[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin’s value exhibits the need to develop, with a number of makes an attempt to breach the resistances holding it from going additional up. Nevertheless, the shopping for stress isn’t robust sufficient to push the coin previous $31k. A whole lot of it’s believed to be attributable to market uncertainty.

Bitcoin’s latest bull run resulted from BlackRock and a number of other different firms submitting their Bitcoin spot ETF filings.

The market was rising more and more bearish after the US SEC filed lawsuits towards Binance and Coinbase, however BlackRock, Constancy, and different firms managed to show issues round.

After two weeks of development, the market appeared promising till the SEC rejected the proposals, saying that the dearth of readability is the explanation.

BlackRock, the world’s largest asset supervisor, launched adjustments inside days and refiled the applying. The corporate’s swift response returned optimism to the patrons, however many assume that the SEC Chair, Gary Gensler, will merely discover one more reason to reject the proposal.

Jay Clayton, however, believes that Bitcoin spot ETF might nonetheless get a cross. The previous SEC Chairman commented just lately that the ETF approval can be exhausting to withstand if market efficacy is demonstrated.

Whereas the SEC beneath Clayton’s management additionally rejected ETF proposals prior to now, he mentioned that the scenario is now totally different from the one in his time.

Let’s return to 2015-2016. That is an offshore, retail, nothing near what I’d say are the core of our monetary markets. At the moment, in case you take a look at buying and selling of Bitcoin, the emergence of Bitcoin, it appeared like shares, but it surely was nothing prefer it. Now we’ve seen growth all the way in which to the purpose the place firms whose fame out there issues are saying, ‘You understand what, we expect that buying and selling, that the custody, these protections round this market are enough that we’re prepared to place our identify on it and supply that product.’ That’s really an unimaginable growth, not one I anticipated. I used to be very skeptical of buying and selling within the Bitcoin market after I was the SEC Chair. I believed there have been research that 90% of it was washing buying and selling, ripe for manipulation and the like…

