[ad_1]

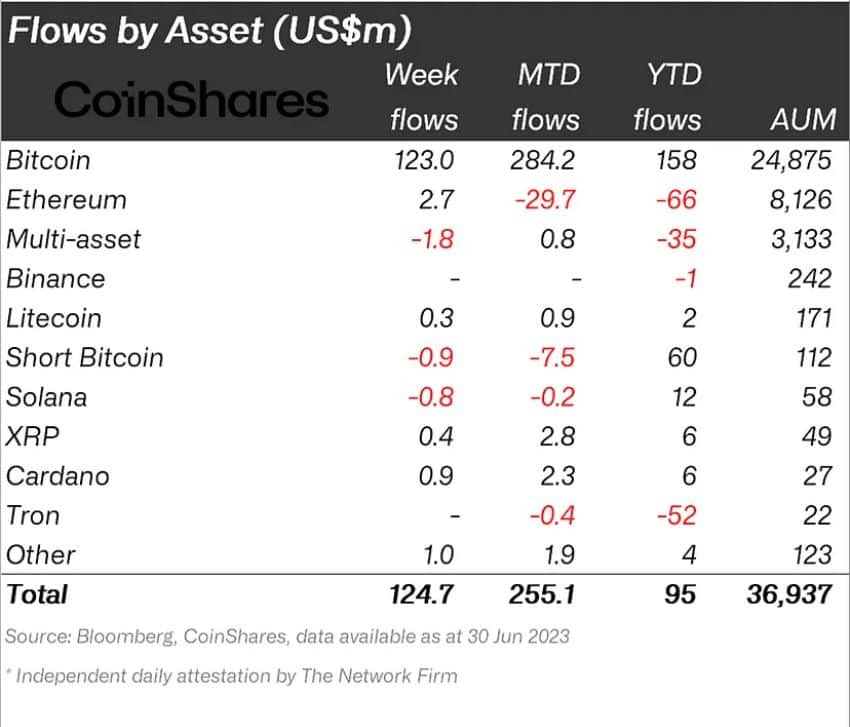

Crypto asset administration merchandise noticed inflows for the second consecutive week ending Jun 30, totaling $125 million, in keeping with CoinShares. This brings the final two weeks of inflows to $334 million, representing nearly 1% of complete belongings below administration (AuM).

Over the past two weeks, Bitcoin funding merchandise took the lion’s share of traders’ curiosity with inflows of $123 million, representing 98% of all digital asset flows. In the meantime, Multi-asset, Brief Bitcoin, and Solana merchandise noticed outflows of $1.8 million, $0.9 million, and $0.8 million respectively.

In response to ETF.com, ProShare’s BITO fund recorded inflows of $14.9 million on Jun 29, adopted by an extra $11.9 million on Jul 3. This introduced the fund’s complete belongings below administration (AUM) to $1.04 billion – a rise of $218 million since Jun 15 – reflecting the continued development in investor curiosity.

Though Brief Bitcoin has skilled outflows for the previous 10 weeks, amounting to 59% of its belongings below administration (AuM), it stays the second-best performing asset when it comes to inflows for the 12 months. Traders have contributed a complete of $60 million to Brief Bitcoin up to now in 2023.

Per CoinShares, the latest improve in crypto worth resulted within the complete worth of belongings below administration (AuM) reaching $37 billion throughout the week of Jun 30. That is the very best level since early June 2022 and is according to the typical AuM all year long. Buying and selling exercise additionally remained excessive, with a complete of $2.3 billion traded throughout the week, which is considerably greater than the typical buying and selling quantity of $1.5 billion up to now this 12 months.

Altcoin administration merchandise skilled modest inflows throughout the week. Amongst them, Ethereum attracted the very best quantity of inflows, totaling $2.7 million. It was adopted by Cardano, Polygon, and XRP, which additionally noticed some inflows from traders of lower than $1 million every.

Many of the inflows to crypto administration merchandise got here from Germany, Canada and america, with Germany contributing $64.8 million, adopted by Canada with $34.7 million and america with $22.7 million.

After witnessing 9 consecutive weeks of outflows, blockchain equities obtained inflows of $6.8 million, indicating a shift in investor sentiment because the crypto market reveals early indicators of bullishness with Bitcoin testing the $30,000 zone in latest weeks.

[ad_2]

Source link