[ad_1]

The worth of Bitcoin is lastly on the transfer after weeks of being caught in a decent buying and selling vary. The primary cryptocurrency by market cap stands at help with the potential for one more re-test of the lows if bulls can’t push it larger.

As of this writing, Bitcoin trades at $28,500 with a 2% loss previously 24 hours. Over the earlier week, the cryptocurrency recorded a 3% loss, whereas different property within the high 10 underperformed and trended decrease. The nascent trade may very well be a short-term crossroads.

Bitcoin Worth Loses $29,000 Degree, However A Restoration Is Seemingly?

As NewsBTC has been reporting, Bitcoin’s volatility reached a multi-year low in spite of everything main narratives beforehand influencing it diminished its power. Now, the spike in volatility favored the draw back, however how a lot stress can the bears train?

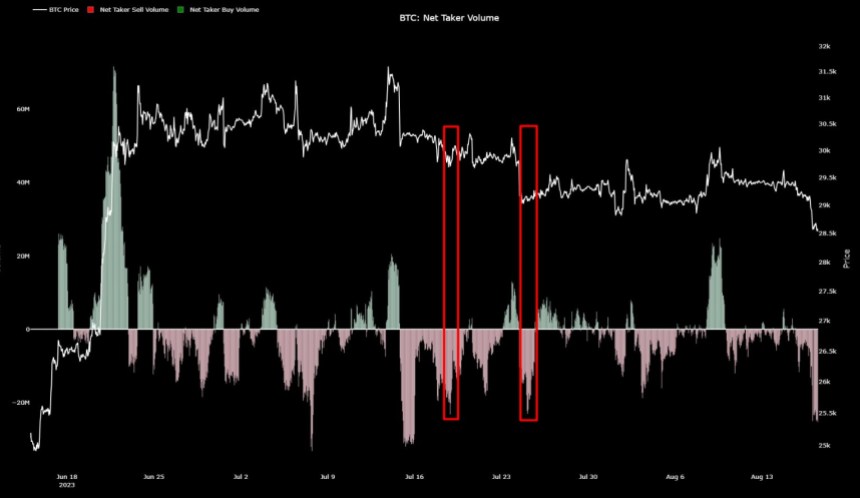

Based on a CryptoQuant analyst, the current worth motion marks one of many highest in current months. As seen within the chart beneath, the final time that Bitcoin noticed comparable promoting stress was in late July. The analyst said:

This marks the strongest surge in promoting since July fifteenth. It wouldn’t be stunning to witness the top of promoting stress at this very second.

As seen within the chart above, the worth of Bitcoin bounced again from help every time that sellers pushed into the present ranges, as measured by the Internet Taker Quantity. Nevertheless, sellers might nonetheless push the metric into the July fifteenth ranges and induce a capitulation occasion.

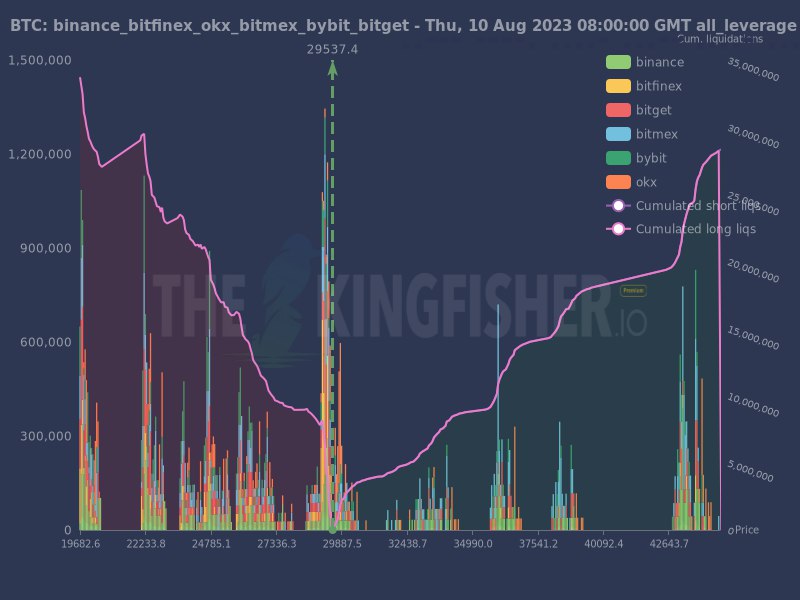

There’s some proof to help the above. The chart beneath reveals that BTC’s lengthy positions have fueled the draw back worth motion by offering liquidity and accelerating the autumn.

If this continues, Bitcoin might proceed trending downwards into the liquidity pool created by lengthy positions at $27,000 and $24,700 if bulls give it. On the latter, crypto analytics agency Materials Indicators famous:

Bitcoin worth and liquidity persevering with to erode and a vital take a look at of help is eminent. IMO… Shedding $29k can be purely psychological. Shedding $28.5k can be technical. Holding $28.3k is vital. Shedding the purchase wall at $27.9k would trigger a cascade.

Cowl picture from Unsplash, chart from Tradingview

[ad_2]

Source link