[ad_1]

Be a part of Our Telegram channel to remain updated on breaking information protection

Bitcoin’s (BTC) worth is bullish after amassing buy-side liquidity below the $25,357 assist degree. The following demand strain has despatched BTC up 5% to breach a vital roadblock. That is marked by the downtrend line at $26,640.

Overhead strain continues to abound for Bitcoin, with the resistance confluence between the 200- and 50-day Exponential Transferring Averages (EMAs) hanging above BTC at $26,987 and $27,401 ranges, respectively. The 100-day EMA additionally provides to the headwinds for the king of crypto at $27,499.

Nevertheless, the general outlook factors to an impending fall in Bitcoin worth. This might probably ship BTC under the $25,357 assist degree. This base is important for BTC as it’s the imply threshold (midline) of the demand zone order block, the place the flagship crypto discovered assist.

If the demand zone fails to carry as assist, it might flip right into a bearish breaker, with the following promoting strain sending the Bitcoin worth to the $24,000 psychological degree. This draw back might be confirmed upon a break and shut under the imply threshold.

In the meantime, analysts have given the identical macro outlook for Bitcoin worth, predicting a drop under $25,000.

$BTC / $USD – Replace

That is my macro play for #Bitcoin going into subsequent 12 months. As soon as we get that macro drop i might be loading into the #Altcoin capitulation pic.twitter.com/UeKzqF1Cdj

— Crypto Tony (@CryptoTony__) September 17, 2023

Analysts have additionally noticed that “Open Curiosity has saved comparatively secure through the weekend.

#Bitcoin’s Open Curiosity has saved comparatively secure through the weekend.

In earlier weekends we regularly noticed an enormous ramp up just for worth to wick in direction of either side late Sunday or early Monday. Would not count on an excessive amount of craziness this time round.

It is good to notice the large partitions on… pic.twitter.com/AcIfWc8iST

— Daan Crypto Trades (@DaanCrypto) September 17, 2023

In earlier weekends, we regularly noticed a major ramp up just for the worth to wick in direction of either side late Sunday or early Monday.

As such, not a lot craziness is anticipated this time round. Nonetheless, noting the large partitions on Binance’s BTC futures is nice, which pushes costs wherever desired. Throughout low quantity/liquidity hours (just like the weekend), these typically mark good reversal areas, as indicated within the circled areas on the chart above.

Momentum indicators additionally counsel a drop, with the Relative Power Index (RSI) tipping south to point out diminished purchaser exercise. The place of the Superior Oscillator can also be damaging, suggesting bears nonetheless have a say available in the market.

On-chain Metrics: IntoTheBlock

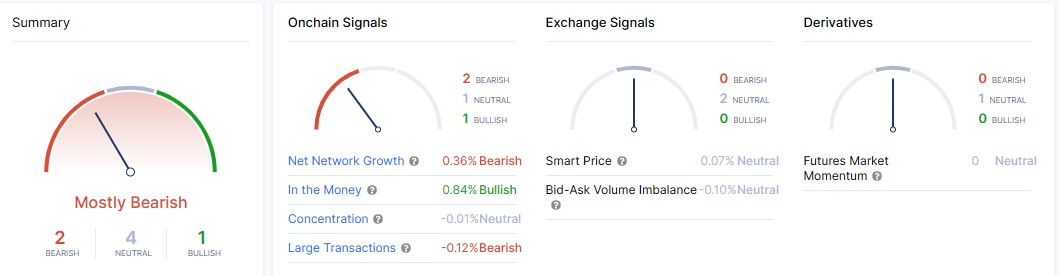

IntoTheBlock’s sign signifies that the market remains to be “primarily bearish for Bitcoin, including credence to the draw back.

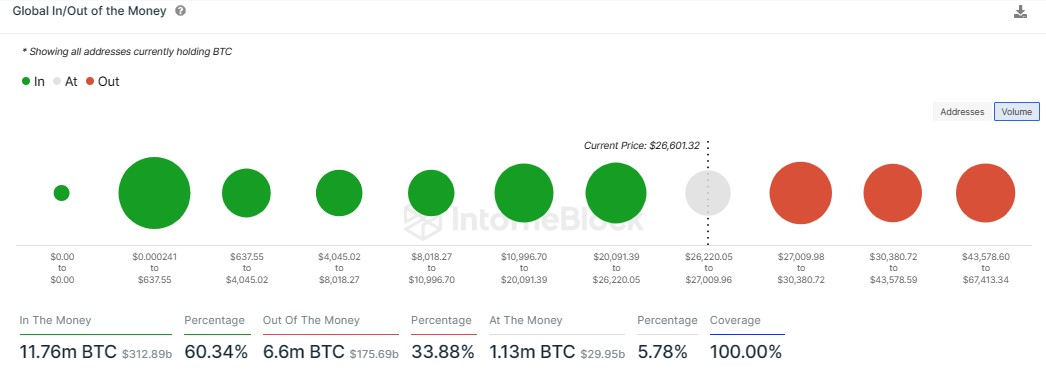

It’s also price mentioning that on the present worth of $26,573, 60.34% of BTC addresses are sitting on unrealized revenue (within the cash). Comparatively, 33.88% are sitting on unrealized losses (out of the cash), whereas 5.78% are breaking even (on the cash).

With extra addresses within the cash, profit-appetite stays a menace to Bitcoin worth’s upside potential, growing the chances for a hunch.

Converse Case

On the flipside, elevated shopping for strain might see Bitcoin worth transfer north, breaching the resistance confluence between the 200- and 50-day EMAs at $26,987 and $27,401 ranges, respectively. Additional north, the individuals’s crypto might transfer above the 100-day EMA at $27,499.

