[ad_1]

On-chain knowledge reveals the Bitcoin change inflows of the short-term holders have intensified not too long ago because the asset’s rally has come to a halt.

Bitcoin Quick-Time period Holders Are Displaying Elevated Change Inflows

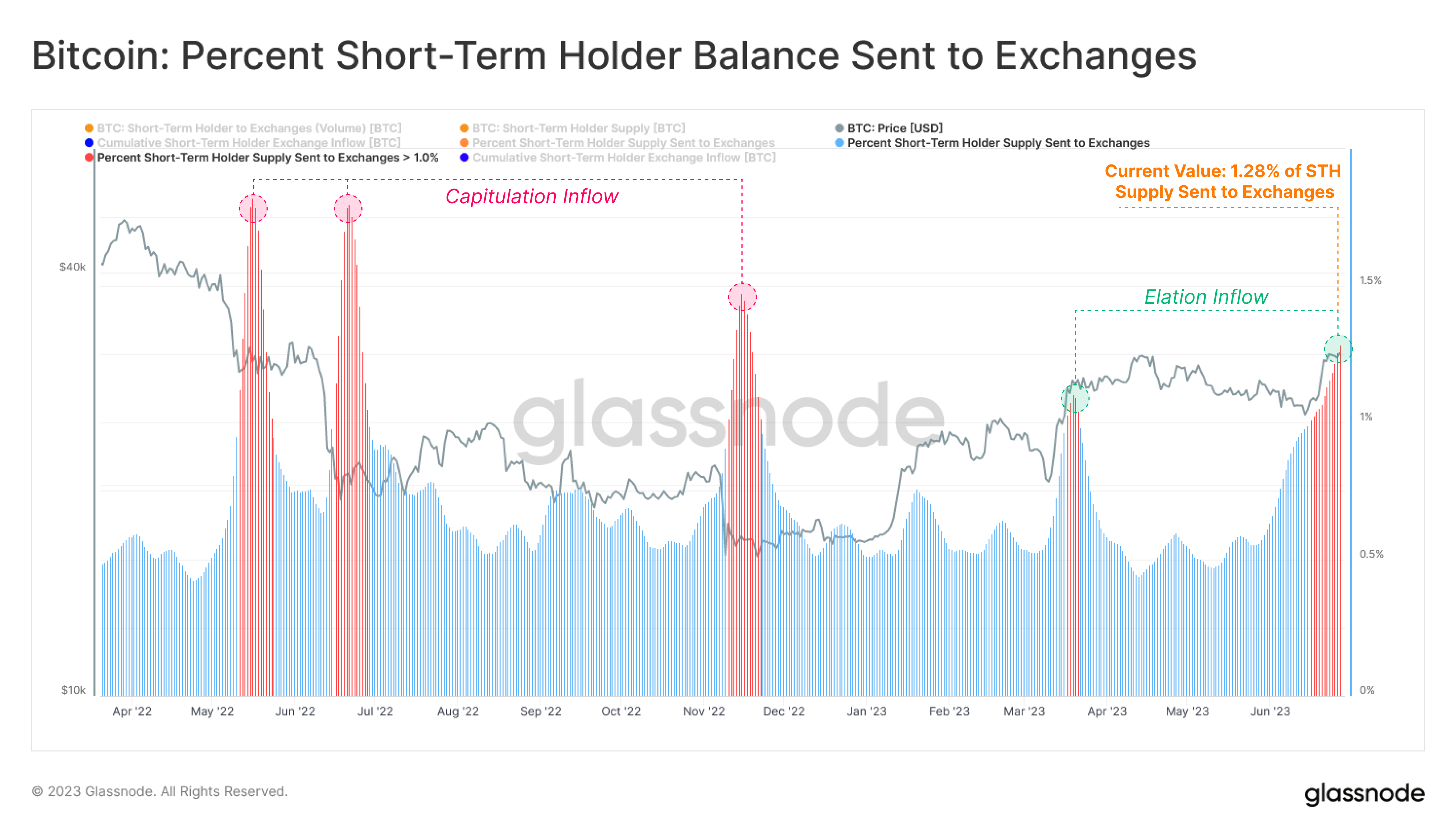

In keeping with knowledge from the on-chain analytics agency Glassnode, the short-term holders have not too long ago made inflows equal to 1.28% of their complete provide. The “change influx” right here refers to an indicator that measures the whole quantity of Bitcoin that buyers are depositing to centralized exchanges presently.

Usually, buyers deposit to those platforms for selling-related functions, so at any time when this metric’s worth is excessive, it’s a doable signal that there’s dumping happening out there. Naturally, this sort of pattern can have bearish penalties for the cryptocurrency’s value.

The change influx is normally outlined for your complete market, however within the context of the present dialogue, the main target is just on the inflows being made by the “short-term holders” (STHs).

The STHs make up one of many two main cohorts within the Bitcoin market (the opposite being the “long-term holders”), and so they embody all buyers who’ve been holding their cash since lower than 155 days in the past.

As their title already implies, these buyers don’t have a tendency to carry for too lengthy, as they’re normally probably the most fickle bunch out there, simply promoting on the sight of any FUD or profit-taking alternatives.

Now, beneath is a chart that reveals the pattern within the Bitcoin change inflows particularly for the STHs during the last yr or so.

The worth of the metric appears to have been fairly excessive in latest days | Supply: Glassnode on Twitter

Right here, the change influx of the STHs is represented as a proportion of their provide (that’s, the sum of the pockets quantities that every particular person STH is holding proper now). From the graph, it’s seen that the indicator’s worth had risen to notable values earlier within the month when the market was going by FUD just like the SEC lawsuits towards cryptocurrency exchanges Binance and Coinbase.

Whereas the STHs had been clearly exhibiting panic then, the dimensions of their promoting was nonetheless considerably decrease than the opposite selloffs which have taken place through the previous yr.

After the most recent rally within the cryptocurrency’s value above the $30,000 degree has occurred, nevertheless, the indicator’s worth has proven a pointy enhance. Now, the metric has hit a worth of 1.28%, which implies that the STHs have not too long ago made inflows equal to 1.28% of their provide.

This degree is larger than what was seen through the rebound rally again in March of this yr. As is seen from the graph, the rally again then had hit the brakes when the STHs ramped up their promoting.

Up to now, Bitcoin has been trending sideways for the reason that latest sharp value surge occurred. So it’s doable that the present intensified promoting from the STHs is behind this pattern, just like the way it was again in March.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,100, up 4% within the final week.

BTC continues to carry above the $30,000 mark | Supply: BTCUSD on TradingView

Featured picture from Maxim Hopman on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link