[ad_1]

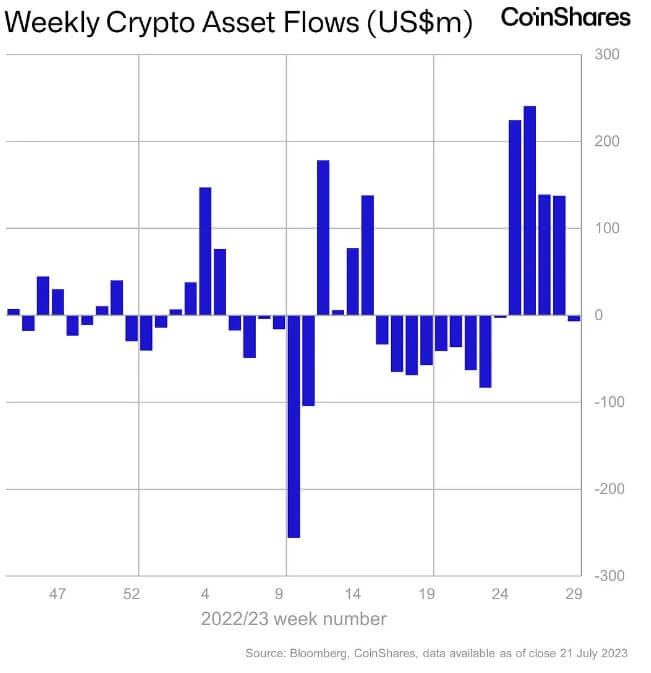

Digital property funding merchandise recorded $6.5 million in outflows this week after 4 consecutive weeks of inflows totaling $742 million, Coinshares reported on July 24.

This week’s outflows break the longest streak of inflows since late 2021, coinciding with the latest market downturn that noticed Bitcoin’s (BTC) worth dump to its lowest worth since June 21.

Coinshares additional reported that the buying and selling quantity for the week ending July 21 was $1.2 billion, under the yr’s weekly common of $1.4 billion and considerably decrease than the $2.4 billion recorded within the week ending July 14.

Ethereum, and XRP see inflows.

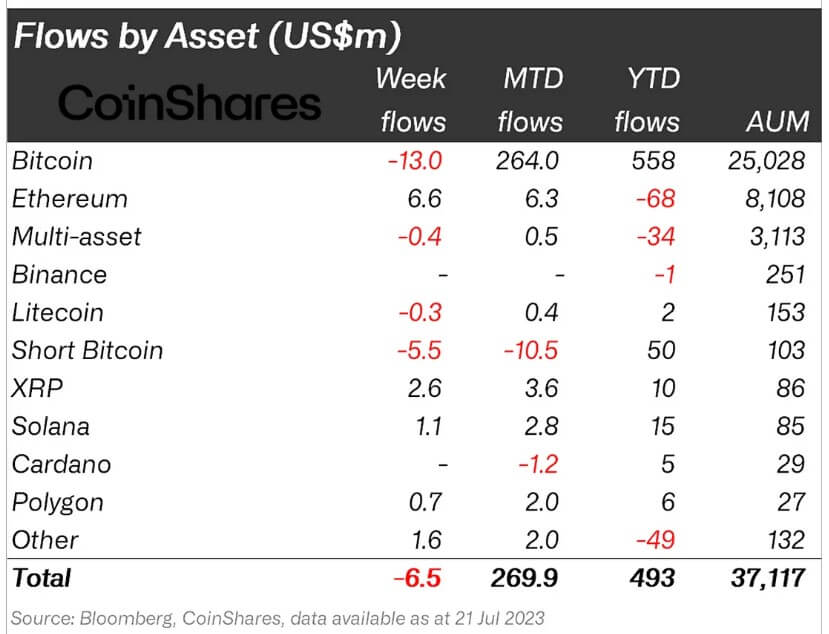

Through the previous week, Ethereum (ETH) funding merchandise topped the leaderboard for inflows seeing $6.5 million in influx.

James Butterfill, the top of Coinshares analysis, wrote that the inflows counsel that sentiments surrounding the asset would possibly change. Because the starting of the yr, ETH has seen outflows of $68 million on the year-to-date metric.

In the meantime, XRP noticed inflows of $2.6 million throughout the interval, taking its year-to-date influx to $10 million.

Coinshares famous that buyers’ confidence in XRP has grown following Ripple’s partial victory towards the U.S. Securities and Alternate Fee (SEC). Based on the agency, the digital asset funding merchandise noticed a $6.8 million influx over 11 weeks.

Different altcoins, together with Solana (SOL), Polygon (MATIC), and Uniswap (UNI), recorded minor inflows at $1.1 million, $0.7 million, and $0.7 million, respectively.

Bitcoin dominates outflows

After weeks of dominating inflows, buyers withdrew $13 million from Bitcoin funding merchandise. As compared, the quick BTC funding product continued its streak of outflows with $5.5 million flows to mark the thirteenth consecutive week.

The property underneath administration for brief bitcoin investments now stand at $103 million. At its peak, it accounted for 1.4% of all Bitcoin funding merchandise. It has now dropped to 0.4%.

Coinshares said that the outflows have been primarily because of adverse sentiment within the North American market, the place 99% of the $21 million outflows got here from. However inflows of $12 million in Switzerland and $1.9 million in Germany have been in a position to offset the affect.

The publish Bitcoin sees first outflows in a month as Ethereum, XRP take pleasure in buyers’ confidence appeared first on CryptoSlate.

[ad_2]

Source link