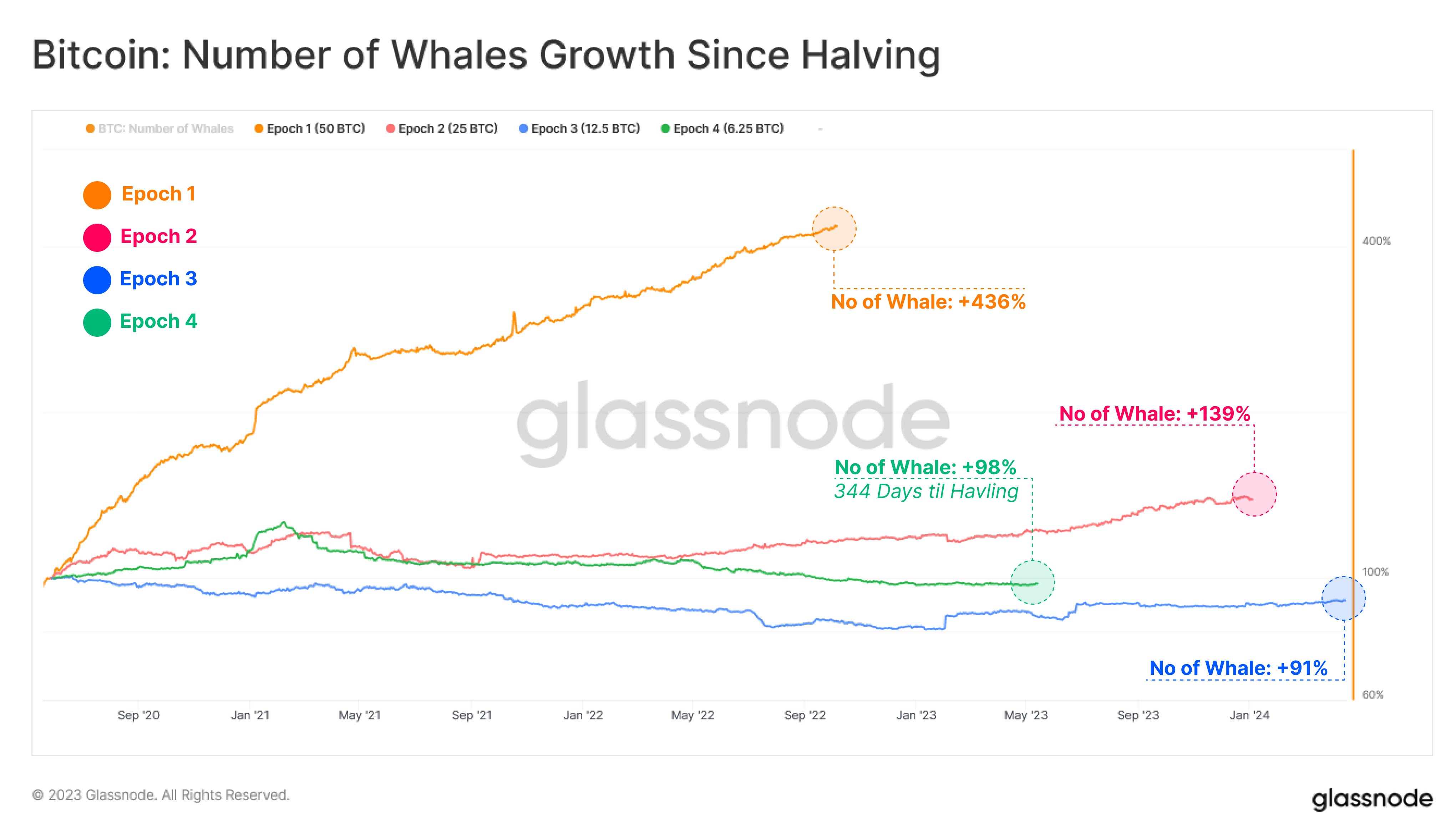

The overall variety of whales appears to have gone up by 98% within the present cycle | Supply: Glassnode on Twitter

The metric of curiosity right here is the share progress that the variety of whales have registered throughout every of the epochs. The analytics agency has outlined “whales” as entities which might be holding no less than 1,000 BTC of their wallets.

Be aware that entities right here don’t simply confer with particular person wallets, but in addition “a cluster of addresses which might be managed by the identical community entity,” that are “estimated via superior heuristics and Glassnode’s proprietary clustering algorithms.”

From the chart, it’s obvious that the variety of whales went up by 436% within the first cycle, whereas they solely went up by 139% in the second. The third one noticed even much less progress at about 91%.

This might point out that with every of those Bitcoin cycles, whereas the BTC whales had continued to extend in quantity, their share progress had been diminishing.

The present cycle, nevertheless, appears to have turned out totally different from these previous cycles thus far, as the expansion within the variety of whales has truly been stronger than the earlier epoch this time.

Whales have grown by 98% for the reason that begin of the cycle, nevertheless it’s value noting that there are nonetheless round 344 days to go earlier than the following halving occasion. It now stays to be seen whether or not the indicator resumes the development from the final epochs earlier than the tip of the present one, or if the cycle will actually finish with the sample being damaged.

BTC Value

On the time of writing, Bitcoin is buying and selling round $27,000, down 2% within the final week.

BTC has largely moved sideways in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Mike Doherty on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link