[ad_1]

Bitcoin, the world’s largest and most well-known cryptocurrency, has had a tumultuous previous few days, and based on Mike McGlone, a senior macro strategist at Bloomberg Intelligence, the volatility within the BTC market might very properly impression different threat property.

McGlone believes that BTC’s affect in the marketplace has turn into contagious, and consequently, different threat property may very well be negatively affected if the worth of BTC continues to say no.

McGlone’s feedback are a mirrored image of the rising consciousness of BTC’s affect on the worldwide economic system. As BTC continues to achieve mainstream acceptance and adoption, its actions are being carefully watched by buyers and policymakers alike.

Threat Belongings At Threat? Bitcoin Community Congestion Raises Issues

At a time when the Bitcoin community is presently dealing with unprecedented ranges of congestion as a result of inflow of Ordinals, McGlone has shared his views on the potential impression of Bitcoin’s worth decline on different threat property.

Over the weekend, the congestion turned so extreme that main buying and selling platforms like Binance had been pressured to briefly halt some transactions.

Bitcoin Might Tempo Declines for Threat Belongings –If the worst isn’t over for threat property, #Bitcoin could prepared the ground decrease. pic.twitter.com/UlEVjCEKwr

— Mike McGlone (@mikemcglone11) Might 8, 2023

Based on McGlone on Twitter, if the present decline within the worth of threat property continues, Bitcoin has the potential to guide the remainder of the unstable asset class downwards.

He emphasised that the affect of Bitcoin in the marketplace is now contagious, and its impression may be felt throughout the monetary system.

In different phrases, if Bitcoin’s worth continues to drop, it might set off a domino impact that leads to the decline of different dangerous property.

Bitcoin’s Community Congestion, Volatility Increase Regulatory Issues

McGlone’s feedback relating to the potential impression of Bitcoin’s worth volatility on the broader monetary system come at a time when buyers are rising more and more anxious.

The cryptocurrency’s fluctuations might doubtlessly have ripple results on the worldwide economic system, underscoring the necessity for regulatory oversight.

BTCUSD drops the $28K deal with. Chart: TradingView.com

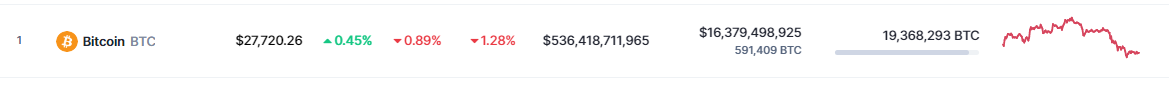

In the meantime, the present BTC worth, as reported by CoinGecko, has decreased by 0.89% prior to now 24 hours and 1.28% over the past seven days, indicating a normal downward development.

Supply: CoinMarketCap

This downward development might exacerbate issues about Bitcoin’s potential impression on the monetary system and immediate requires elevated regulatory measures.

The current halt of transactions on main platforms similar to Binance because of community congestion points additionally highlights the pressing have to discover a answer. If left unaddressed, community congestion might result in vital disruptions within the cryptocurrency market.

As such, regulators should take swift motion to mitigate the dangers related to the market’s volatility and guarantee its stability.

-Featured picture from International Information

[ad_2]

Source link