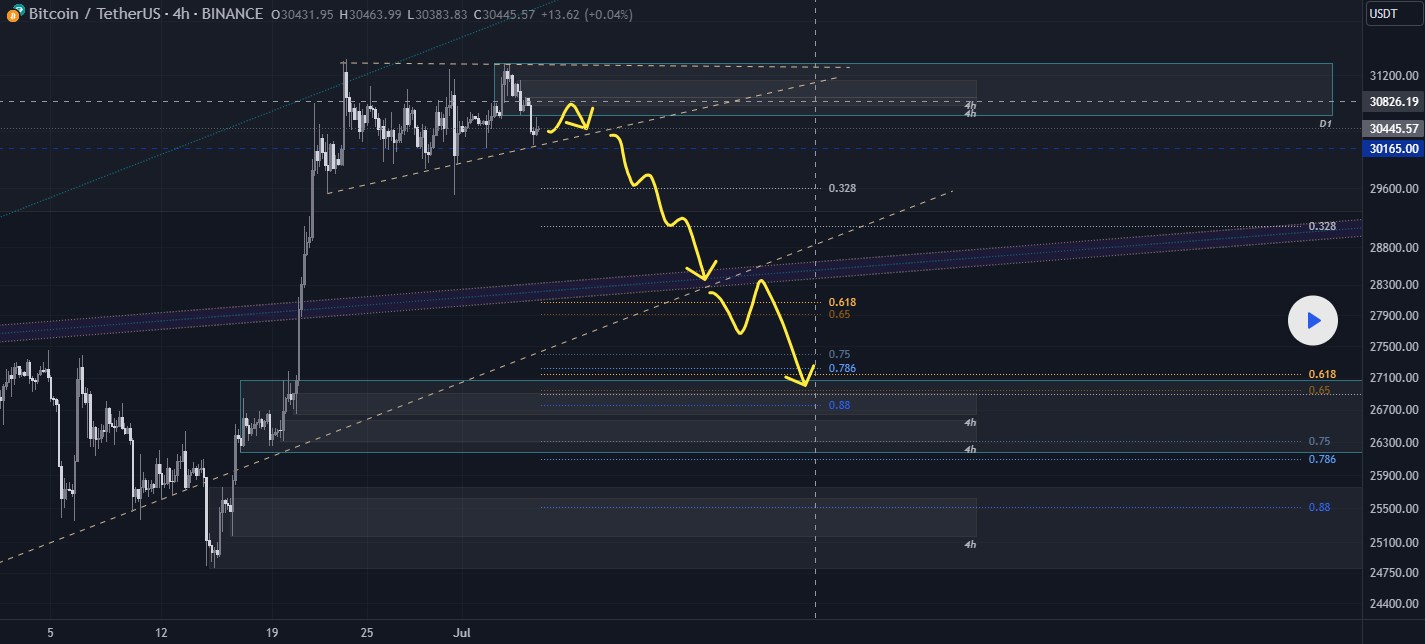

Bitcoin makes one other Burj Khalifa as the value spikes, then will get rejected

After spiking as much as $31,366 on July sixth, Bitcoin value was buying and selling sideways for 4 days, between early Friday and late Monday, solely to repeat comparable conduct late on July tenth. The coin noticed one other surge, though this one solely took it close to the $31k vary earlier than its value was once more rejected to $30,220.

As many have identified, Bitcoin is caught above $30k, which continues to be constructive. Nevertheless, its incapability to progress additional solely will increase the possibilities of the assist ultimately breaking.

Michael van de Poppe, CEO and founding father of Eight, mentioned that the latest transfer had the hallmarks of a leverage crunch. He mentioned that “Bitcoin had a leverage crunch prior to now 24 hours, taking out all of the highs & going again to the beginning in a single go. The one distinction between now and Thursday? No new lows have been made. $30,200 supporting. Don’t get chopped out!”

The markets simply continues chopping.#Bitcoin had a leverage crunch prior to now 24 hours, taking out all of the highs & going again to the beginning in a single go.

The one distinction between now and Thursday? No new lows have been made.

$30,200 supporting.

Do not get chopped out! pic.twitter.com/nDG26u7BKZ

— Michaël van de Poppe (@CryptoMichNL) July 11, 2023

On the time of writing, Bitcoin is down 2% in comparison with yesterday’s excessive, sitting at $30,451. Whereas it managed to interrupt the resistance at $30.4k, holding it again for the previous a number of days, stronger resistances nonetheless preserve it in place.

Regardless of this, traders are optimistic in the long run, figuring out that subsequent 12 months’s halving will deliver a brand new bull run.

Bitcoin halving won’t profit the miners, says Berenberg Capital Market

Bitcoin halvings are at all times extremely anticipated occasions, as bull runs often comply with them. Because of this miners are inclined to cease promoting their BTC when a halving begins approaching, which reduces the market provide, and contributes to the upcoming bull run.

Nevertheless, in accordance with a latest bull case offered by Berenberg Capital Market, the subsequent 12 months’s halving won’t be nice for the miners.

The analysis observe defined that just about half of Bitcoin miners function with suboptimal effectivity. They may anticipate vital challenges after the halving, as their rewards will probably be lowered.

There’s a window between the halving and a Bitcoin bull run that makes the coin extra invaluable, and it usually lasts for months. It will likely be very exhausting for miners to proceed their operations and pay excessive electrical energy payments whereas ready for Bitcoin to start out transferring.

The place is Bitcoin going from right here?

Bitcoin’s value has been making strikes influenced by latest builders, however technical alerts can nonetheless level the way in which for traders and merchants.

