[ad_1]

The Bitcoin and crypto market eagerly noticed the expiry of the quarterly BTC and ETH choices as we speak (at 8:00 am UTC / 4:00 am EST). It was the second largest in historical past with a quantity of 159,000 BTC choices and 1.25 million ETH choices with a complete worth of just about $7 billion.

The market was anticipating a pointy enhance in volatility, however it did not materialize. Within the run-up, the BTC value briefly spiked as excessive as $31,300 earlier than seeing a pullback in direction of $30,700. The occasion has thus just about turn into a nothing burger.

Choices analysts at Greeks.Reside confirmed a couple of minutes in the past that the quarterly expiration has been accomplished, with extra BTC block calls being traded in the previous couple of days, primarily to shut and roll positions on the finish of the quarter, with ETH being primarily within the order guide, including:

With the quarterly expiry, the market has seen a launch of positions which have constructed up in latest months, and choices might see a bigger shift if the market helps it in July.

Though volatility ranges have risen this month and market makers are completely satisfied to actively purchase positions, the downward development in main time period IV may be very a lot in proof amidst the sturdy promoting stress from quarterly supply.

What’s Subsequent For Bitcoin?

At present’s each day shut might turn into extraordinarily essential for the Bitcoin value. At present is month-end, quarter-end and the Private Consumption Expenditure (PCE) value index, the US Federal Reserve’s most popular inflation gauge, shall be launched at 8:30 am EST (12:30 pm CET). On Tuesday, the U.S. market is closed for the Fourth of July, Independence Day.

The Private Consumption Expenditure (PCE) value index is most popular by the Fed as a result of it supplies broader protection of client spending, consists of chain weighting to precisely monitor behavioral adjustments, accounts for the substitution impact, and makes use of complete information sources. The PCE is subsequently thought of a extra versatile and consultant indicator of inflation in comparison with different indexes such because the Shopper Worth Index (CPI).

Whereas headline CPI information have seemed extraordinarily good in latest months, core inflation has been proven to be very sticky. Numerous focus as we speak will subsequently be on core PCE. The expectation for PCE inflation is 3.9% and for core PCE 4.7% year-over-year. A shock to the draw back has the potential to offer a bullish increase to each the normal monetary market in addition to the Bitcoin and crypto markets.

