[ad_1]

On Could 1, U.S. regulators seized and offered First Republic Financial institution (FRB) and its belongings to JPMorgan in what has now turn into the most important financial institution failure since 2008. FRB is the fifth financial institution to fail in lower than two months, following on from Silvergate, Silicon Valley Financial institution, Signature Financial institution, and Credit score Suisse.

Regardless of the rising variety of struggling banks, regulators proceed to guarantee the general public that these failures aren’t a part of a world banking disaster — blaming short-term turmoil amongst native lenders for the fallout.

A supply near Treasury Secretary Janet Yellen instructed CNN that First Republic was an outlier within the regional banking sector. First-quarter outcomes confirmed that the majority midsize and regional banks had been “well-capitalized” and that deposit flows have stabilized, the supply argued.

Jamie Dimon — the CEO of JPMorgan — echoed the assertion, assuring members of a current investor name that the banking sector was “secure.”

“No crystal ball is ideal, however sure, I feel the banking system could be very secure. This a part of the disaster is over.”

Bending the banking system

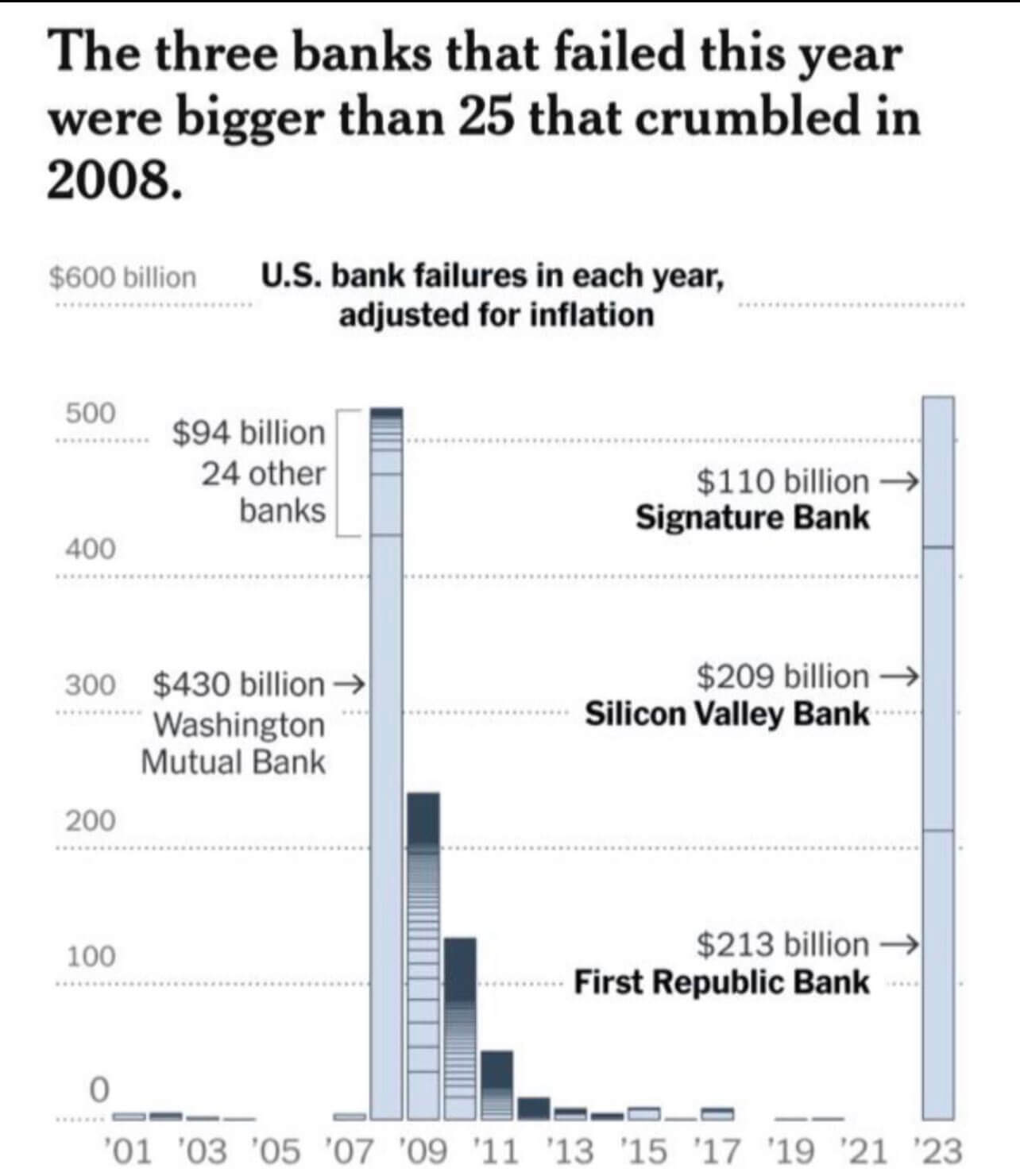

Nonetheless, the failure of First Republic, Signature, and Silicon Valley Financial institution is already larger than the 25 banks that failed in 2008.

Knowledge from The New York Instances confirmed that the three had over $530 billion in belongings — whereas Washington Mutual and the 24 different banks that crumbled in 2008 managed round $524 billion, adjusting the information for inflation.

