[ad_1]

On-chain knowledge reveals Bitcoin’s plummet towards the $26,500 mark has despatched 10% extra of the entire provide right into a state of loss.

Bitcoin Provide In Revenue Has Dropped From 71% To 61% After The Crash

In accordance with knowledge from the on-chain analytics agency Glassnode, the availability in revenue has taken an enormous hit with this value plunge as a result of market beforehand being “top-heavy.”

The “% provide in revenue” right here is an indicator that measures the share of the entire circulating Bitcoin provide that’s at present carrying some quantity of unrealized loss.

The metric works by going by means of the on-chain historical past of every coin to see what value it was final moved at. If this earlier promoting value for any coin was lower than the present spot value of the asset, then that exact coin is alleged to be carrying a acquire. The availability in revenue metric then naturally provides the coin to its rely.

Associated Studying: Crypto Futures Liquidations Hit $150 Million As Bitcoin Plummets

Cash that don’t fulfill this criterion are put below the loss class, which the “provide in loss” retains observe of. The worth of this counterpart indicator of the availability in revenue may also merely be calculated by subtracting the availability in revenue from 100.

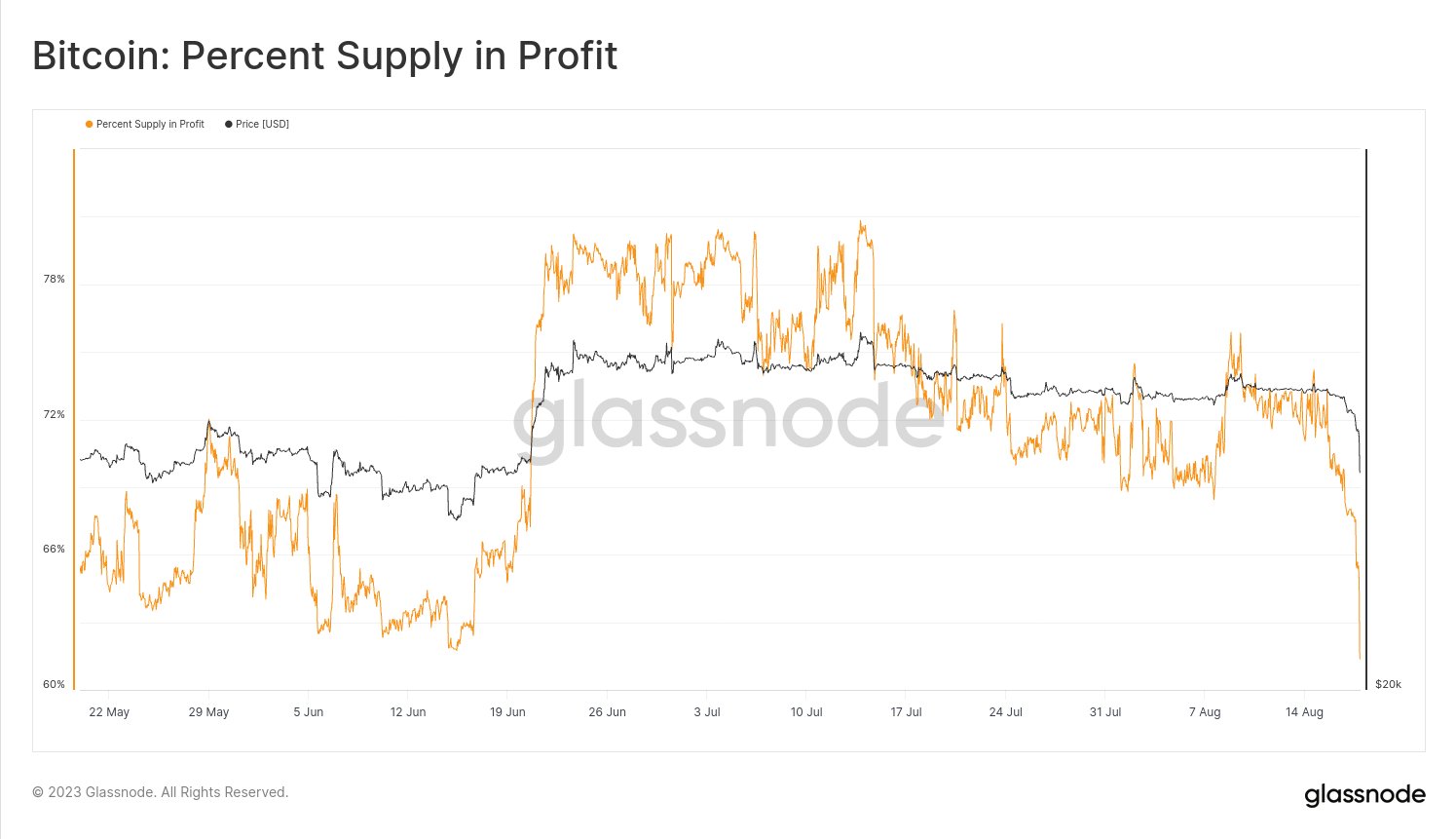

Now, here’s a chart that reveals the development within the Bitcoin % provide in revenue over the previous couple of months:

Seems like the worth of the metric has taken a pointy plunge in latest days | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin % provide in revenue has noticed a pointy drawdown because the cryptocurrency’s value has crashed. Previous to this plunge, the indicator’s worth was round 71%, however now it has decreased to only 61%.

Clearly, because of this the vast majority of the availability continues to be in a state of revenue, however 10% of the availability going underwater so instantly continues to be fairly a major change.

The rationale behind this extraordinary plummet within the indicator lies within the distribution of realized costs available in the market that was current simply earlier than this crash.

The information for the entity-adjusted realized value distribution within the BTC sector | Supply: Glassnode’s The Week Onchain – Week 33, 2023

In short, what this metric tells us about is how a lot provide the traders purchase at what costs. From the chart, it’s seen that the availability was significantly concentrated at ranges close to the $30,000 mark earlier than the newest crash.

Because of this numerous holders had purchased into the market at these costs. This isn’t significantly stunning, as Bitcoin had been caught in consolidation round these value ranges for fairly some time.

As traders continued to purchase and promote on this sideways interval, the fee foundation of the common investor naturally registered an increase, and the distribution began to grow to be top-heavy.

High-heavy markets are fairly delicate to actions within the value, as numerous holders can instantly go into loss or revenue with them. Thus, the 7% plunge that Bitcoin has seen prior to now 24 hours has additionally resulted in a major shift within the profit-loss stability of the sector.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,500, down 10% within the final week.

BTC has sharply plunged throughout the previous day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link