[ad_1]

Be part of Our Telegram channel to remain updated on breaking information protection

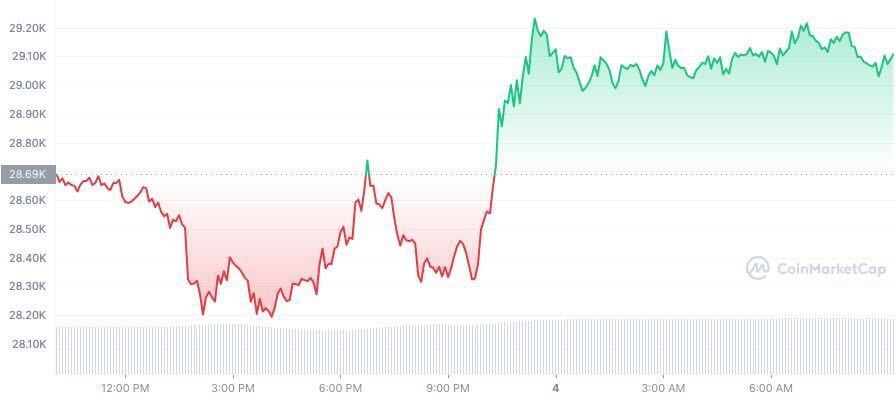

The foremost cryptocurrency Bitcoin has continued to achieve floor within the final 24 hours. To date, the digital forex has surpassed $29,000 whereas recording a 1.57% spike in the identical breath.

Bitcoin’s spectacular pushback to profitable methods has additionally rubbed off on the broader crypto market. The nascent business is up by 1.23% whereas pushing its market cap again to the $1.20 trillion valuation.

Whereas the bulls are placing a brand new psychological threshold on Bitcoin crossing the $30,000 value goal, a collection of macro occasions have helped the crypto king regain its bullish momentum.

One such is Star Wars Day which is usually celebrated on Could 4th.

BTC At all times Ship Positive factors On Could 4th

Created by George Lucas, Star Wars is without doubt one of the hottest sci-fi franchise motion pictures ever aired.

To honor the franchise, Star Wars followers have inaugurated each Could 4th because the unofficial day to rejoice it. The celebration is at all times broadly publicized on social media platforms, with many on-line customers greeting each other with “Could the 4th Be With You.”

#StarWars Day “Could the Fourth be with you”

Star Wars Day on 4 Could is an unofficial and informally noticed day to rejoice the Star Wars media franchise created by #George Lucas.#Metagrave #NFTComminity #BTC #NFT pic.twitter.com/LTZXiE70xr

— MetaGrave (@metaGraveGo) Could 4, 2023

Whereas it might appear unrelated to the crypto market, Could 4th has been famously related to the season when Bitcoin value rallies.

A Twitter person detailed a rundown of potential positive aspects from buying Bitcoin on Could 4th since 2013, claiming that buyers might have profited by a whopping 10,481% from the main cryptocurrency.

An analogous buy in 2014 would have netted buyers 2,133%, with a 4,007% acquire recorded for 2015.

For those who purchased bitcoin on star wars day (Could 4th) as of proper now you would be up:

2013: 10481percent2014: 2133percent2015: 4007percent2016: 2080percent2017: 533percent2018: 0.3percent2019: 66%

Not a single loss to this point, might the 4th be with you. #Crypto#BTC #StarWars

— Simms (@cryptosimms) September 24, 2019

Whereas this may appear far-fetched, Bitcoin has largely surged throughout this era.

At press time, the crypto asset is buying and selling at $29,082.56, up 1.57% within the final 24 hours. Whereas this may appear negligible, Bitcoin’s long-term efficiency has left many buyers on the sting.

On its seven-day value trajectory, Bitcoin has gained 2.37% whereas its month-to-month shut is at 4.67%. Its three-month break is up 23.84%, whereas its six-month shut is fluid at 37.55%.

Given Bitcoin’s dismal efficiency in 2022, its year-to-date (YTD) efficiency of 75.86% exhibits that Bitcoin could possibly be on a powerful bullish wave whilst buyers rejoice Star Wars Day.

To substantiate Bitcoin’s bullish streak, we flip our sights to its technicals. Its 50-day transferring common (MA) worth of $28,246.77 exhibits that the digital asset is on a bull run.

The 200-day MA value of $22,104.94 for the long run exhibits that Bitcoin just isn’t making any plans to drop anytime quickly.

On its relative energy index (RSI), the asset’s oscillator determine of 53.85 exhibits that the digital asset is within the underbought zone however is quickly climbing.

Additionally, its transferring common convergence divergence (MACD) factors to a slow-forming purchase sign whilst momentum builds within the bigger market.

Fed Charges Hike Boosting Bitcoin’s Large Attraction

Whereas Could 4th could possibly be a catalyst for Bitcoin’s bullish breakout, different macro occasions have lent a severe serving to hand.

The U.S. Federal Reserve just lately elevated the benchmark rate of interest for the federal futures fund by 25 foundation factors (25bps).

💥BREAKING: The Federal Reserve simply introduced a 0.25% rate of interest hike.

— Crypto Rover (@rovercrc) Could 3, 2023

In line with the U.S. central financial institution Chair Jerome Powell, the continued improve is anticipated to curb inflation and maintain it inside its 2% annual determine.

The Federal Reserve simply introduced its tenth straight rate of interest hike.

Keep in mind: Counting on the Fed to boost charges places the burden of preventing inflation totally on lower-wage employees who’re already hurting most from rising costs.

Cease elevating charges! pic.twitter.com/DNVt7tjH0u

— Robert Reich (@RBReich) Could 3, 2023

The Fed Reserve’s latest improve comes on the again of a brand new U.S. financial institution closure within the case of First Republic Financial institution.

The financial institution, which JPMorgan has since acquired, witnessed giant withdrawals resulting in a weak steadiness sheet.

Nevertheless, experiences are additionally making the rounds that one other U.S. financial institution is on the snapping point.

PACWEST now down 54% after hours. $PACW

Financial institution run might be on for deposits. Most likely can be closed on Friday by the FDIC.

We’re simply ready for Jim Cramer to inform us it’s a “robust financial institution” earlier than we name this one as completed. https://t.co/Nkme5yNBCx pic.twitter.com/5VFU02WLwf

— Wall Avenue Silver (@WallStreetSilv) Could 3, 2023

Following the announcement of the rate of interest hike yesterday, Bitcoin crossed $28,700 and has continued to surge in worth.

The continued failure of the standard monetary area regularly alerts to buyers that decentralized currencies have the potential to be the way in which ahead.

Provided that it holds over 46% share of the crypto market, Bitcoin is seen as a pure recourse for buyers searching for to guard their investments as a consequence of its deflationary nature.

The challenges of the standard monetary panorama might inadvertently play to the energy of the digital asset, serving to it rise even larger to its former file excessive of $69,000 within the coming months.

Associated Information

AiDoge – New Meme to Earn Crypto

Earn Crypto For Web Memes

First Presale Stage Open Now, CertiK Audited

Generate Memes with AI Textual content Prompts

Staking Rewards, Voting, Creator Advantages

Ecoterra – New Eco Pleasant Crypto

CertiK Audited

Doxxed Skilled Staff

Earn Free Crypto for Recycling

Gamified Environmental Motion

Presale Reside Now – $2M+ Raised

Yahoo Finance, Cointelegraph Featured Venture

Be part of Our Telegram channel to remain updated on breaking information protection

[ad_2]

Source link