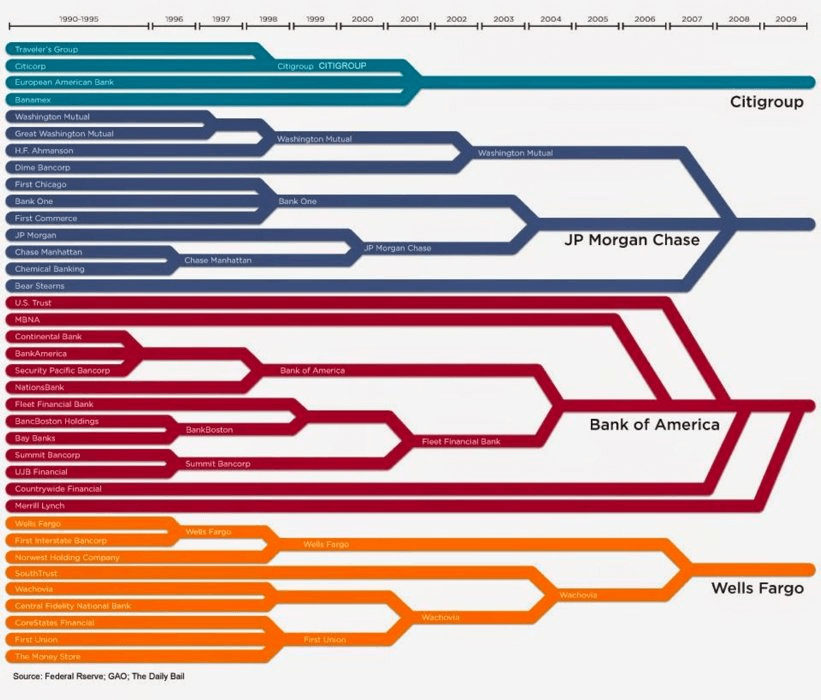

JPMorgan’s acquisition of First Republic was lauded by U.S. regulators as a heroic transfer that saved the taxpayers from fronting the invoice for its failure. Nonetheless, it units a harmful precedent that would see the U.S. market turn into dangerously centralized and government-dependent.

Whereas there’s no specific regulation prohibiting banks from controlling any share of the nation’s complete deposits, there are safeguards in place that forestall systemic banking points. The Dodd-Frank Act — handed in 2010 in response to the 2008 monetary disaster — allows regulators to dam mergers and acquisitions that may lead to a financial institution changing into “too large to fail.”

Quite a few economists and analysts warned that JPMorgan’s acquisition of First Republic ought to by no means have been allowed. The controversial $10 billion deal noticed JPMorgan purchase the substantial majority of FRB’s belongings and assume its deposits — each insured and uninsured — from the FDIC.

This pushed JPMorgan’s complete belongings over $3.2 trillion, cementing its place as the most important financial institution within the U.S.

As a part of the deal, JPMorgan acquired $173 billion of loans and $30 billion value of securities from FRB. It additionally assumed round $92 billion of deposits, together with $30 billion of enormous financial institution deposits, all of which shall be repaid after the deal closes. The FDIC will share JPMorgan’s loss on $13 billion value of residential mortgage loans and industrial loans, in addition to present JPMorgan with $50 billion of financing.

