[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin momentarily dropped under the $26k mark earlier than a panic rally pushed its worth again up. However the world’s oldest cryptocurrency remains to be discovering it arduous to maintain this degree, with indicators exhibiting that it might drop down as soon as once more. Are the bears taking cost of the narrative, or will the bulls come again to reclaim the token?

Bitcoin Climbs 0.52%

Bitcoin’s worth motion has been tumultuous within the final 24 hours. Hourly charts present the token dropping by 0.32% to $25.8k earlier than a panic rally pushed it again into motion. The BTC worth is presently up by 0.52%, the place it’s struggling to remain above $26k.

Bitcoin Hits Accumulation Vary – Perma Bear Name for New Lows

Mags, one of many verified customers on CoinMarketCap, has revealed that these completely bearish on Bitcoin have began calling for brand spanking new lows in response to Bitcoin’s present state.

This comes at a time when Bitcoin has hit an accumulation vary whereas exhibiting a slight bullishness in the best way it’s transferring alongside the worth chart.

This slight bullishness is accompanied by an RSI that has slowly began to maneuver up and presently stands at 58. Shifting Common Convergence/Divergence can be transferring in a constructive path. These elements point out that bears could be loosening the leash they’ve had over Bitcoin because it dropped simply above the $25k mark.

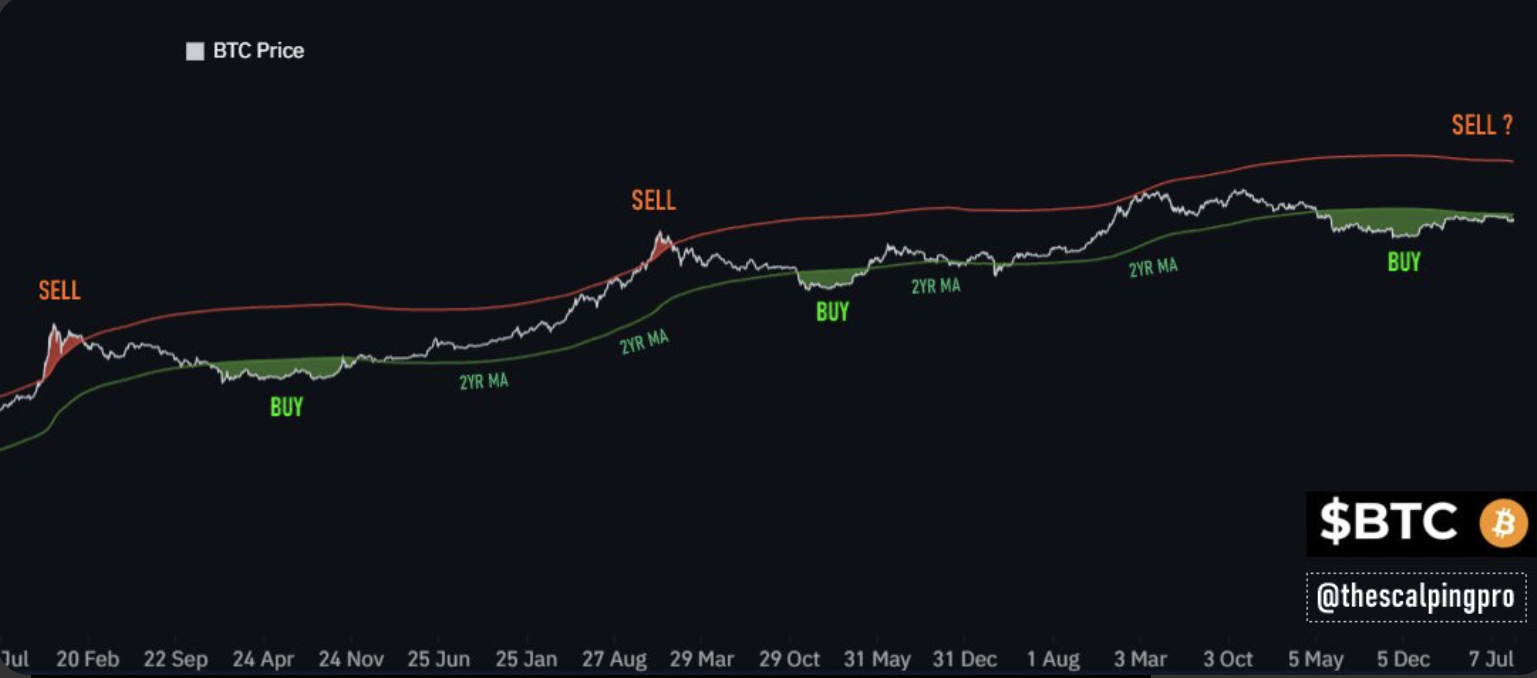

Bitcoin Worth Evaluation – Lengthy Time period

Bitcoin’s long-term evaluation doesn’t have the identical bullish image as its hourly charts. This premier crypto is presently transferring under its 50-day transferring common and its 20-day MA. This deviation appears to be rising. A wider separation between the 2 might imply that Bitcoin will hit even decrease lows within the coming days.

The Fibonacci Retracement chart additionally exhibits that Bitcoin is presently in the midst of its present resistance and assist. An extended pink within the coming days might push its worth under $25,300. An extended inexperienced, alternatively, may also help it retest its $26,800 resistance and purpose for $28,000.

