[ad_1]

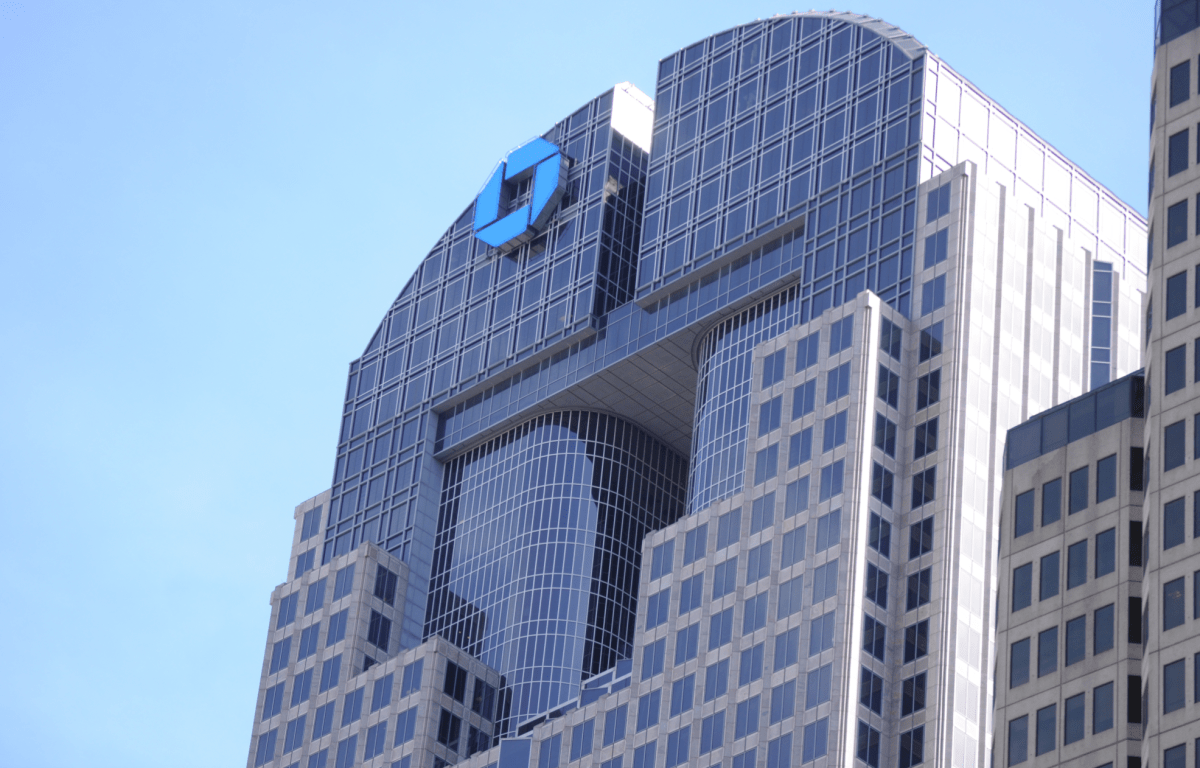

Six years in the past, in a now-famous CNBC interview, JP Morgan CEO Jamie Dimon made headlines with scathing remarks about Bitcoin, calling the digital cash system that transcends worldwide borders a “fraud” that can “ultimately blow up.”

In September 2017, throughout a convention in New York, Dimon acknowledged that Bitcoin was solely appropriate for “drug sellers and murderers.” He would later take again the feedback in 2018 after Bitcoin handed $20,000 that 12 months.

On the time, the Bitcoin market was nonetheless in its infancy, and plenty of conventional monetary leaders seen it with skepticism. Dimon’s feedback would reverberate by means of the monetary world, however little did he know that his phrases would come again to hang-out him.

Quick ahead six years, and the tables have turned dramatically. Bitcoin has not solely survived however thrived, turning into a official asset class and a family identify. Its value has skyrocketed, making early traders fortunes and attracting institutional curiosity. Bitcoin’s market capitalization has surged, and it has gained widespread acceptance as a retailer of worth and a hedge towards inflation.

Within the years following Dimon’s feedback, Bitcoin defied all odds and surged in worth, rising over 500%. Bitcoin was buying and selling at simply over $4,000 on the time of the feedback, however trades routinely at above $25,000 right now.

As Bitcoin Historian Pete Rizzo commented on X right now, the feedback stand in stark distinction given Wall Avenue’s latest reversal on Bitcoin, with high companies together with Blackrock and Constancy submitting for spot Bitcoin ETFs.

JP Morgan started promoting Bitcoin to excessive net-worth purchasers in 2021.

[ad_2]

Source link