[ad_1]

For the primary time since mid-March, Bitcoin value dropped beneath $25,000 as commerce volumes decreased and the U.S. Federal Reserve left rates of interest untouched based mostly on projections however warned of extra hikes this 12 months to fight inflation.

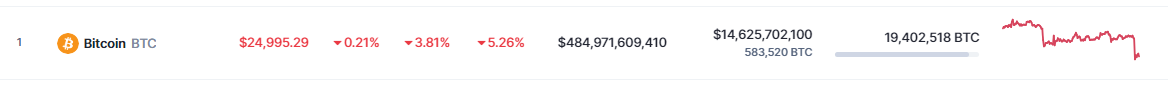

On the time of writing, Bitcoin was buying and selling at $24,995, down 3.8% within the final 24 hours, knowledge from crypto market tracker CoinMarketCap reveals. BTC has now misplaced 5.26% of its worth within the final seven days. Crypto property could also be significantly weak to the central financial institution’s projection of a better terminal charge later this 12 months.

Supply: CoinMarketCap

Bitcoin value had been secure round $26,000 for the previous few days because the market processed the SEC’s lawsuit towards Binance and Coinbase and rising macroeconomic anxiousness about rate of interest alerts from the Fed.

SEC Lawsuits, Hawkish Fed Message Hammer Bitcoin Worth

In line with Benjamin Stani, head of enterprise improvement and gross sales at cryptocurrency buying and selling platform Matrixport, the SEC’s lawsuit towards the 2 largest cryptocurrency exchanges is a significant component out there’s current losses. Nearly all of altcoins additionally took a beating in worth in consequence.

CoinMarketCap knowledge reveals that previously 24 hours, the complete cryptocurrency market cap has dropped 2.7%, to $1.02 trillion, whereas each day crypto buying and selling quantity has decreased 5.3% to $31.89 billion.

BTCUSD drops to the $24K degree. Chart: TradingView.com

Regardless of widespread expectations for a charge suspension, the Federal Open Markets Committee signaled future charge hikes in its assertion, which usually dampens investor enthusiasm for threat property like cryptocurrencies.

Since early 2022, the US central financial institution has been steadily rising rates of interest, with essentially the most extreme results seen by the riskiest property. When rates of interest rise, it turns into dearer to borrow cash, which results in decrease ranges of funding and client spending.

And due to the extended crypto winter, Bitcoin has been plunging because the starting of the 12 months. Analysts say it could take awhile for the alpha coin to muster a powerful rebound and break previous the important thing $27K or $28K degree given the cryptocurrency’s sluggish efficiency of late.

Sluggish XRP Creates Detrimental Ripples Throughout Bitcoin Market

Add to the continued distress for Bitcoin is the frustration emanating from the XRP group following the discharge of the Hinman paperwork, that many anticipated can be a savior of types to the value of the token and its creator Ripple, whose authorized tussle with the SEC has but to see closure.

BTC value on a downward trajectory. Supply: TradingView.

These Hinman emails are essential within the ongoing case between Ripple and SEC. No matter adverse information comes out of it impacts Bitcoin value – and crypto usually – in some ways.

In the meantime, as technical elements play out, IntoTheBlock stories that Bitcoin-related negativity on Twitter has reached an all-time excessive. It emphasizes the relevance of this reality, which is that enormous peaks have usually occurred simply earlier than or after value lows up to now.

Santiment, an on-chain analytics firm, additionally stories that the variety of Bitcoins accessible for buying and selling has hit a brand new low not seen since February 2018. Even whereas lawsuits proceed towards Binance and Coinbase, it has been reported that merchants have continued to maneuver BTC into self-custody.

Featured picture from Pixels

[ad_2]

Source link