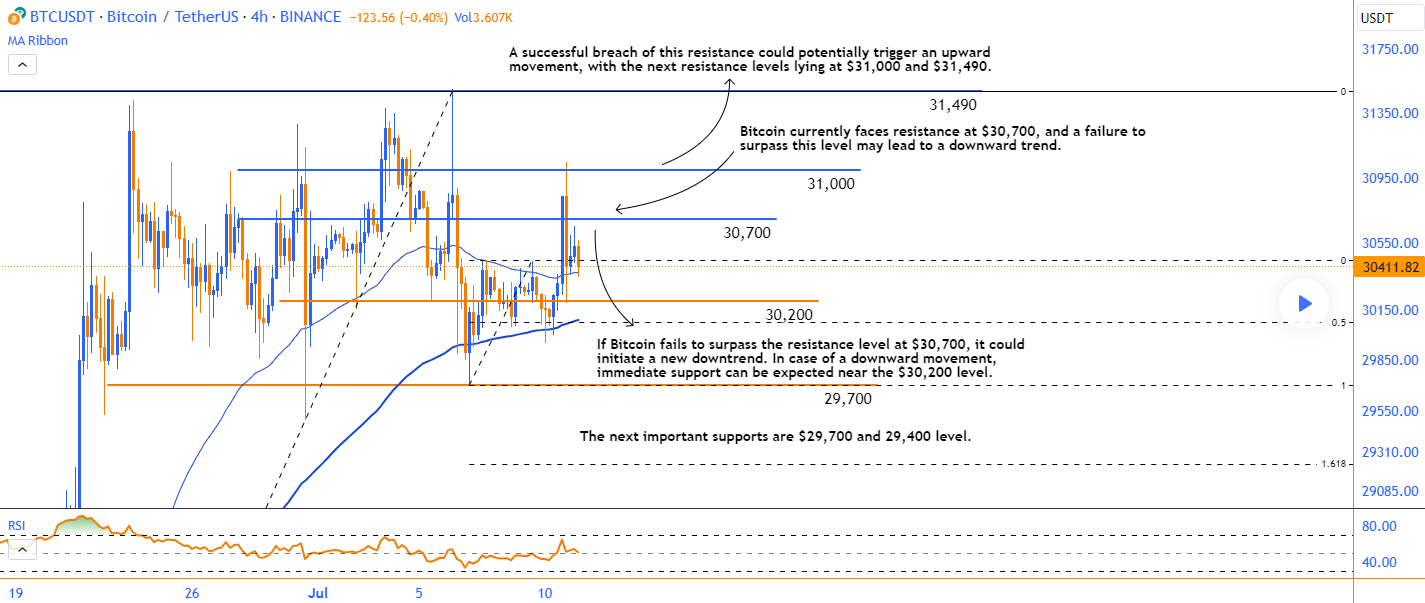

In keeping with analysts, the coin is at the moment being traded at a value of $30,400 over a 4-hour interval. The RSI sits at 50.95, indicating that the market sentiment is at the moment impartial. In the meantime, the EMA 50 is $30,373, whereas the EMA 100 is $30,088. Lastly, the MACD worth sits at 25.

Analysts imagine that Bitcoin should surpass the resistance at $30,700 to withstand the downward development.

If it fails, it nonetheless has fast assist at $30,200, however the value in free fall might simply break it, wherein case the assist at $30k can be examined. If this degree breaks as effectively, Bitcoin will decline towards $29,700, or probably even decrease to $29,400.

If the shopping for stress manages to push the coin up strongly sufficient for it to interrupt the resistance at $30,700, BTC can have an opportunity to retest the resistance at $31k. If this degree breaks as effectively, the subsequent one sits at $31.4k. Breaking this barrier as effectively might open the door to new alternatives, corresponding to BTC hitting $32k.

Wall Avenue Memes presale hits $14 million raised

Regardless of the impartial sentiment towards Bitcoin in the meanwhile, traders nonetheless appear greater than enthusiastic about Wall Avenue Memes (WSM). The brand new meme coin has managed to promote sufficient of its tokens to lift $14 million, and the presale continues to be going.

The following stage is anticipated inside hours when the value of the WSM token will go from the present $0.0313 to $0.0316.

The token was impressed by the subreddit known as WallStreetBets, which consists of beginner traders.

After seeing establishments shorting the shares of a number of revered firms in early 2021 as a way to earn a living, beginner traders began shopping for the focused shares en masse, pumping their costs.

Outraged by the establishments’ disregard for the way forward for these firms, Redditors got here to the rescue whereas costing institutional traders some huge cash.

Wall Avenue Memes is a method to commemorate their wrestle. Those that want to take part within the presale can purchase WSM tokens in alternate for ETH, BNB, and USDT, or just purchase them with their credit score/debit playing cards.

Associated

Wall Avenue Memes – Subsequent Large Crypto

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link