[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

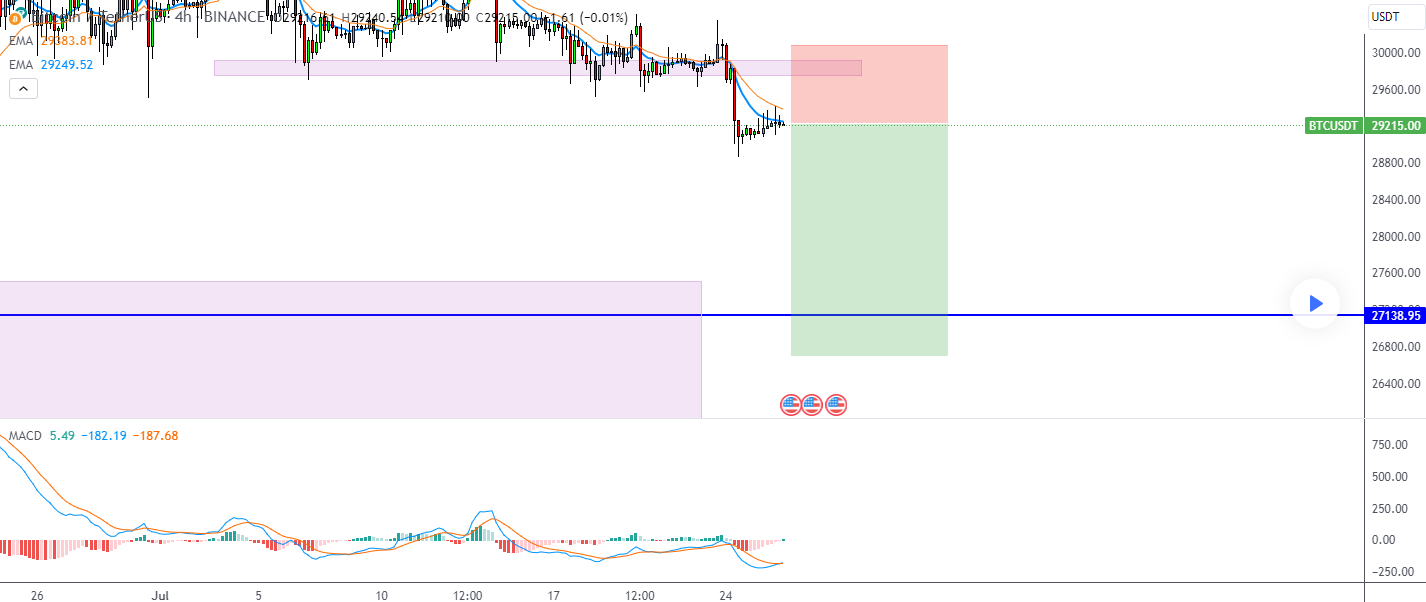

Merchants have carefully monitored Bitcoin’s value for days as they waited for the coin to make its subsequent transfer.

After dropping from $30k to $29k at first of the week, Bitcoin discovered short-term stability for about 24 hours, beginning on Monday after the drop. Nevertheless, on Tuesday afternoon, July twenty fifth, the coin began seeing larger volatility.

Its value surged from $29.1k to $29.35k, solely to drop again all the way down to $29.2k. Since then, this stage has largely held as a brand new help, however the coin discovered a number of resistances above it, together with those at $29.25k, $29.30k, and $29.35k.

The final one was reached solely as soon as within the final 24 hours, though the coin approached it on two different events with out with the ability to attain it absolutely.

On the time of writing, Bitcoin’s value sits at $29,188, with its value solely 0.01% increased than 24 hours in the past.

Bitcoin awaits spot ETF resolution

Bitcoin’s latest volatility exhibits elevated uncertainty amongst merchants, which probably comes from uncertainty surrounding the Bitcoin spot ETF standing. The coin’s value has seen a bearish wave just lately, however the opportunity of an ETF approval continues to be giving hope to some merchants.

It has additionally been speculated that the approval of the ETF may set off a Bitcoin rally within the absence of some other macro catalyst.

