[ad_1]

Bitcoin (BTC) premium trades on Binance.US is a symptom of an illiquid market and never proof of market makers exiting the platform, in accordance with blockchain analytical agency Kaiko.

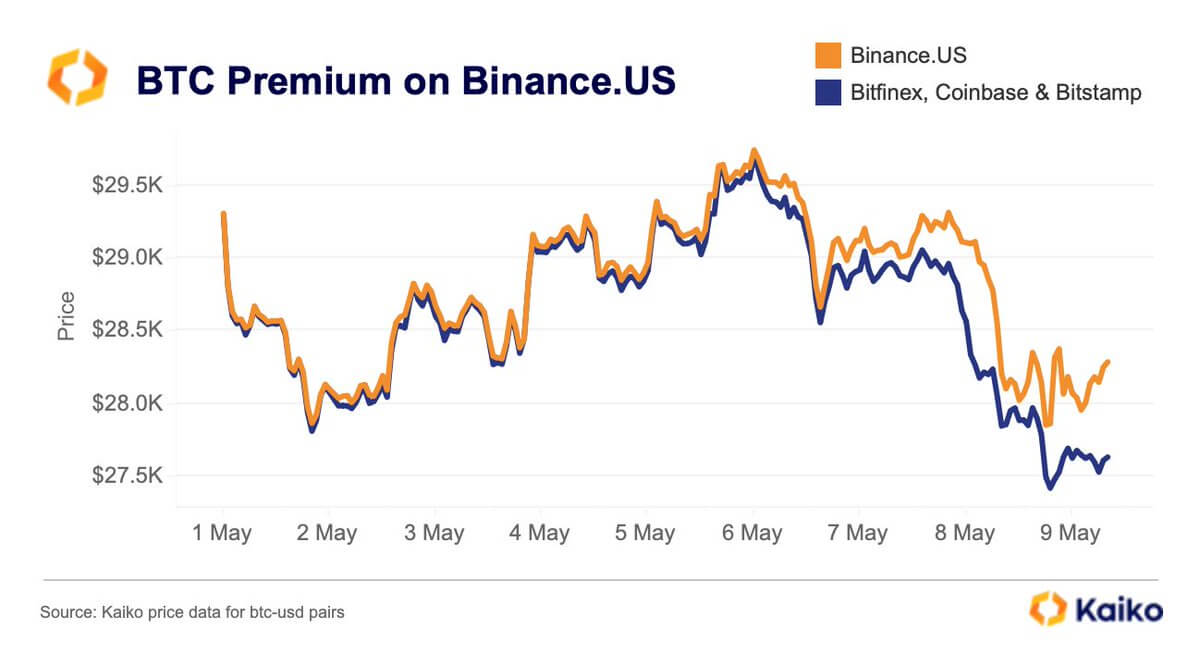

In its Could 9 report, the info aggregator defined why the flagship digital asset traded at a 2.5% premium on Binance.US in comparison with different U.S.-based exchanges.

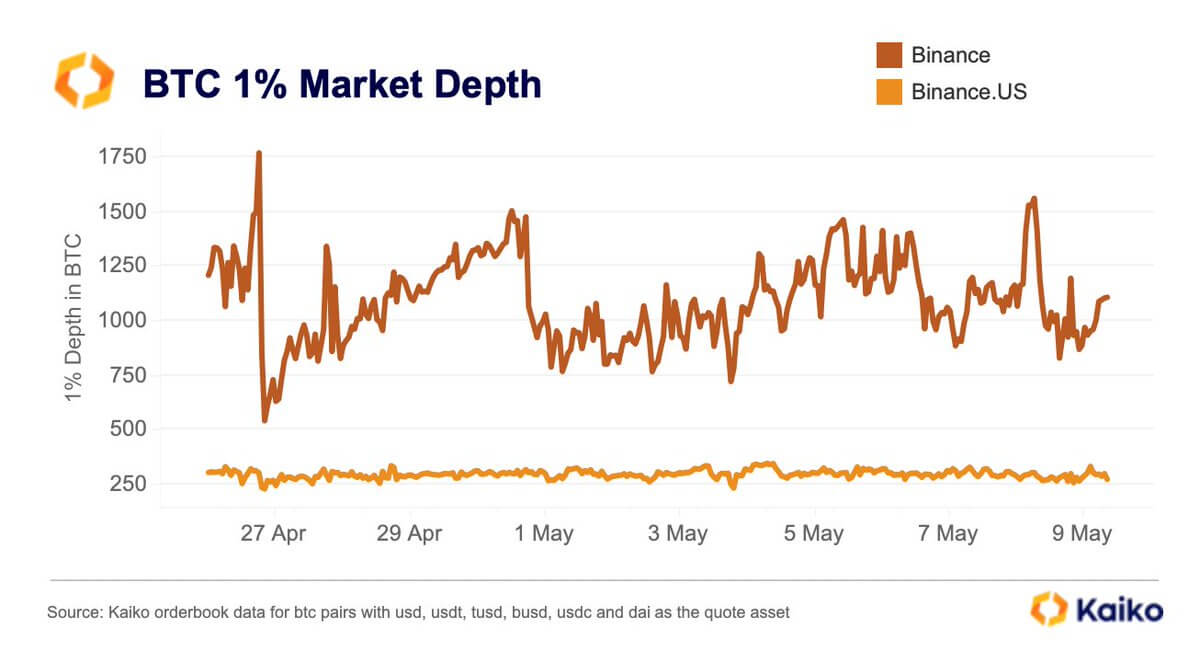

In line with the agency, speculations that market makers is perhaps exiting the platform had been mere rumors as there are not any modifications in its market depth.

Since April, a number of crypto neighborhood members have highlighted the rising premium BTC commerce on the platform — with many inferring that market makers and insiders is perhaps leaving due to attainable authorized motion.

Nevertheless, Kaiko rejected such assertions noting that the change’s wrestle for a banking companion may play a task within the trades.

Kaiko stated:

“The premium on Binance.US is extra doubtless associated to the change’s struggles to discover a banking companion for the reason that closure of Signature and Silvergate. With a surging demand for BTC typically, buyers on Binance.US are doubtless taking a look at faster withdrawal instances for BTC in comparison with USD, and are dashing to commerce into BTC on the identical time, leading to a premium on the change.”

In comparison with the worldwide Binance change, whose BTC’s 1% market depth has alternated between a number of highs and lows, Binance.US’s depth has remained secure. Kaiko knowledge famous that this might not be so if a serious market maker had left the platform.

Following the U.S. banking disaster that claimed three main crypto-friendly banks in March, the crypto business has been uncovered to low liquidity dangers. On the time, CryptoSlate Perception reported that BTC’s order ebook reached a 10-month low.

One other report famous that U.S.-based exchanges and market makers grew to become much less liquid as they appear most affected by Silvergate’s implosion.

The put up Bitcoin premium on Binance.US is symptom of illiquid market: Kaiko appeared first on CryptoSlate.

[ad_2]

Source link