A decisive shut above this degree would open the skies for extra features, probably going so far as the availability zone on the $29,000 psychological degree. Affirmation of the uptrend would happen upon a decisive every day candlestick shut above the order block’s imply threshold at $29,367.

Notably, the histogram bars of the AO have maintained a gradual inexperienced really feel and are edging in direction of the optimistic facet, suggesting bulls are gaining floor. A sustained accumulation sample might bode properly for Bitcoin buyers to rake in income.

Nevertheless, whereas Bitcoin worth stays within the woods, contemplate BTCBSC, retailing for a similar worth BTC auctioned for in 2011, $0.99. As such, it offers you an opportunity to relive historical past, this time with extra info, to get pleasure from good turnover as soon as the worth takes off. Many individuals remorse not shopping for Bitcoin when the worth was nonetheless basically reasonably priced.

🚀Seize a bit of historical past with #BitcoinBSC!

The preliminary section of the #Presale kicks off with 4M tokens at 99¢ like 2011 #Bitcoin.

Unsold tokens post-listing contribute to the #Staking contract for a hard and fast 21 million $BTCBSC provide.💰 https://t.co/oM0YP8IlbV#Stake2Earn pic.twitter.com/NelsRkmHXS

— Bitcoinbsc (@Bitcoinbsctoken) September 12, 2023

Bitcoin Different

BTCBSC, abbreviated for Bitcoin on Binance Sensible Chain, is the ticker for the Bitcoin BSC ecosystem. The token is within the early providing stage, with over $2.5 million collected in presale gross sales.

With prospects for extra features and the promise of elevated worth as soon as the token is listed on exchanges, now’s the time to purchase BTCBSC.

Stake for a sustainable future with #BitcoinBSC!🌿

Earn incentives linked to your stake and present APY, mirroring Bitcoin’s historic schedule from April 2011.

Don’t miss out on the $BTCBSC #Presale and buy your #Tokens at present!🚀https://t.co/oM0YP8IlbV#Stake2Earn pic.twitter.com/Y9U7BIb3pD

— Bitcoinbsc (@Bitcoinbsctoken) September 16, 2023

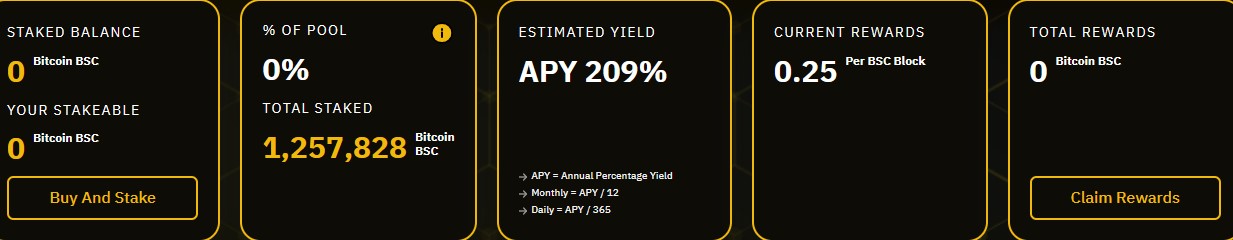

The venture has a staking operate to extend income-earning alternatives for BTCBSC group members. Based on the Bitcoin BSC web site, over 1.25 million BTCBSC tokens have been staked, with stakers having fun with Annual Share Yields (APY) as excessive as 209%. That is in opposition to the identical block rewards as Bitcoin, 0.25 per Binance Sensible Chain block.

In addition to presenting as a possibility for passive earnings, staking additionally reduces promoting strain for BTCBSC, giving the token time to develop in worth.

Uncover the fusion of Bitcoin’s legacy and Binance Sensible Chain in #BitcoinBSC! 🚀

Our sustainable #Staking methodology fosters enduring dedication and group involvement.

Be a part of the #Presale at present and safe your $BTCBSC #Tokens!

🔗https://t.co/oM0YP8IlbV #CryptoCommunity #Web3 pic.twitter.com/kyZSmpOPRD

— Bitcoinbsc (@Bitcoinbsctoken) September 14, 2023

One other means for passive earnings incomes on Bitcoin BSC is the referral program. Invite your pals and earn 5% from every buy they make utilizing your unique hyperlink

Do not miss out on the $BTCBSC Referral Program!🤝

Invite your pals and earn 5% from every buy they make utilizing your unique hyperlink.💸

Hyperlink up your pockets, seize your distinctive referral hyperlink, share it and indulge in the advantages.

Get began straight away!🔗https://t.co/oM0YP8IT1t pic.twitter.com/d9ff3t6B8T

— Bitcoinbsc (@Bitcoinbsctoken) September 15, 2023

Don’t miss out on the subsequent large factor. Go to BTCBSC right here

Missed out on the #Bitcoin surge?

You are in good firm! Most of us caught on a bit late.🙄

However this is your golden ticket with #BitcoinBSC – Seize it at solely $0.99!💰

Let’s remodel letdowns into possibilities!

Be a part of the #Presale proper right here 👉 https://t.co/oM0YP8IlbV pic.twitter.com/VR8R5Mim8V

— Bitcoinbsc (@Bitcoinbsctoken) September 16, 2023

Additionally Learn:

Ends Quickly – Wall Avenue Memes

Early Entry Presale Stay Now

Established Group of Shares & Crypto Merchants

Featured on Cointelegraph, CoinMarketCap, Yahoo Finance

Rated Finest Crypto to Purchase Now In Meme Coin Sector

Workforce Behind OpenSea NFT Assortment – Wall St Bulls

Tier One Change Listings September 27

Tweets Replied to by Elon Musk

Be a part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link