[ad_1]

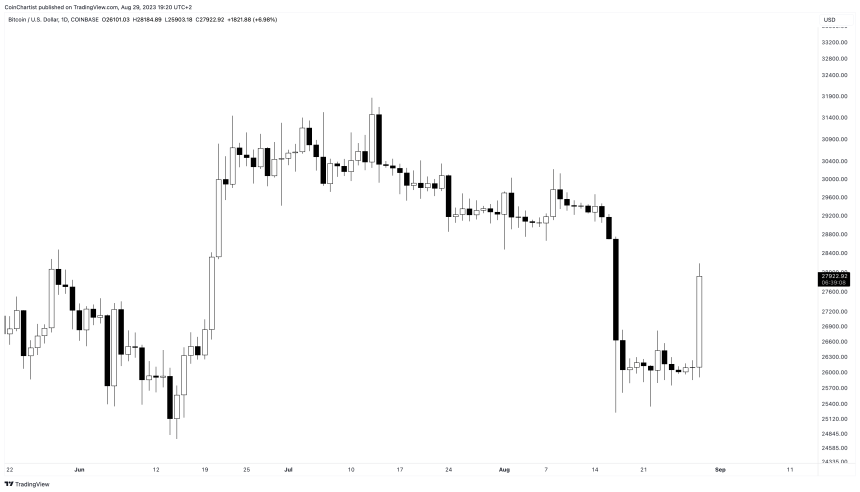

Bitcoin worth has to date made a 7% intraday transfer following information {that a} US court docket dominated in favor of Grayscale towards the SEC. On the identical time, the inventory market is surging.

Might an ideal storm for the highest cryptocurrency by market cap be constructing?

Again At $28,000: Grayscale Courtroom Ruling Causes BTC To Bounce

In an asset class as unstable as crypto, costs — and moods — can change in a flash. That’s precisely what we’ve witnessed on a small scale right this moment, moments after information broke {that a} US court docket is forcing the SEC to rethink Grayscale’s Bitcoin ETF.

The information is critical as a result of not solely does it enhance the possibility Grayscale can transfer forward with an ETF, nevertheless it additionally improves the probability of different ETFs likeBlackRock getting the inexperienced gentle.

Inexperienced is unquestionably the colour of the day, with BTCUSD climbing again to $28,000 per coin on the heels of the information.

Bitcoin worth rockets 7% increased in a day | BTCUSD on TradingView.com

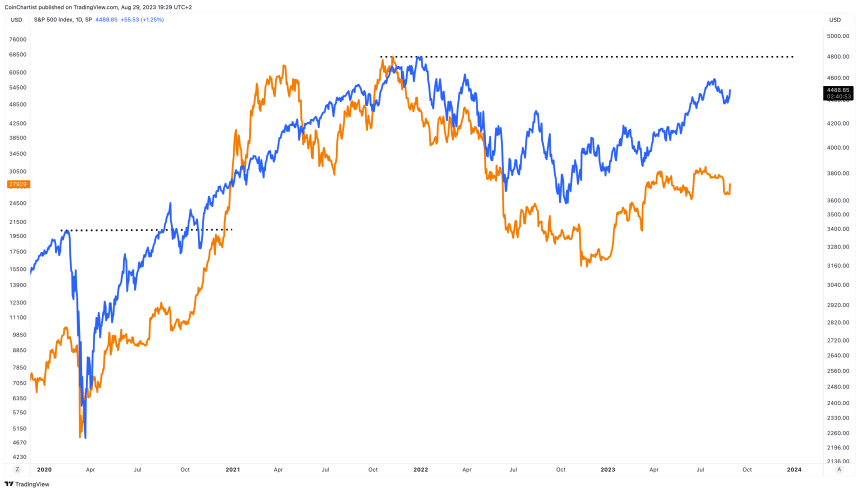

Bitcoin Value Might Profit From A New Inventory Market Excessive

It isn’t simply crypto getting a significant enhance right this moment. US inventory indexes are additionally hovering right this moment. The S&P 500 is up over 1.2%, the tech-heavy Nasdaq over 1.88%, and the Dow Jones Industrial Common at 0.63%. The newest bounce in shares places conventional markets inside putting distance of a brand new all-time excessive.

That is necessary as a result of if Bitcoin worth is already turning bullish within the wake of the Grayscale information, then a simultaneous inventory market all-time excessive may trigger crypto to go ballistic.

BTC versus the SPX | BTCUSD on TradingView.com

Cryptocurrencies have a ton of catching as much as do relative to the inventory market. Moreover, again in 2020, after the S&P 500 made a brand new all-time excessive, Bitcoin worth adopted within the weeks to come back and set a file of its personal. Is that this what we will count on if the inventory market units new file highs, and a slew of ETFs are authorised?

[ad_2]

Source link