Issues are nonetheless ambiguous for Bitcoin, which makes investing in another asset a greater possibility proper now.

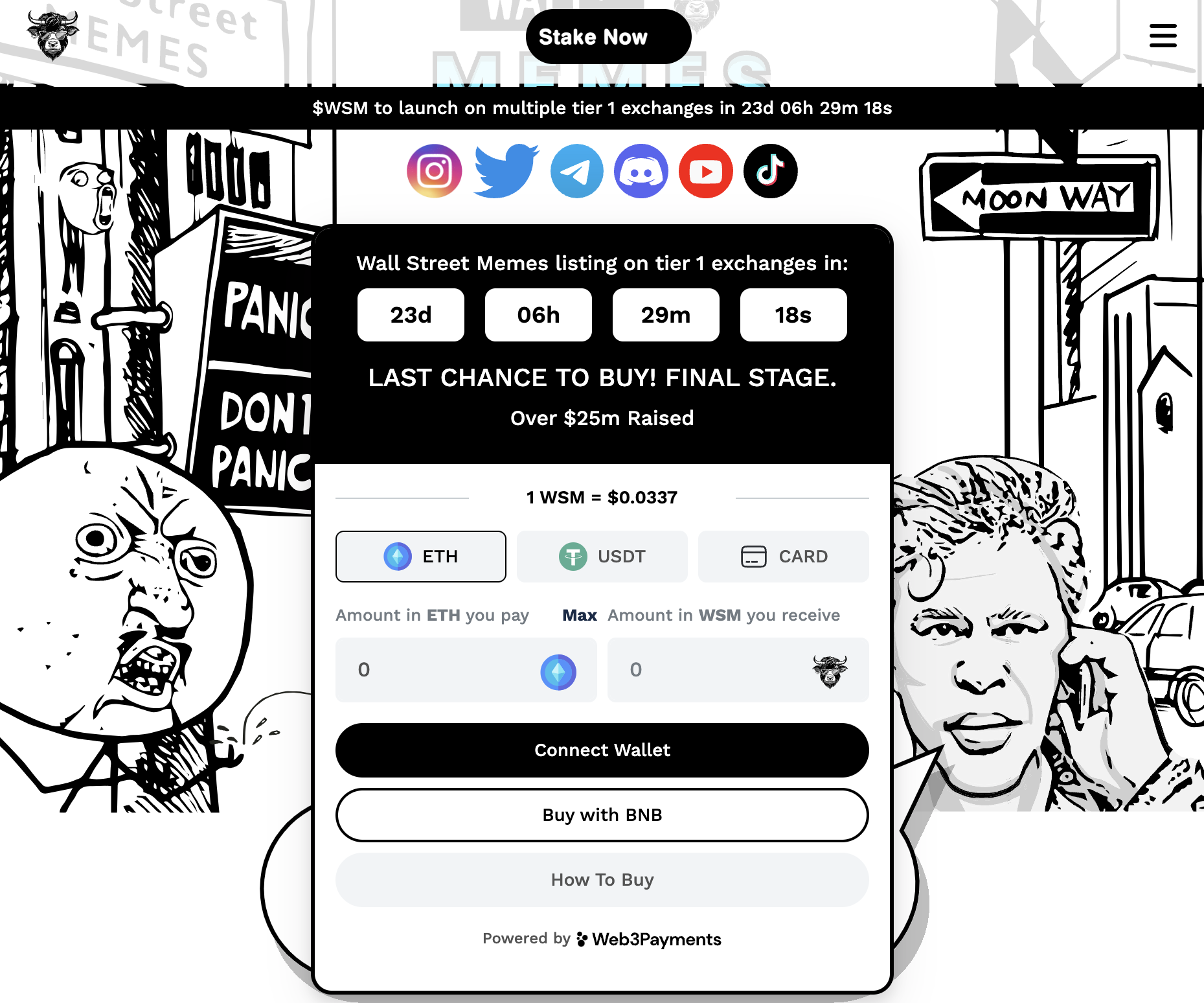

Bitcoin Different – Wall Avenue Memes

Wall Avenue Memes is a low-cap crypto undertaking and the very best different to Bitcoin proper now. With its array of community-centric attributes, Wall Avenue Memes is already making rounds as an acceptable asset for these trying to make early chicken positive aspects.

Impressed by Wall Avenue Bets, Wall Avenue Memes goals to show WSM – its native crypto – right into a wealth-generating asset by establishing a group that may come collectively to mobilize its worth to go up on the worth chart.

Serving to with this endeavour is a slew of finance-related memes which have gotten ample engagement on social media platforms. The Wall Avenue Memes group is 1 million sturdy, with over 260,000 followers on X (previously Twitter).

Wall Avenue Memes opened its ICO (Preliminary Coin Providing) in June 2023 and has raised greater than $26 million to date. These trying to make early chicken positive aspects should buy WSM at the moment at a reduction worth of $0.0337 earlier than it goes reside on a number of tier-1 exchanges within the subsequent 23 days.

Associated

Wall Avenue Memes – Subsequent Huge Crypto

Early Entry Presale Dwell Now

Established Group of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Crew Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link