[ad_1]

Bitcoin has noticed a surge in direction of the $26,700 stage prior to now day. Right here’s what on-chain knowledge says relating to whether or not this rise would keep.

Bitcoin Has Damaged The $26,700 Degree Throughout The Previous Day

After a long term of stagnation round and beneath the $26,000 stage, Bitcoin lastly appears to be making a gradual run above it, because the cryptocurrency has now breached the $26,700 mark.

Appears like BTC has noticed a rise over the previous few days | Supply: BTCUSD on TradingView

With this newest rise, BTC is up about 4% through the previous week, making the coin the most effective performer among the many prime 10 belongings by market cap within the sector. After seeing so many fragile makes an attempt at restoration in current weeks, although, Bitcoin buyers may be uncertain whether or not this rise is right here to remain.

On-chain knowledge may present some hints about this. First, listed here are how the help and resistance ranges seem like from an on-chain perspective, in response to knowledge from the market intelligence platform IntoTheBlock:

The focus of holders on the completely different value ranges | Supply: IntoTheBlock

Usually, buyers have a tendency to purchase extra at their price foundation (the worth at which they purchased their cash) each time the worth dips again to their price foundation from above.

As that they had been in earnings earlier than this dip, they could imagine that the worth would rise shortly and that their price foundation might be a worthwhile entry level for additional accumulation.

Then again, buyers in loss may look ahead to the worth reaching their price foundation to promote and exit. This could present resistance to the asset if many buyers have the identical price foundation as the worth it’s making an attempt to check from beneath.

Within the above infographic, the varied value ranges and the investor concentrations at them are displayed. When IntoTheBlock posted it, the worth had been buying and selling at $26,100.

The cryptocurrency is at present mowing by way of the $26,100 to $26,900 vary, which holds the associated fee foundation of an honest quantity of buyers. Ought to the asset’s makes an attempt fail, although, the $25,300 to $26,100 vary ought to present loads of help, because it at present has a thick focus of holders.

Bitcoin Change Inflows Have Occurred All through The Final Month

Nonetheless, one signal which may be regarding for the asset is that the whales have been making vital deposits to exchanges through the previous month, as analyst James V. Straten has identified.

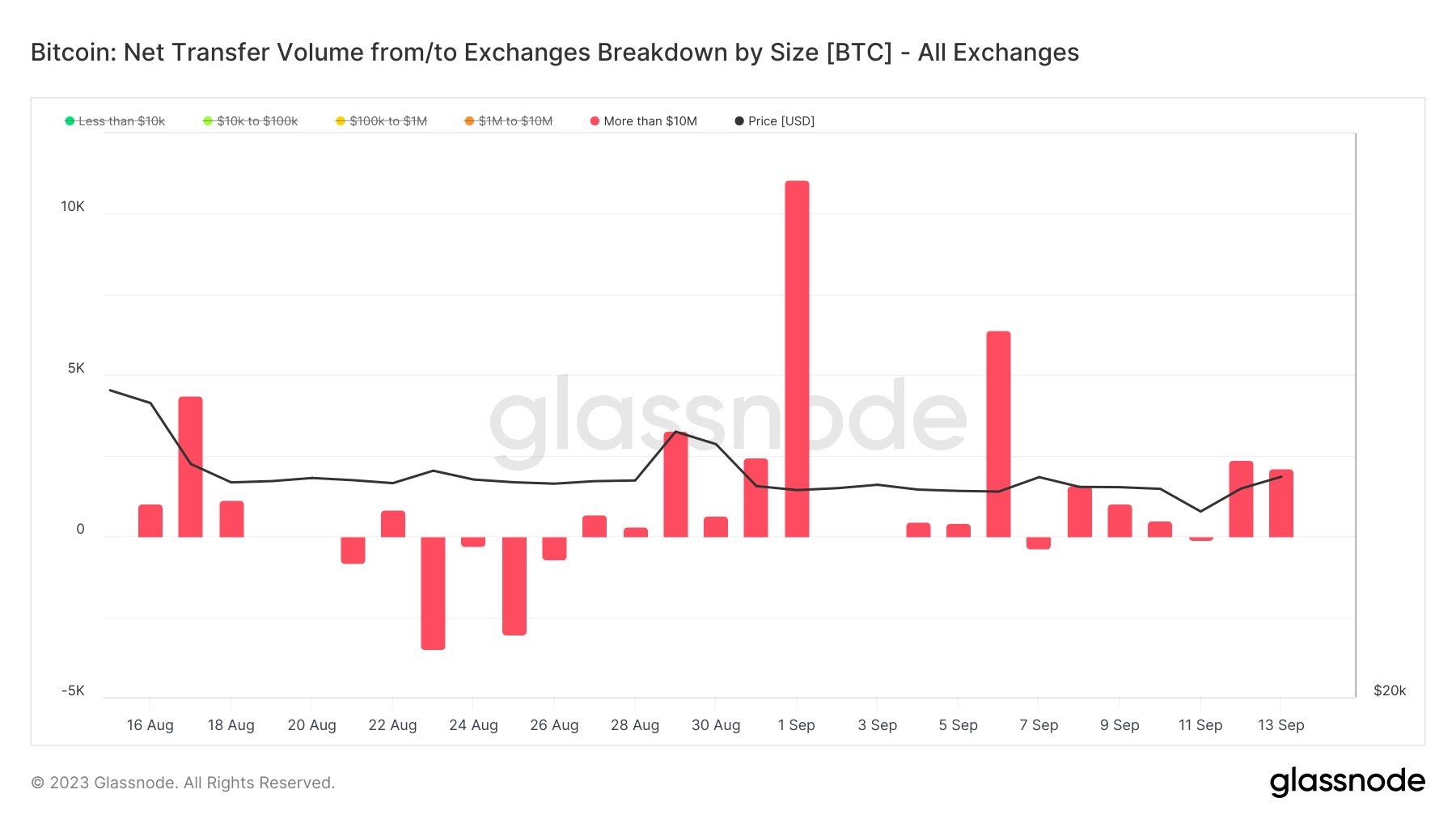

The worth of the metric appears to have been above zero for many of this era | Supply: @jimmyvs24 on X

The above chart exhibits the info for the Bitcoin alternate netflows just for transfers value a minimum of $10 million. This graph exhibits that the metric has largely had a constructive worth all through the previous month, which means that giant entities just like the whales have been consistently shifting cash into these platforms.

As one of many principal causes these buyers could switch to exchanges is for promoting functions, this might point out that these holders have been making ready for a selloff.

It stays to be seen whether or not these Bitcoin whale alternate inflows would result in this short-lived rise or if the market would bash by way of the promoting stress.

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link