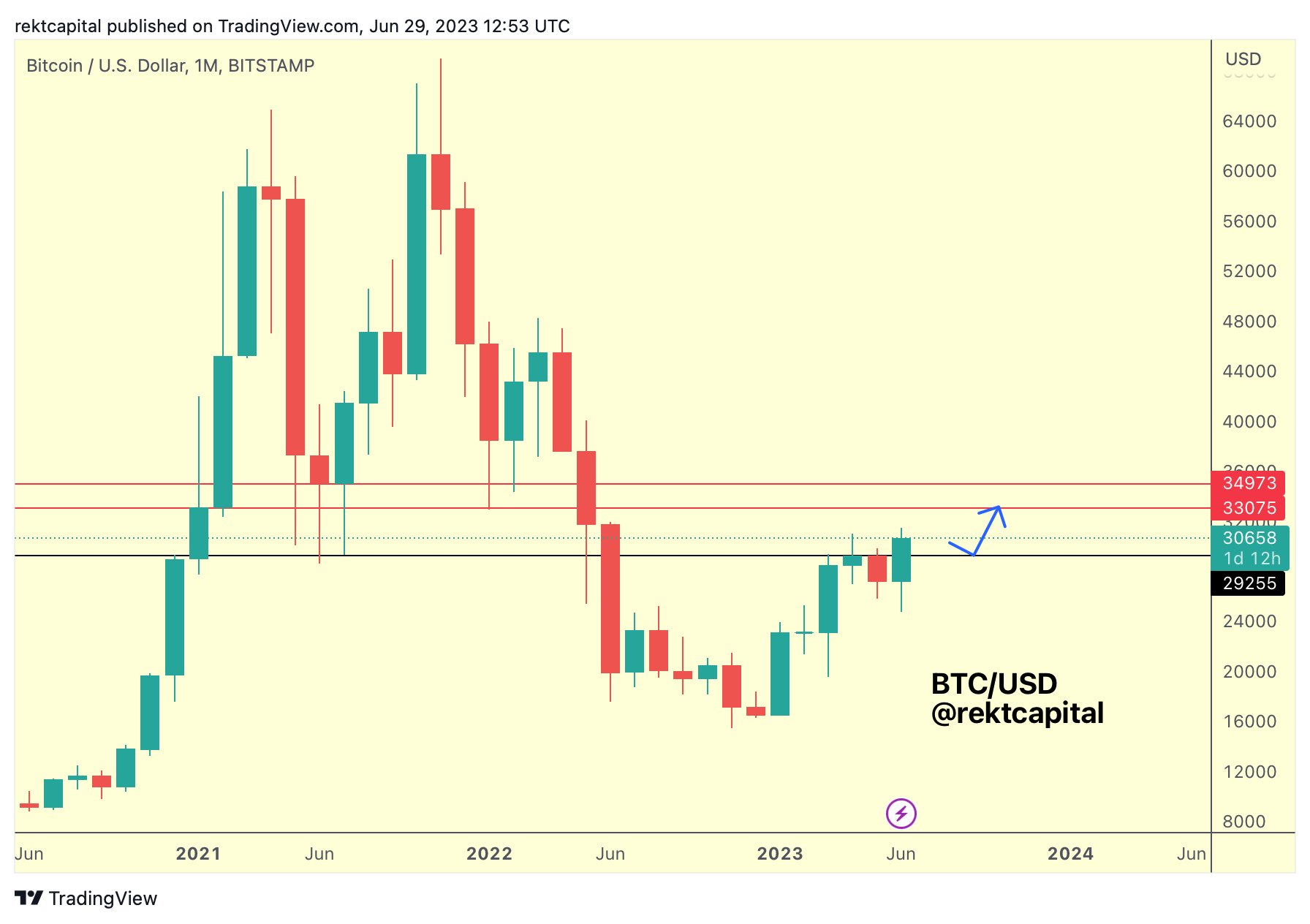

As famend analyst @rektcapital writes through Twitter, BTC is positioning itself for a month-to-month shut above a resistance that had rejected the worth for the previous three months. Presently, BTC is holding above the identical stage (black). Thus, the month-to-month in addition to the quarterly shut may very well be an especially bullish harbinger for July.

Is The Greatest Time To Purchase Subsequent Monday?

