[ad_1]

The highest digital asset, Bitcoin (BTC), has not too long ago struggled to keep up a bullish outlook following a worthwhile Q1 for the miners and holders. Buying and selling round $27.36k on Thursday, up 2.1 % up to now 24 hours, Bitcoin value is on the cusp of dropping additional towards $24k. Moreover, technical evaluation on the upper time charts reveals Bitcoin value is buying and selling under the neck of a head and shoulder candlestick sample.

Moreover, the each day 50 MA has been appearing as a resistance degree for the previous two weeks, which signifies the sellers are slowly overtaking the patrons. The rise of BRC-20 tokens has briefly elevated Bitcoin’s on-chain exercise, together with the each day common transactions that not too long ago spiked to ATH.

Bitcoin Distinctive Addresses: What Does It Inform Us?

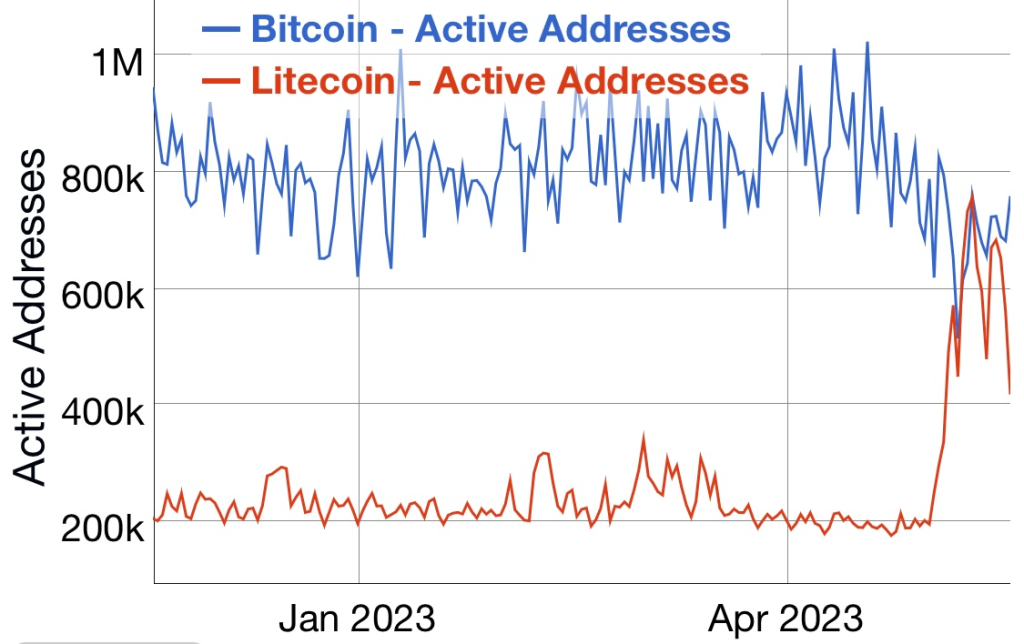

The variety of Bitcoin distinctive addresses is a significant component when analyzing the general demand for Bitcoin within the international market. In keeping with a report by market intelligence platform Santiment, the variety of distinctive Bitcoin addresses has been on a decline within the latest previous to hit a 22-month low.

Apparently, the full variety of distinctive Bitcoin addresses dropped considerably in Might under 800k amid the rise of BRC-20 tokens.

Litecoin Features Traction

Because the variety of energetic addresses on the Bitcoin community diminishes, the third largest PoW ecosystem, Litecoin, posted a rise within the general energetic handle. The spike in demand for Litecoin amid the upcoming halving has additionally elevated its each day traded quantity and underlying worth.

Associated: Prime Causes Why Litecoin (LTC) Value Will Go Parabolic Quickly – Coinpedia Fintech Information

Bitcoin Market Evaluation & Future Outlook

The liquidity within the Bitcoin market has thinned within the latest previous attributable to international geopolitical variations. As an illustration, the crypto crackdown in the US has diminished USD on/off ramp providers. In keeping with market mixture knowledge from Kaiko, the altcoin liquidity has fallen by about 17 % over the past month, in contrast with 4 % and a couple of % for Bitcoin and Ethereum respectively.

[ad_2]

Source link