Bitcoin

On the alternative aspect of the monetary spectrum stands Bitcoin, which appears to have used the continuing banking disaster to put a powerful basis for the remainder of the 12 months.

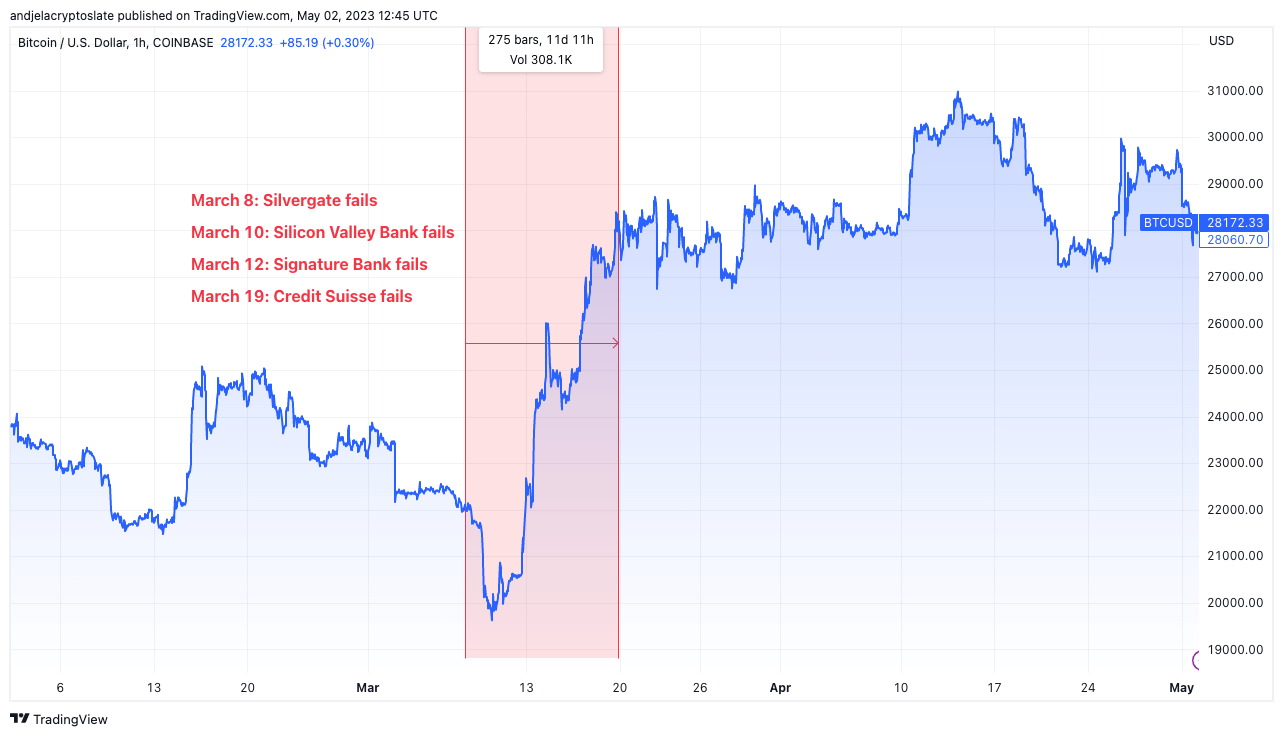

The 4 consecutive financial institution failures that passed off between March 8 and March 18 this 12 months affected Bitcoin’s worth — wiping out practically 17% of its market cap. Nonetheless, the impact was short-lived and Bitcoin rapidly started recovering from the preliminary shock regaining the 17% loss in lower than three days.

Since then, Bitcoin’s worth has been going up, with BTC buying and selling at simply over $28,000 at press time. The volatility BTC skilled when crossing $30,000 and its constant correction at round $27,000 might imply that robust resistance was shaped.

