[ad_1]

Information exhibits that Bitcoin buyers could also be near embracing greed as market sentiment has surged into impartial territory.

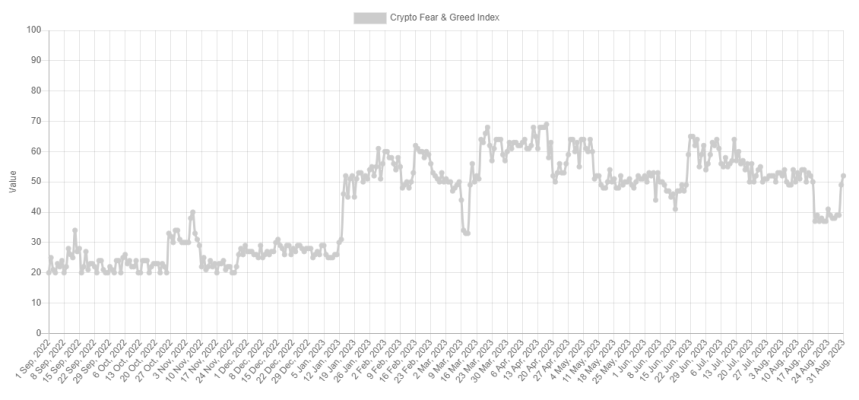

Bitcoin Worry & Greed Index Factors At Impartial Dealer Sentiment

The “Worry & Greed Index” is an indicator that tells us concerning the basic sentiment among the many buyers within the Bitcoin and wider cryptocurrency sector. Based on the index’s creator, Different, the metric takes under consideration a number of components for calculating this sentiment.

The 5 components it presently makes use of within the indicator’s worth are particularly: volatility, buying and selling quantity, social media sentiment, market cap dominance, and Google Tendencies knowledge. Earlier, the index additionally made use of surveys, however for now, they’re on pause.

To signify the market sentiment, the concern and greed index makes use of a numeric scale that runs from 0-100. All values above the 54 mark recommend greed among the many merchants, whereas values under 46 indicate concern. The in-between area means the presence of a impartial mentality.

In addition to these three fundamental sentiments, there are additionally two excessive sentiments, known as “excessive concern” (happening under 25) and “excessive greed” (occurring above 75). Traditionally, these two areas have been fairly vital for Bitcoin, as cyclical bottoms and tops have often shaped within the respective zones.

Now, here’s what the Worry & Greed Index seems like for the market proper now:

The worth of the metric seems to be 52 in the mean time | Supply: Different

Based on the index, the buyers as an entire are sharing a impartial sentiment, which means that they aren’t leaning by hook or by crook. Though, on the present 52 worth, the metric is actually nearer to the greed territory than the concern one.

Earlier within the month, when BTC witnessed a crash from the $29,000 degree to under the $26,000 mark, the sentiment available in the market naturally plummeted. Buyers had develop into fearful and had remained so for the length that the asset consolidated round these lows.

After the rally spurred by Grayscale’s lawsuit victory, although, the sentiment quickly registered an enchancment and surged towards the present impartial values.

The under chart represents how the Worry & Greed Index’s worth has modified just lately:

Appears to be like just like the indicator’s worth has noticed a pointy uplift in latest days | Supply: Different

Whereas the sentiment available in the market has seen a speedy enchancment with the most recent rally, the buyers haven’t fairly but made up their minds in the event that they wish to give in to greed or not.

It’s potential that extra optimistic worth motion would wish to occur earlier than the buyers are in a position to totally embrace the bullish momentum.

Nonetheless, a break into the greed territory would naturally be a inexperienced sign for any surge’s sustainability, as it could imply that almost all of the buyers are able to assist the transfer.

BTC Worth

After observing a pullback for the reason that rally excessive, Bitcoin is presently buying and selling across the $27,200 degree, with buyers nonetheless having fun with income of about 3% over the previous week.

The BTC worth surge has slowed down | Supply: BTCUSD on TradingView

Featured picture from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Different.me

[ad_2]

Source link