[ad_1]

On-chain knowledge exhibits the Bitcoin sell-side threat ratio has approached all-time lows just lately, an indication {that a} massive transfer may very well be coming for the coin.

Bitcoin Promote-Facet Threat Ratio Has Noticed A Plunge Lately

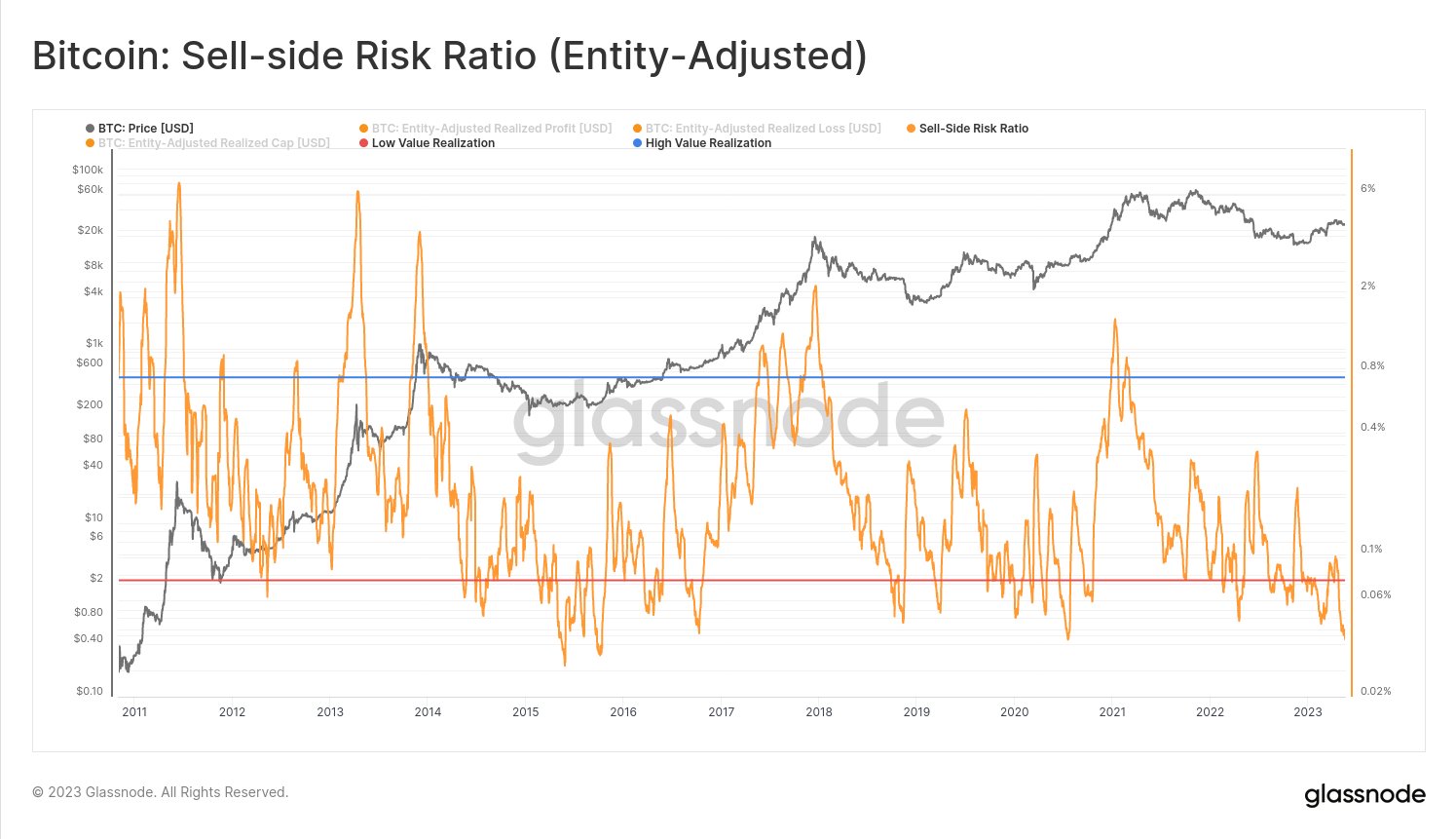

As identified by the lead on-chain analyst at Glassnode in a Tweet, BTC sellers might have develop into exhausted just lately. The “sell-side threat ratio” is an indicator that measures the ratio between the sum of all income and losses being realized within the Bitcoin market and the realized cap.

The “realized cap” right here refers back to the capitalization mannequin for Bitcoin that calculates a kind of “true” worth for the cryptocurrency by assuming that every coin within the provide is just not value the identical as the present spot worth, however the worth at which it was final moved.

Because the income and losses being harvested out there are nothing however a measure of the promoting strain out there, this indicator tells us how the promoting strain (or the sell-side threat) seems like relative to the worth of the cryptocurrency (the realized cap).

When the worth of this indicator is excessive, it means the traders are collaborating in a excessive quantity of revenue/loss realization proper now. Such a market is often excessive threat, as the worth tends to be extra unstable during times with these values.

However, low values suggest the holders are reluctant to promote presently. These circumstances typically happen when the market has calmed down and accumulation tends to happen in such intervals.

Now, here’s a chart that exhibits the development within the Bitcoin sell-side threat ratio over the historical past of the cryptocurrency:

Seems to be like the worth of the metric has noticed a decline in latest days | Supply: @_Checkmatey_ on Twitter

As proven within the above graph, the Bitcoin sell-side threat ratio has seen a pointy plunge just lately, an indication that there’s little revenue or loss realization going out there proper now.

The indicator is now under the “low worth realization” line that the analytics agency has outlined (coloured in pink within the chart). Traditionally, at any time when the metric has plunged into this zone, the market has constructed up in the direction of a sizeable transfer within the worth.

Since such low values of the indicator suggest the shortage of sellers out there, the widespread expectation could also be that this is usually a bullish signal. Nonetheless, as is seen from the graph, this hasn’t essentially been the case.

Each bullish and bearish worth motion has occurred following the formation of this sample. Simply again in March of this 12 months, the indicator had proven this development, however the cryptocurrency had adopted up with a pointy correction.

Breaks into the excessive worth realization zone (that’s, the situation the place there may be a considerable amount of promoting occurring), although, have typically at all times been bearish for Bitcoin.

Because the indicator has as soon as once more dipped into the low worth realization space, it’s attainable that a big transfer within the worth might observe quickly. Though it’s unsure which course precisely this volatility would possibly go.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,100, down 2% within the final week.

BTC seems to have plunged | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link