[ad_1]

Knowledge exhibits the Bitcoin shorts that had amassed after the current crash have now been squeezed following the restoration within the asset’s value.

Bitcoin Shorts Take Beating As Value Reveals Sharp Rebound

In line with information from the on-chain analytics agency Santiment, the funding fee on Binance had grow to be deeply adverse after the crash. The “funding fee” right here refers back to the variety of periodic charges that the perpetual contract merchants are exchanging with one another.

When the worth of this metric is optimistic, it implies that the lengthy merchants are paying a premium to the quick traders to be able to maintain onto their positions proper now. Such a pattern implies that bullish sentiment is held by the bulk presently.

However, adverse values of the indicator recommend {that a} bearish sentiment is extra dominant out there in the mean time, because the shorts are paying a payment to the longs.

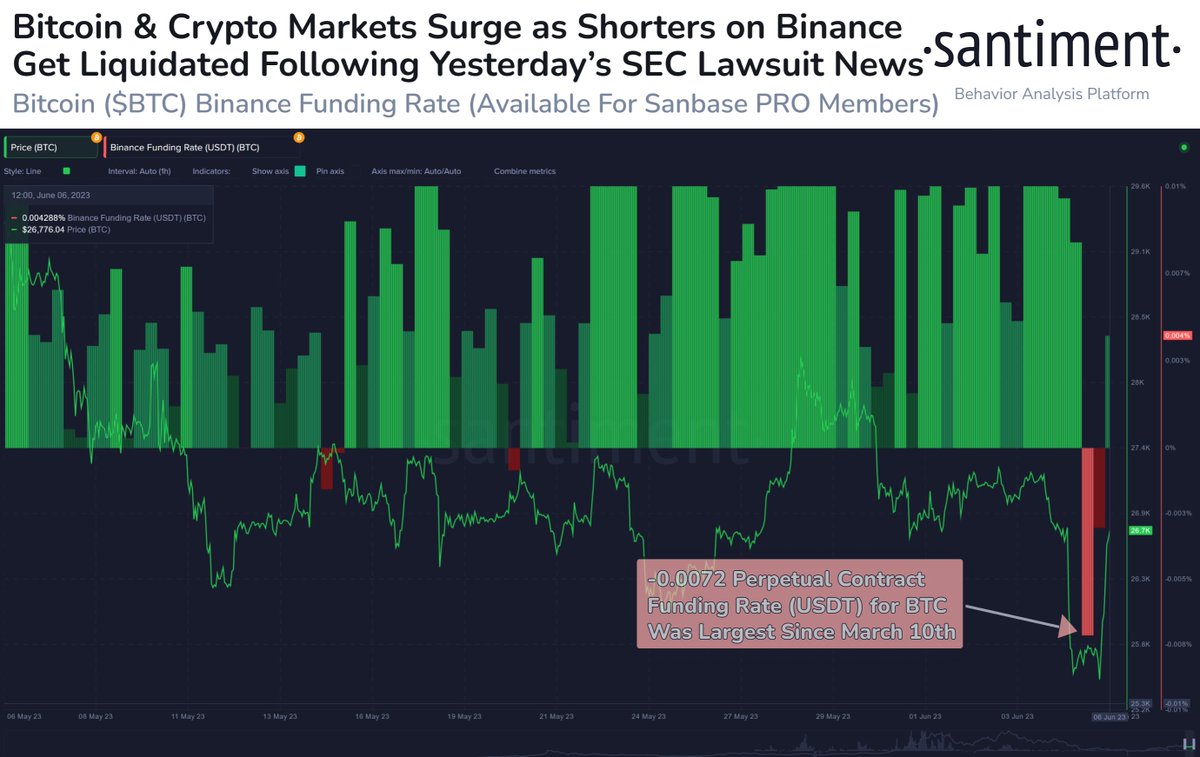

Now, here’s a chart that exhibits the pattern within the Bitcoin perpetual contract funding fee on the cryptocurrency change Binance over the previous month or so:

The worth of the metric appears to have taken a plunge in current days | Supply: Santiment on Twitter

As displayed within the above graph, the perpetual contract funding fee for Bitcoin on Binance had been at optimistic values throughout many of the previous month, that means that bullish sentiment was being held by the vast majority of the traders.

Following the crash brought on by the information of SEC suing Binance, although, the indicator’s worth in a short time plunged down and hit some deep pink values. Throughout this value plunge, an enormous quantity of lengthy contracts had been liquidated.

Occasions, the place such a mass quantity of liquidation happens, are known as “squeezes.” Naturally, the leverage flush through the crash was an instance of a “lengthy squeeze,” as the intense majority of the contracts concerned in it had been longs.

With the bullish sentiment being cleared out within the current lengthy squeeze, the funding fee took a plunge. It will seem that the merchants then turned keen to begin betting on the worth decline to increase additional, resulting in the indicator’s worth changing into very adverse.

At their peak, these pink funding charges had hit the best worth since 10 March 2023. Again then in March, the metric had assumed sharp adverse values after the asset’s worth had noticed a plummet under the $20,000 degree.

After the funding charges had grow to be deep pink, although, a brief squeeze befell out there as the worth sharply recovered. One thing related has additionally regarded to have taken place this time as effectively, as Bitcoin has as soon as once more sharply recovered.

The perpetual contract funding charges on Binance have additionally naturally grow to be optimistic once more, suggesting that the traders who had prematurely shorted the asset have suffered liquidation.

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,800, down 1% within the final week.

BTC has surged through the previous day or so | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link