[ad_1]

On-chain information exhibits the Bitcoin Spent Output Revenue Ratio (SOPR) has bounced again into the revenue zone with the most recent rally above $30,000.

Bitcoin SOPR Has Efficiently Retested 1.0 Assist Line

In accordance with information from the on-chain analytics agency Glassnode, buyers at the moment are promoting their cash at a revenue. The “SOPR” is an indicator that tells us whether or not profit-taking or loss-taking is dominant within the Bitcoin market presently.

When the worth of this metric is bigger than 1.0, it implies that the income being realized by the buyers are greater than the losses presently. Then again, the values of the indicator underneath this mark recommend the market as a complete is transferring/promoting cash at a loss.

The SOPR being precisely equal to 1.0 naturally means that the typical investor is simply breaking even on their promoting for the time being, as the whole quantity of income being harvested out there is the same as the losses.

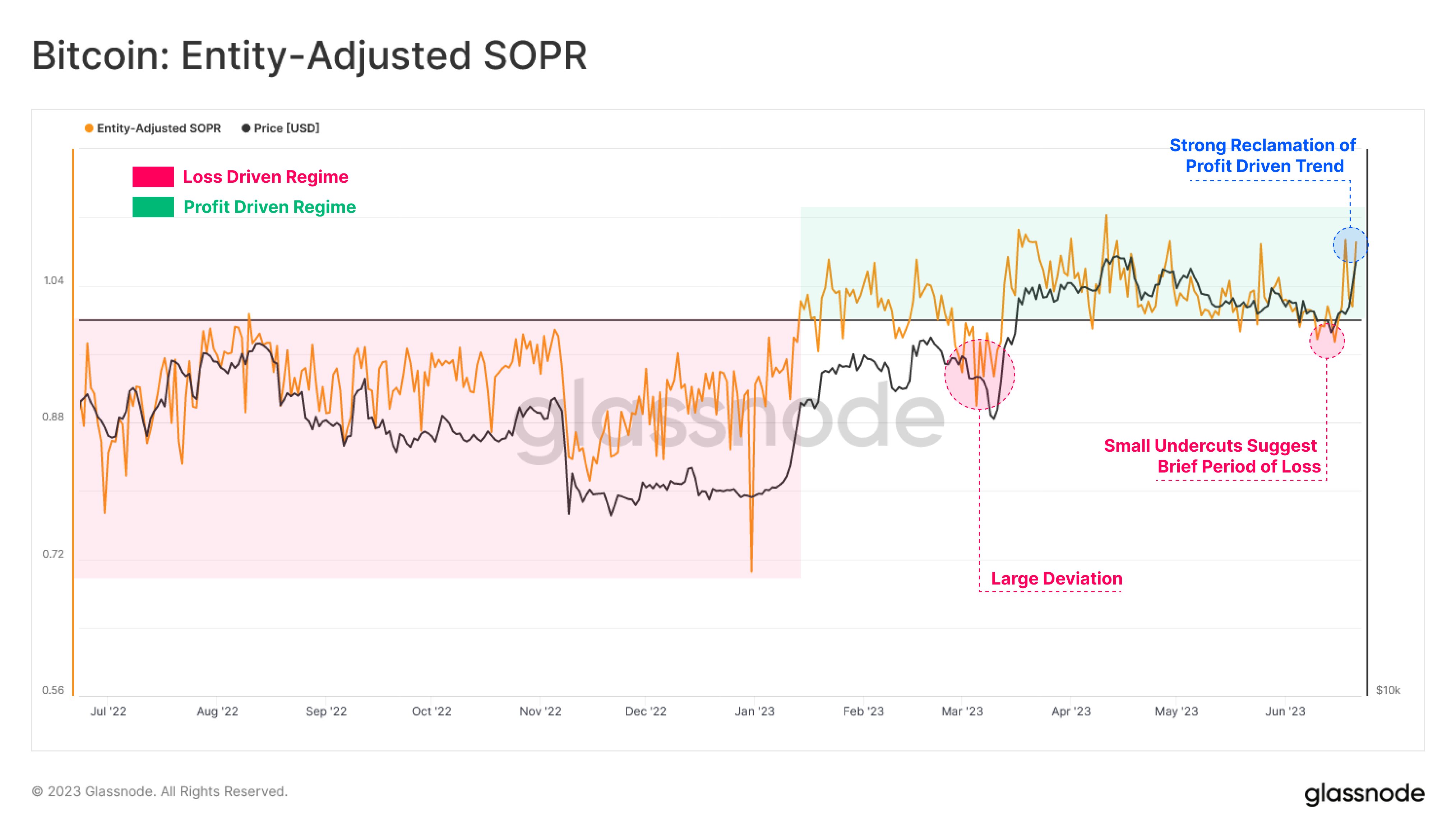

Now, here’s a chart that exhibits the development within the Bitcoin SOPR over the previous yr:

Appears like the worth of the metric appears to have shot up in current days | Supply: Glassnode on Twitter

Word that the model of the SOPR getting used right here is the “entity-adjusted” one, that means that it solely takes under consideration the transactions made between separate entities on the community and never all particular person wallets.

An “entity” right here refers to a single deal with or a set of addresses that Glassnode has decided to belong to the identical investor. As transfers the place a holder strikes cash to a special pockets of theirs aren’t really gross sales in any respect, they aren’t related to the SOPR, and so, eradicating them from the info makes the indicator extra correct.

As you’ll be able to see within the above graph, the entity-adjusted SOPR has been principally at values above 1.0 throughout the previous few months, a development that is sensible because the asset has noticed a rally on this interval, which is certain to have put buyers into notable income.

Again in March, nonetheless, the indicator had deviated away from this profit-taking development, because the Bitcoin worth had taken a big hit. This deviation didn’t final for too lengthy, although, because the metric returned to values above 1.0 because the rally resumed.

Traditionally, the transition line between these two zones, that’s, the 1.0 degree, has had an fascinating relationship with the worth. Throughout bearish tendencies, this line has proved to be a resistance level for the coin, whereas in bullish tendencies, it has usually acted as assist.

Just lately, as Bitcoin had been struggling, the SOPR had noticed a slight drop underneath the 1.0 degree once more, though the deviation was fairly small when in comparison with the occasion in March.

Because it has occurred many occasions prior to now, it could seem that the 1.0 retest has offered a bounce to BTC this time as effectively, because the cryptocurrency has rallied in direction of the $30,000 mark.

The Bitcoin SOPR has surged above 1.0 with this rebound, implying that the buyers at the moment are as soon as once more harvesting a considerable amount of income.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $30,100, up 17% within the final week.

BTC has slowed down for the reason that sharp soar | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link