[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

The large hope for Bitcoin (BTC) is approval of spot Bitcoin Change-Traded Funds (ETFs) and former Securities and Change Fee (SEC) chair Jay Clayton says that’s inevitable.

Approval could occur as early as subsequent month however the SEC has till March subsequent 12 months to approve or decline the seven purposes from firms together with BlackRock, Constancy and Ark Make investments.

To some, BlackRock is in pole place and could also be first to get the inexperienced mild. The asset supervisor has some $9 trillion in property beneath administration and has acquired just one rejection from 576 ETF purposes.

BlackRock has utilized for 576 ETFs.

They’ve solely ever been rejected as soon as.

That is a 99.8% success price on their ETF purposes.#Bitcoin Spot ETF approval isn’t a matter of if, it is a matter of when. pic.twitter.com/msDDFg9Y2A

— Crypto Rover (@rovercrc) September 9, 2023

Take word additionally that Grayscale Funding just lately secured a victory in its longstanding authorized battle towards the SEC. On August 29, a court docket dominated that the SEC’s resolution to stop Grayscale from changing its Grayscale Bitcoin Belief right into a spot Bitcoin ETF was “arbitrary and capricious.”

The victory compels the SEC to assessment its resolution, growing the percentages for an approval of the primary spot Bitcoin ETF within the US. An excerpt from the ruling learn:

…ORDERED and ADJUDGED that Grayscale’s petition for assessment be granted, and the Fee’s order be vacated, in accordance with the opinion of the court docket filed herein this date.

Bitcoin jumped nearly 10% on the information with as much as $50.7 million briefly positions liquidated towards $20.2 million longs. The scales look like steadily transferring in favour of a “sure” from the SEC slightly than a “no.”

Bitcoin Worth Prognosis With A Spot BTC ETF Approval In The Horizon

BTC is at the moment exchanging fingers for $25,856, a each day drop of 0.21%. As is attribute of weekends, the quantity of trades is minimal, with momentum indicators flattening out. In the meantime, Bitcoin value continues in its range-bound horizontal slide.

Knee-high inside a requirement zone, Bitcoin value has an opportunity to push north for so long as it sustains above the imply threshold at $25,261.

A bullish outlook, on this case, comes as a requirement zone is outlined by aggressive shopping for. If the bulls act now, the king of crypto may leap to beat the resistance offered by the 200-, 50-, and 100-day Exponential Transferring Averages (EMA) at $27,043, $27,298, and 27,690 ranges, respectively. BTC may restore above the uptrend line in a extremely bullish case, probably hitting the $30,000 psychological goal. This could point out a 15% rise above present ranges.

In extremely formidable instances, the transfer north may extrapolate to the $31,804 excessive, the place Bitcoin value was rejected round mid-July.

The histogram bars’ inexperienced really feel on the Superior Oscillators (AO) factors to a presence of bulls that would bode nicely for Bitcoin value if sustained.

However, the Relative Energy Index is flat, that means bulls might be sitting on their fingers. Its trajectory, nearly crossing beneath the sign line (yellow band), exposes BTC to the danger of a fall.

A decisive transfer beneath the imply threshold at $25,261 would invalidate the bullish prospects. Bitcoin may then lose the $24,000 psychological help or revisit the March 13 lows at $21,915 within the dire case.

In the meantime, think about shopping for BTCBSC, a extra reasonably priced various with the potential for extra positive aspects. Apart from that, it provides you a second probability in case you missed out on the BTC bandwagon in 2011.

BTC Various

BTCBSC, the native cryptocurrency for the Bitcoin BSC ecosystem, is at the moment promoting for $0.99, the identical value Bitcoin retailed for in 2011. The presale is transferring quick, with nearly $740,000 raised to date.

Broaden your choices with #BitcoinBSC!🌐

Buy $BTCBSC #Tokens utilizing $USDT on the #Ethereum chain.

🔗Join your pockets, pay with $ETH, and make sure you’ve acquired sufficient ETH for gasoline charges.

Declare on the BNB Good Chain.

Seize the chance now!🚀https://t.co/oM0YP8IlbV pic.twitter.com/8kPTP8TOtK

— Bitcoinbsc (@Bitcoinbsctoken) September 9, 2023

It’s value mentioning that whereas BTCBSC isn’t a fork of Bitcoin, its name-sharing doesn’t make it a pump-and-dump scheme. As an alternative, the BEP-20 token solely offers each day revenue with BTCBSC value positive aspects. Additionally, stakers can use it for passive returns, achieved by means of ultra-high annual share yields (APY).

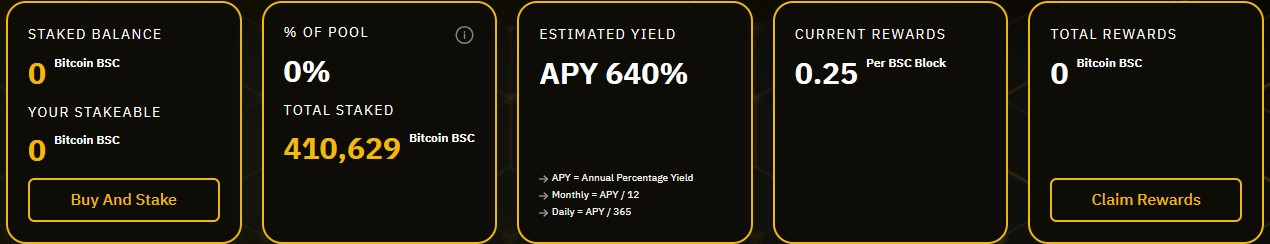

As much as $410,629 BTCBSC tokens have been staked, with the APY reaching 640%. The rewards might be distributed to customers block-by-block, with 69% of the overall provide reserved for staking. Be part of the neighborhood of stakers for top APY right here.

🚀Earn passive revenue with #BitcoinBSC!

Stake your #Tokens in our sensible contract and get rewarded with 69% of the token provide each 10 minutes!

Lock withdrawals for 7 days and revel in rewards primarily based in your pool share.

Be part of the #Presale at this time!💸 https://t.co/oM0YP8IlbV pic.twitter.com/t36G52ECyn

— Bitcoinbsc (@Bitcoinbsctoken) September 8, 2023

Purchase BTCBSC within the presale right here.

Additionally Learn:

Wall Avenue Memes – Subsequent Massive Crypto

Early Entry Presale Stay Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Greatest Crypto to Purchase Now In Meme Coin Sector

Staff Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link