[ad_1]

On-chain knowledge reveals the Bitcoin provide on exchanges has fallen to a price of simply 6.4%, which is the bottom degree in additional than 5 years.

Bitcoin Provide On Exchanges Has Continued Its Downtrend Lately

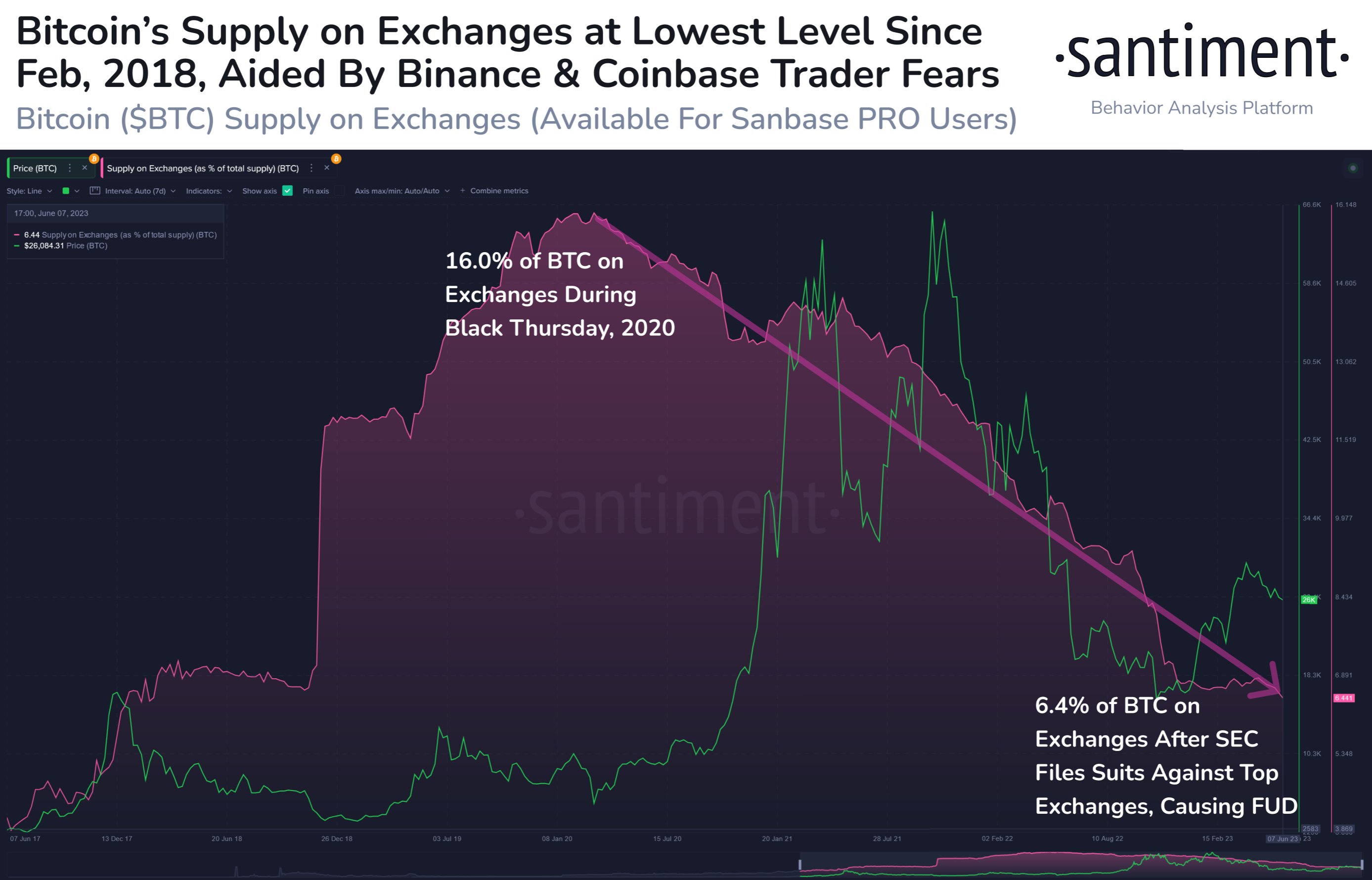

Based on knowledge from the on-chain analytics agency Santiment, traders have continued to maneuver their cash to self-custody just lately. The “provide on exchanges” is an indicator that measures the share of the overall Bitcoin provide that’s at the moment sitting within the wallets of all centralized exchanges.

When the worth of this metric rises, it implies that a web variety of cash are getting into these platforms proper now. As one of many principal explanation why an investor might deposit their cash to exchanges is for selling-related functions, this type of pattern can have bearish implications for the asset within the quick time period.

However, decreasing values of the indicator indicate the holders are withdrawing their BTC from the exchanges at the moment. Such a pattern, when extended, could be a signal of accumulation from the traders, and therefore, might be bearish for the worth of the cryptocurrency.

Now, here’s a chart that reveals the pattern within the Bitcoin provide on exchanges over the previous couple of years:

The worth of the metric appears to have been taking place in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the Bitcoin provide on exchanges has been in a relentless downtrend for a number of years now. Which means that traders have been consistently transferring their cash out of those centralized entities.

In the course of the newest rally, nevertheless, the metric had been transferring sideways as an alternative as some traders have been depositing their cash to those platforms for promoting to benefit from the profit-taking alternative.

Lately, although, the indicator has once more resumed its downward trajectory. The possible purpose behind this renewed decline within the metric is the FUD across the market that has unfold after the US SEC sued Binance and Coinbase.

The customers of those platforms have made massive Bitcoin withdrawals, though the decline within the reserve has been way more pronounced on Binance than on Coinbase.

Whereas the short-term adjustments within the provide on exchanges can have direct implications for the asset’s worth, the long-term view can have a extra complicated significance for the market.

This downtrend that has now been happening for years implies that traders have been making a relentless push towards self-custody. Holders conserving their cash away from central custody is a constructive growth for the asset, because it results in the availability being unfold out over completely different entities, relatively than being locked with a number of massive gamers.

As occasions just like the 3AC chapter or the FTX collapse have already proven, any destabilization in these massive central platforms may also destabilize the complete market. If there may be solely a low variety of cash being saved on such platforms, then their affect on the sector, and therefore, any domino impact attributable to them, will probably be small as effectively.

Again throughout 2020’s Black Thursday, 16% of the complete circulating Bitcoin provide was within the custody of centralized exchanges. At present, this worth has come down to simply 6.4% of provide.

BTC Value

On the time of writing, Bitcoin is buying and selling round $25,900, down 2% within the final week.

BTC has been caught in consolidation throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link