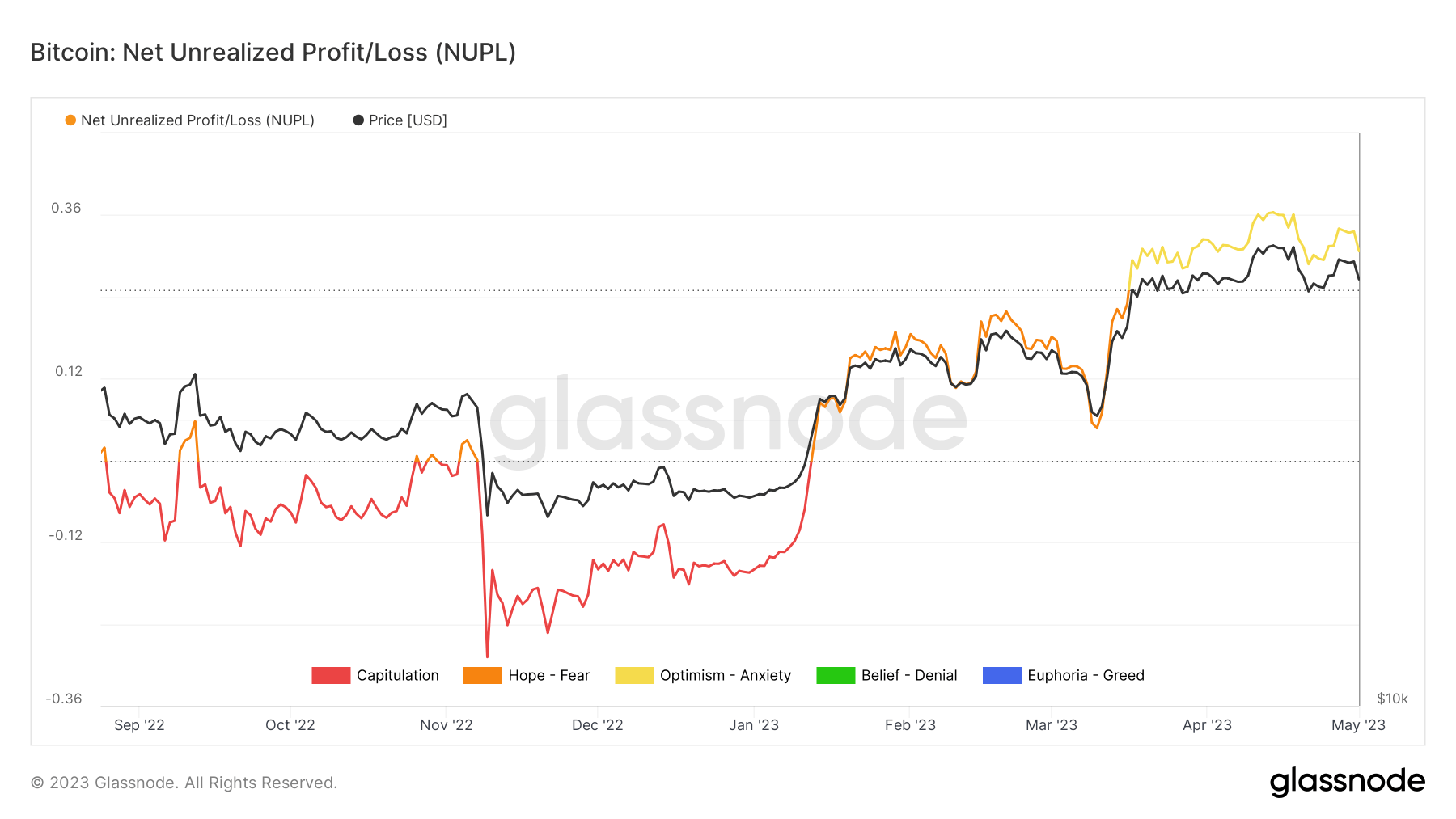

Financial institution failures additionally appear to have injected the crypto market with a long-awaited optimism. The Web Unrealized Revenue/Loss (NUPL) is an indicator used to find out whether or not the community as a complete is in a state of revenue or loss. The upper the NUPL rating is, the extra unrealized income there are within the community and the extra optimistic the community is general about upcoming worth motion.

Bitcoin’s NUPL rating exhibits that any semblance of worry introduced on by the failure of Silvergate, Signature, and Silicon Valley Financial institution was rapidly worn out.

The publish Bitcoin rises amidst string of financial institution failures: is that this the beginning of a brand new monetary period? appeared first on CryptoSlate.

[ad_2]

Source link