On that entrance, ETF analyst James Seyffart steered a sequence of vital dates within the race for approval which embody deadlines for various ETF filings.

By standard demand — This is probably the most up to date checklist of dates to look at for the present #bitcoin ETF Race.

(Grayscale can also be sorta on this race through their lawsuit in opposition to the SEC. Judges ought to challenge a ruling there throughout the subsequent month or two) pic.twitter.com/agJj82XanO

— James Seyffart (@JSeyff) July 25, 2023

It’s attainable that the coin’s value will see larger volatility as these dates method, as the thrill builds up amongst merchants and traders.

Bitcoin drops forward of Fed assembly

One other occasion imagined to have a robust impression on Bitcoin is that this Wednesday’s Fed assembly. The Fed is broadly anticipated to hike rates of interest by 25 foundation factors on the finish of its two-day assembly later immediately, because the inflation stays above the central financial institution’s goal.

A hawkish tone may find yourself boosting US Treasury yields and the USD, which might weigh on Bitcoin, in addition to Ethereum. The expectation alone could have been sufficient to trigger the coin’s 3% drop from earlier this week.

There has additionally been concern concerning the latest revelations relating to Binance.

Particularly, the change’s CEO, Changpeng Zhao, apparently steered in a personal dialog that came about in 2019 that Binance associates had accounted for a good portion of buying and selling quantity in the course of the launch of Binance.US.

Now, some are questioning whether or not this exercise constituted wash buying and selling, which was imagined to inflate quantity.

Bitcoin whales moved $60 million in 5 days

Whale exercise is one other factor that generally causes unease amongst merchants, and there was loads of it just lately.

Even the long-dormant whales have been making strikes currently. On July twentieth, two wallets from 2021 have moved their BTC to a distinct tackle after 12 years of inactivity. Every of the addresses had 10 BTC.

Solely a day after that, one other pockets holding 5 BTC began displaying indicators of exercise.

As merchants began to marvel what this meant, one other pockets moved over $30 million in BTC, shifting the cash for the primary time since 2012. In complete, these whales moved over $60 million in BTC in solely 5 days.

A BTC whale that has been dormant for 11 years transferred all 1,037.42 $BTC($37.8M) to a brand new tackle”bc1qtl” an hour in the past.

The whale acquired 1,037.42 $BTC($5,107 at the moment) on Apr 11, 2012, when the worth was $4.92.https://t.co/k8ZmO5vc8X pic.twitter.com/xBaw2dQfY8

— Lookonchain (@lookonchain) July 22, 2023

What do the analysts say?

Bitcoin is in a interval of nice uncertainty, recent out of crypto winter, however not but in its bullish part. Its value doesn’t have a transparent course in order that it might do primarily something. Many are involved that the worth will spiral down, however one analyst wrote that their examination of technical evaluation led to a constructive conclusion.

In accordance with their analysis, indicators and patterns recommend a good consequence, indicating potential alternatives and constructive market developments. Nonetheless, they famous that this can be very vital to proceed to watch the market carefully.

Evil Pepe presale is closing in on $1 million

Whereas some benefit from the speculative interval that Bitcoin is in proper now, others have turned to new alternatives within the meme coin sector. Particularly, one mission has been attracting quite a lot of consideration currently — Evil Pepe (EVILPEPE).

It is a crypto mission based mostly on a preferred meme, and it invitations customers to embrace their evil aspect. Every investor has that little voice inside their thoughts that tosses in an occasional intrusive thought, reminiscent of taking over big dangers and spending all of their cash on dangerous belongings.

Evil Pepe takes accountability for this voice and encourages customers to take a position.

Up to now, many have seemingly listened, because the mission’s presale raised over $860k in only some days. The presale will final for an additional week, promoting $EVILPEPE at a value of $0.000333 per token.

Customers can purchase it with ETH or USDT at any time in the course of the subsequent 7 days.

Associated

Wall Road Memes – Subsequent Massive Crypto

Early Entry Presale Stay Now

Established Neighborhood of Shares & Crypto Merchants

Featured on BeInCrypto, Bitcoinist, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Workforce Behind OpenSea NFT Assortment – Wall St Bulls

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link