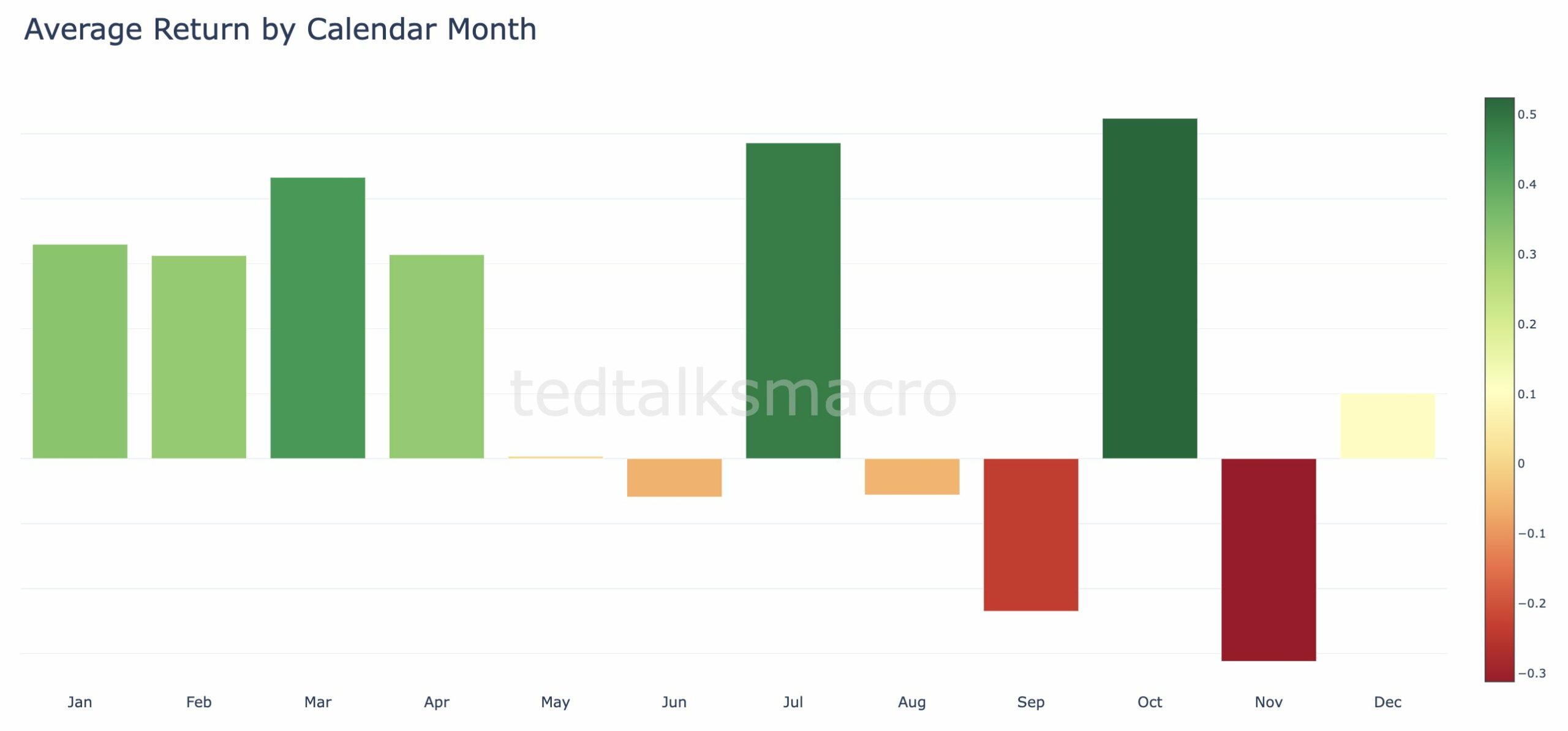

Analyst @tedtalksmacro lately printed an evaluation about Bitcoin’s historic efficiency through Twitter. The consequence could recommend that the upcoming Monday, July 3, is the best choice for a Bitcoin purchase, no less than traditionally.

Because the analyst famous, July has been the perfect performing month since October 2009. Nevertheless, the info is skewed as a result of a 10x in July 2010. Taking solely the final 5 years of information, the perfect performing month is October, carefully adopted by July.

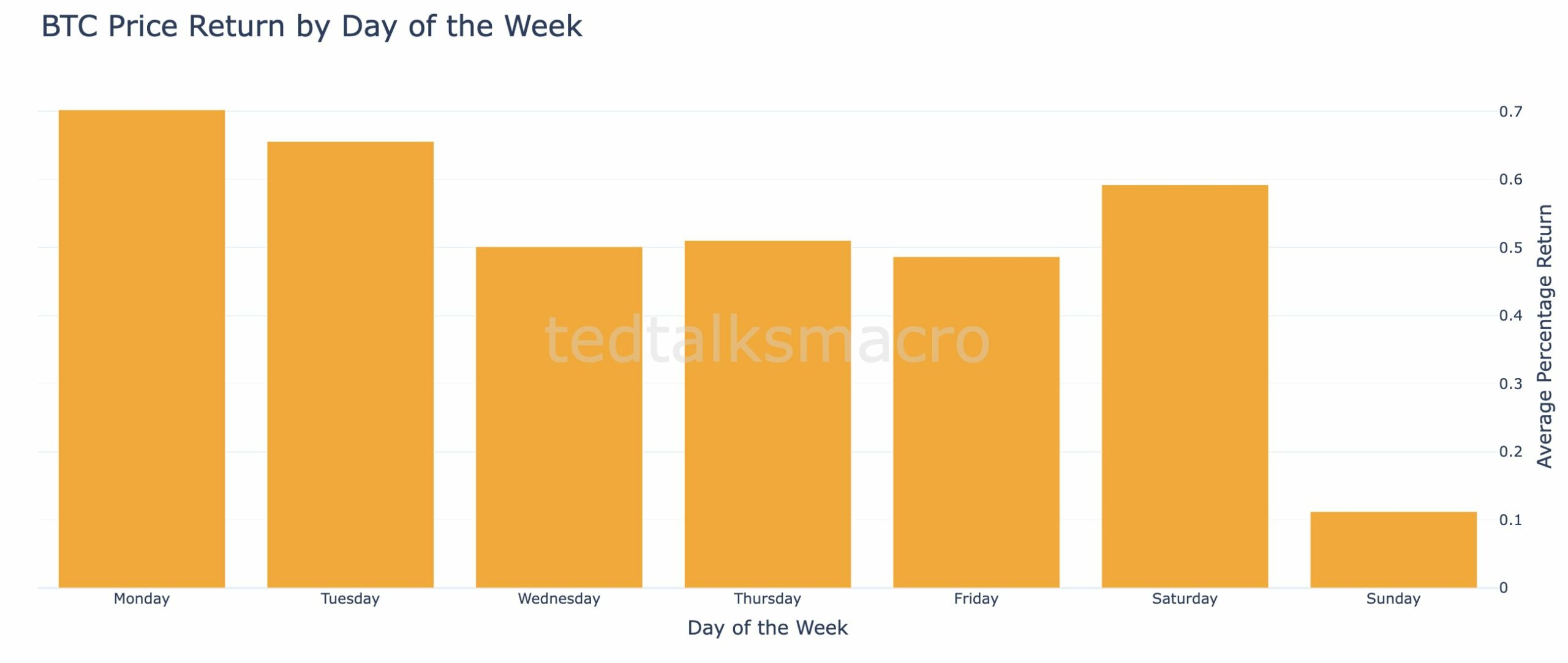

On a weekly foundation, Mondays are the perfect day to purchase and maintain BTC. This assumes that consumers don’t maintain BTC on any day apart from the nominated one, because the analyst evaluated.

At press time, the Bitcoin value hovered beneath the $31,000 resistance zone, buying and selling at $30,856.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link