[ad_1]

Bitcoin worth simply skilled one among its quickest and sharpest corrections in over a yr, dropping 10% in a matter of minutes.

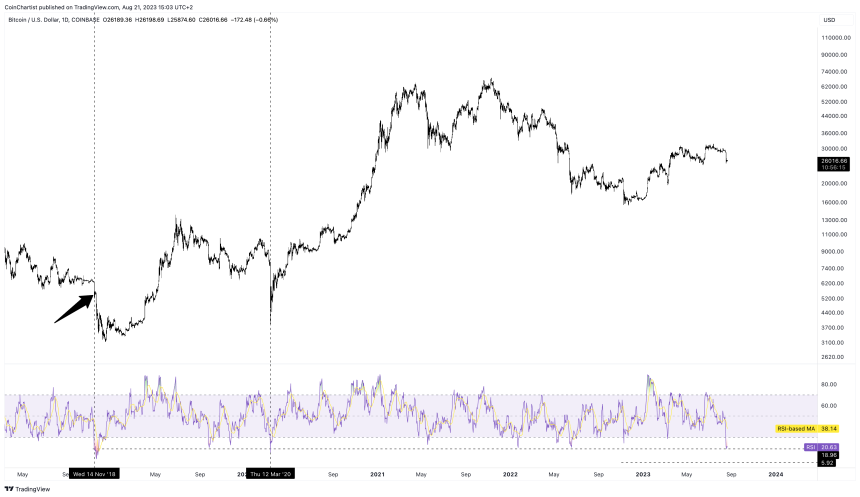

The mass liquidations and panic from the selloff precipitated BTCUSD every day charts to succeed in probably the most oversold stage for the reason that COVID crash in early 2020.

BTC Panic-Promoting Reaches Extremes Not Seen Since COVID Crash

As a lot as folks attempt to combat it, investing and buying and selling is an emotion-driven course of. Few feelings trigger people to take motion extra urgently than these related to worry and panic.

That is exactly why selloffs are usually sharper and scarier than bull markets. “Bulls take the steps, bears journey the elevator” is only one adage that symbolizes this famous market habits.

For instance, the COVID collapse in March 2020 took solely a matter of days to erase 70% of Bitcoin’s worth. This occasion was the final time the Relative Energy Index technical indicator on the every day timeframe grew to become this oversold.

After Bitcoin’s just lately drop this week, the every day RSI is again at the same excessive for the primary time in additional than three years. What isn’t clear fairly but, is that if the acute represents one other excellent shopping for alternative, or if that is the onset of a deeper decline.

The RSI has reached the deepest studying in years | BTCUSD on TradingView.com

Bitcoin Day by day RSI Plunges To Most Oversold Degree Since 2020

The Relative Energy Index is a momentum indicator that tells buyers and merchants when an asset is overbought and oversold on a relative foundation. When the software reaches extremes above 70 or under 30, it could current a possibility to purchase or promote. The RSI is now decrease than the LUNA or FTX collapse, or at any level since March 2020.

Throughout particularly sturdy strikes, nevertheless, the RSI can stay elevated for prolonged phases regardless of reaching such overheated readings. Such was the case in December 2018, the earlier occasion of the every day Bitcoin RSI reaching such a low.

In that case, the RSI stayed scorching for 2 full weeks, slicing down BTCUSD worth by one other 40% earlier than it was all mentioned and performed. A 40% correction in Bitcoin would take costs again to the November 2022 backside.

If Bitcoin as a substitute rebounds and reacts extra akin to 2020, new all-time highs might be simply months away. If not, a deeper reset is feasible.

#Bitcoin every day RSI is now probably the most oversold in all of 2023

Act accordingly pic.twitter.com/GpKFAvsonc

— Tony “The Bull” (@tonythebullBTC) August 17, 2023

[ad_2]

Source link