[ad_1]

Information from Glassnode exhibits the Bitcoin switch quantity remains to be 79% decrease than what was noticed through the bull run again in 2021.

Bitcoin Switch Quantity Stays Low Regardless of The Rally

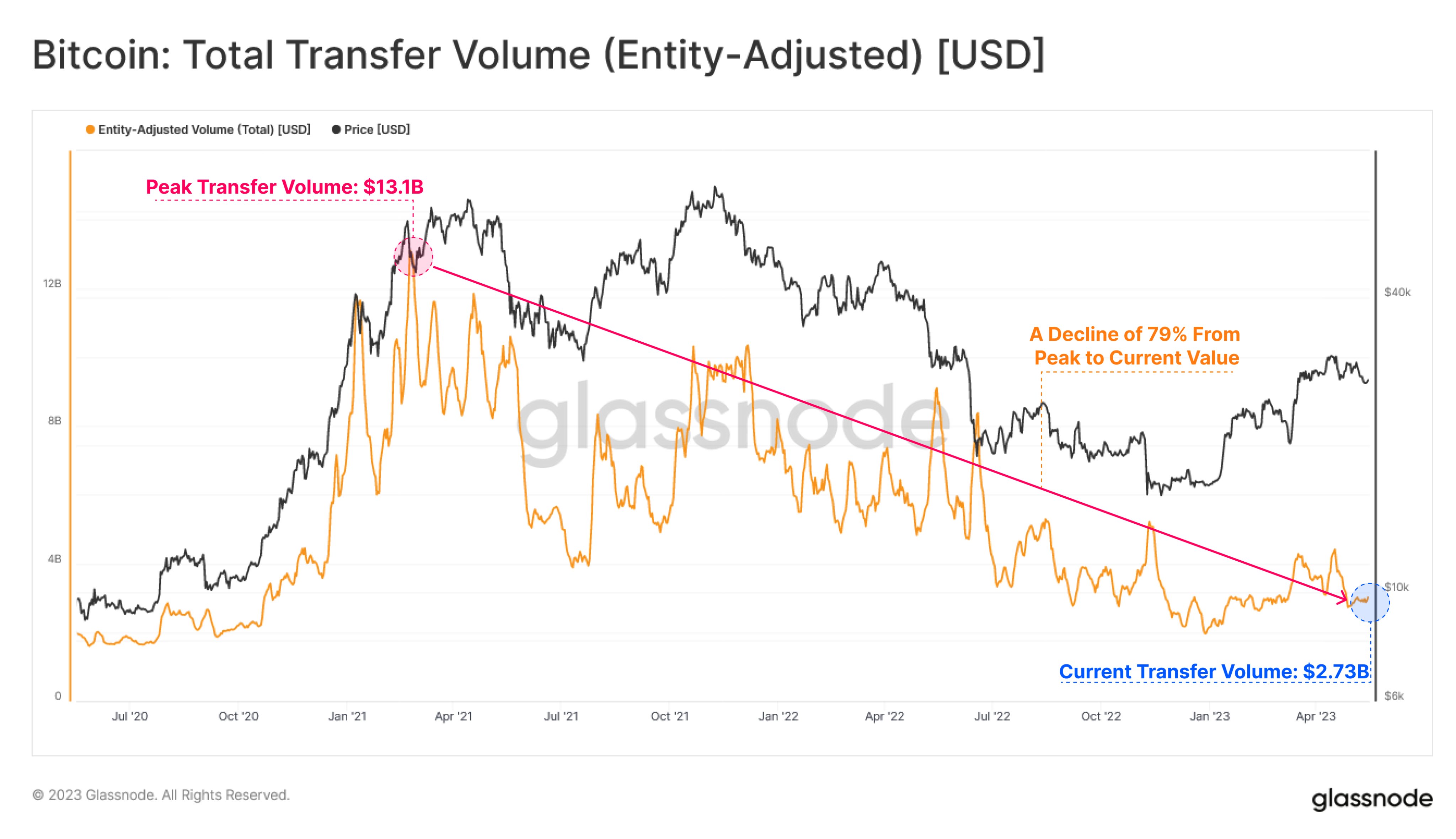

In accordance with knowledge from the on-chain analytics agency Glassnode, the full switch quantity on the BTC community is simply $2.73 billion per day presently. The “whole switch quantity” right here is an indicator that measures the full quantity of Bitcoin (in USD) being transacted on the blockchain day by day.

When the worth of this metric is excessive, it means the traders are transferring numerous cash across the community presently. Such a development is usually an indication that merchants are energetic out there proper now.

However, low values of the indicator suggest the blockchain is observing low exercise for the time being. This sort of development can recommend that the final curiosity within the coin amongst traders could also be low presently.

Now, here’s a chart that exhibits the development within the Bitcoin whole switch quantity over the previous few years:

The worth of the metric appears to have been in an general downtrend since fairly some time now | Supply: Glassnode on Twitter

Observe that the Bitcoin whole switch quantity indicator used right here is the “entity-adjusted” one, that means that the transactions being counted listed here are those being achieved between entities, and never particular person wallets.

An “entity” refers to a set of addresses that Glassnode has decided to belong to the identical investor. Making the adjustment for entities has the profit that every one transfers achieved between the wallets of a single holder are faraway from the equation, thus offering a greater estimation of the exercise on the chain.

From the above graph, it’s seen that the Bitcoin entity-adjusted whole switch quantity had surged to some fairly excessive values when the bull run within the first half of 2021 had taken place.

This development is sensible, as sharp worth actions like rallies are thrilling to the final investor, so a variety of customers get interested in the blockchain throughout such durations and add to the switch quantity.

On the peak throughout this bull run, the indicator had managed to hit a worth of round $13.1 billion. Since then, nonetheless, the metric has been in an general state of decline.

The bull run within the second half of 2021 additionally noticed an uplift within the switch quantity, however the metric nonetheless didn’t hit values as excessive as through the rally within the first of that yr.

Bear markets have traditionally seen this metric drop to low values (as the value tends to show boring sideways worth motion for giant stretches throughout such durations), so it’s not stunning that the indicator additionally plunged through the current bear market.

What could also be surprising, nonetheless, is that regardless of the beginning of a rally this yr, the Bitcoin whole switch quantity has nonetheless not seen any vital uplifts. The indicator’s worth is presently round $2.73 billion, which is 79% decrease than the 2021 bull run peak worth.

This lack of quantity would recommend that the cryptocurrency doesn’t have anyplace close to the identical curiosity behind it that it did in 2021, which might presumably be worrying for the sustainability of the rally.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,800, down 2% within the final week.

BTC consolidates sideways | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link