[ad_1]

The Bitcoin worth has failed to interrupt above the important thing resistance stage of $27,800 since Monday. With right now’s launch of the US Client Worth Index (CPI), a directional resolution could also be imminent: Will Bitcoin climb once more in the direction of $30,000 or is a drop to $25,000 looming?

Who Will Buckle First?

The Client Worth Index (CPI) can be introduced an hour (8:30 am EST) earlier than the US buying and selling session opens. Headline inflation on an annual foundation (YoY) is anticipated to be unchanged at 5.0% (vs. 5.0% final time). The core charge is anticipated to fall barely, from 5.6% to five.5%. On a month-to-month foundation, headline CPI is anticipated at 0.4% vs. 0.1% final and the core charge at 0.3% vs. 0.4% final.

At the moment’s CPI launch might be of main significance as a result of there’s a important discrepancy between the US Federal Reserve (Fed) and market expectations. In accordance with the dot plot and Jerome Powell, there are not any charge cuts scheduled this 12 months, whereas in line with the CME FedWatch software, the market is looking a bluff and the bulk is forecasting two to a few charge cuts.

One facet should buckle prematurely, and if the CPI numbers are available worse than anticipated, it might be the market. In consequence, it may be anticipated that the inventory market will plummet and presumably drag Bitcoin down as nicely. A constructive shock in right now’s CPI numbers is due to this fact extremely important for the market.

Remarkably, Goldman Sachs expects core CPI to rise by 0.47% in April, above the consensus of 0.3%. This is able to additionally put the annual charge at 5.59%, above consensus of 5.5%. The banking big additionally predicts headline CPI to rise to 0.50% (vs. 0.4%), which might elevate the annual charge to five.09% (vs. 5.0%).

Bitcoin Forward Of CPI

Forward of the CPI launch, the Bitcoin worth is caught in a difficult state of affairs. The bears are beginning to really feel in management, however the bulls proceed to have the higher hand within the larger time frames.

As analyst @52skew notes, there are indicators that the Bitcoin perpetuals market is oversaturated with quick positions. Whereas the Bitcoin Perp CVD Buckets & Delta Orders present some liquidation of quick positions, they nonetheless present heavy quick positioning on upswings. That is “typically outlined as quick management,” the analyst stated. Binance spot is the market promoting aggressor right now.

$BTC Spot CVD Buckets & Delta OrdersStill very a lot the identical, each day vwap illustrates when MMs are twap promoting into worth by way of small spot orders / MM spot orders & TWAP CVD / MM CVD

Bounces nonetheless being bought by MMs.

Binance spot is the market promoting aggressor right now https://t.co/k02hc5qCDL pic.twitter.com/hwVw1YJcqm

— Skew Δ (@52kskew) Could 10, 2023

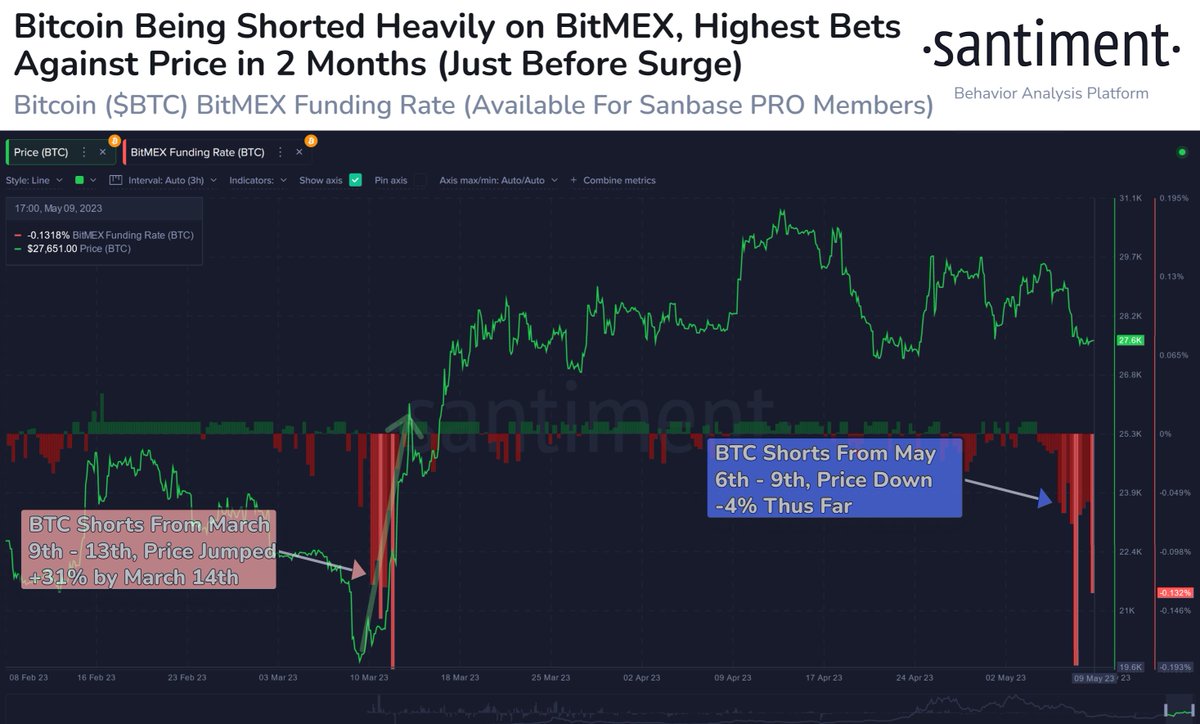

However, an previous ‘reversion indicator’ of 2019 is simply flashing up: Bitmex buying and selling under spot. As on-chain evaluation service Santiment additionally observes, Bitcoin’s funding charge on BitMEX is displaying its most unfavourable ratio for the reason that huge bets towards costs in mid-March, simply earlier than costs spiked.

“Usually, worth rise possibilities enhance when the group overwhelmingly assumes costs can be dropping,” Santiment concludes.

In any other case, a head & shoulders sample within the 1-day chart is presently being hotly debated. The bearish facet argues that BTC is dealing with a deeper fall. However, there are additionally good arguments why this needn’t be the case.

Chartered Market Technician (CMT) Aksel Kibar makes the argument that chart patterns ought to be analyzed in relation to the earlier worth motion:

Whereas this final one month consolidation appears to be like like a H&S high, high reversals kind after an prolonged uptrend, because of this can’t be analyzed as a high reversal. I’m extra to play the lengthy facet of this one month lengthy consolidation. Assist (neckline for backside reversal) continues to be at 25K.

At press time, the Bitcoin worth traded at $27,647.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link